Introduction

As a business registered for GST, it is imperative that you issue GST invoices or bills for every sale that you make. GST invoices, also known as GST bills, serve an important purpose as they provide a record of the transaction for both the seller and the buyer. They include information such as the details of the goods or services provided, the cost of the transaction, the payment due date, and the legally required tax information.

Having an accurate record of all your sales and the associated GST charges is important for compliance purposes and for keeping track of your business's financial situation.

The format of a GST bill is also crucial. It must include all the necessary information required by law and should be easy to understand for both the seller and the buyer. The GST bill should list out the items that are being sold, the cost of the items, and the payment due date.

Additionally, it should include the GST registration number of the seller, the GST rate that has been applied to the sale, and any GST credits or discounts that have been applied.

Format of a GST Bill

When issuing a GST invoice, it is important to use a format that is compliant with the legal requirements and also presents a professional impression to the customer. The invoice serves as a record of the transaction, and it's essential that it includes all the necessary information for both the seller and buyer, especially for compliance purposes.

The GST invoice should include the following information: invoice number and date, customer's name and contact information, GST registration number (if applicable), HSN or SAC code, place of supply, details of the items being sold (description, quantity, unit, total value), taxable value and any discounts, GST rate and amount, whether GST is payable on a reverse charge basis, and the signature of the supplier.

Having a consistent and clear format for your GST invoice will make it easy for your customers to understand and for your business to keep accurate records.

In the case of the buyer being not registered for GST and the purchase being valued at less than 50,000 INR, the invoice format can be slightly different. In this scenario, it must include the name and address of the recipient, delivery address, state name, and code.

While these details may be less crucial for tax compliance, it's still important to have this information for your own records and for ease of communication with your customers.

It is also worth mentioning that a GST invoice needs to have all the necessary information for the customer to manage input tax credit (ITC). This means that a GST invoice must have all the details of GST Registration number, Taxable value, GST rate and amount, whether GST is payable on a reverse charge basis, and supplier's signature.

Also, if your invoice is missing any of this information, it will be deemed as non-compliant, and your customer may face difficulty in claiming the input tax credit.

How to create a GST Bill?

Creating a GST bill involves several steps:

Start by filling in your company and contact information, including the date and invoice number. This makes it easy for the client to identify the invoice and match it with their own records.

Next, provide a detailed description of the billable work and the agreed rates. This could include project or hourly rates, as per the agreement.

Once the details of the billable work have been outlined, add the tax information and calculate the total amount due. Be sure to double-check the calculations to ensure accuracy.

Finally, state the payment terms clearly, including when payment is expected, to avoid any confusion.

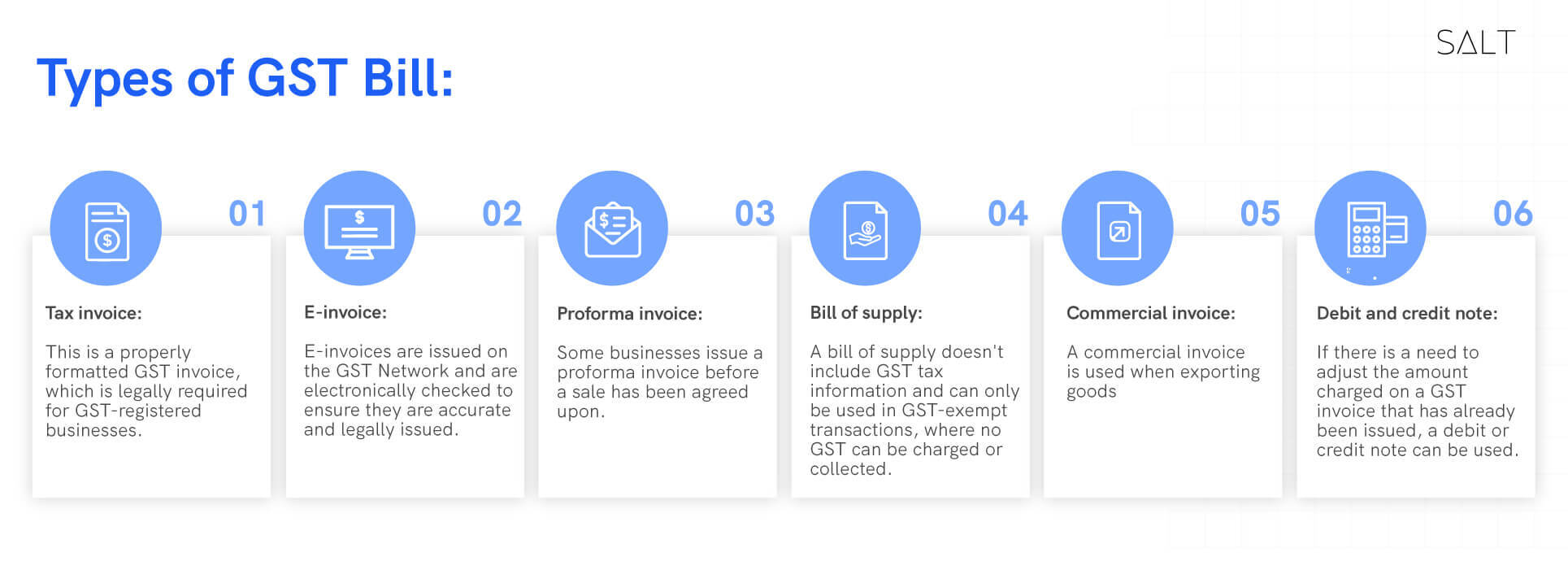

Types of GST bills

As a business owner, it's important to be familiar with the different types of GST bills that may be used. The most common include:

Tax invoice:

Tax Invoice is a properly formatted GST invoice, which is legally required for GST-registered businesses. It allows GST-registered buyers to manage their input tax credit (ITC).

E-invoice:

E-invoices are issued on the GST Network and are electronically checked to ensure they are accurate and legally issued.

Proforma invoice:

Some businesses issue a proforma invoice before a sale has been agreed upon. It's also known as a quote or estimated bill and contains details of the expected sale price and agreement if the buyer chooses to proceed.

Bill of supply:

A bill of supply doesn't include GST tax information and can only be used in GST-exempt transactions, where no GST can be charged or collected.

Commercial invoice:

A commercial invoice is used when exporting goods. It includes customs information to ensure the shipment is properly declared.

Debit and credit note:

If there is a need to adjust the amount charged on a GST invoice that has already been issued, a debit or credit note can be used. A debit note is issued when the cost of a purchase needs to be increased, while credit notes can be issued if the final amount is lower than initially anticipated.

Conclusion

As a GST-registered business, it is your obligation to issue GST-compliant invoices every time you make a sale. Not doing so could result in non-compliance and penalties. Hence, it is important to have an organised system in place for issuing GST invoices, to ensure that all transactions are recorded correctly and that all required information is captured on the invoice. Not only is it a legal requirement, but it also helps in maintaining proper records, generating accurate financial statements, and assisting you in staying on top of your GST compliance.

Now that you know about GST bills, here are the best invoice generator tools you can use.

We hope this article has provided you with enough knowledge about GST bills. To learn more about the world of finance, check out the Salt blog.