Introduction

Running a business venture is an exciting and challenging endeavour, and one of the most important tasks for any founder is to create financial projections for their company.

Financial projections are estimates of a company's future financial performance based on historical data and certain assumptions about the future. They play a crucial role in helping founders plan and make informed business decisions, communicate with investors and stakeholders, and monitor performance over time.

In this article, we will take a comprehensive look at the importance of financial projections for founders, the different types of financial projections, and how to prepare and use them.

Types of Financial Projections

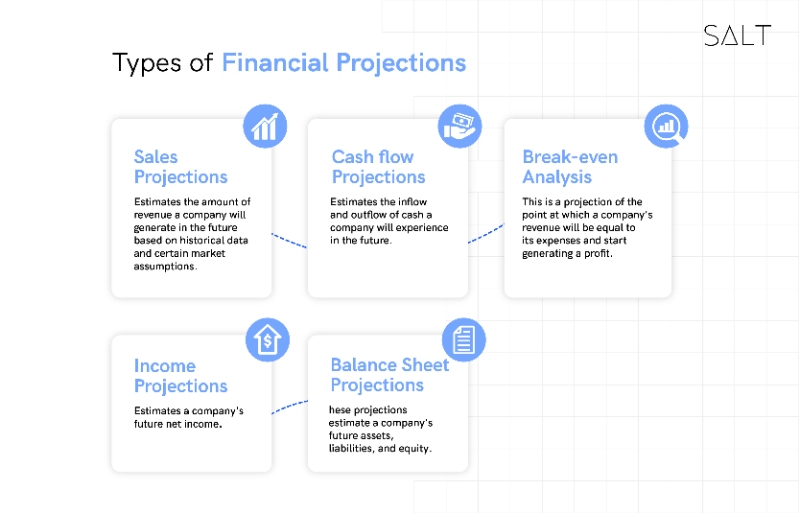

There are several different types of financial projections that founders can create, depending on their needs and the stage of their business. Some of the most common types include:

Sales projections: These projections estimate the amount of revenue a company will generate in the future based on historical data and certain assumptions about the market. Sales projections can be broken down by product or service and by time period (e.g. monthly, quarterly, annually).

Income projections: These projections estimate a company's future net income (i.e. revenue minus expenses) based on its past performance and certain assumptions about the future. An income projection is also known as an income statement or profit and loss statement.

Cash flow projections: These projections estimate the inflow and outflow of cash a company will experience in the future. They are particularly important for founders to understand as they need to ensure that the company has sufficient cash on hand to meet its financial obligations.

Balance sheet projections: These projections estimate a company's future assets, liabilities, and equity. A balance sheet gives an overall picture of a company's financial position at a given time.

Break-even analysis: This is a projection of the point at which a company's revenue will be equal to its expenses and start generating a profit. Break-even analysis can be useful for founders to understand when their business will become profitable and what level of sales they need to reach to do so.

Preparing Financial Projections

Once you've identified the types of financial projections you want to create, the next step is to gather the necessary data and assumptions and put them all together into a cohesive set of projections. Here are some key steps to follow when preparing your financial projections:

Identify key assumptions: Before you begin creating your projections, it's important to identify the key assumptions that will drive your estimates. Make sure to document these assumptions and explain the reasoning behind them.

Gather historical data: To create accurate projections, it's important to have a solid understanding of your company's past financial performance. This includes data on things like sales, expenses, cash flow, and other key financial metrics.

Create a projected income statement: Based on your historical data and key assumptions, create a projected income statement that estimates your company's future net income. This should include line items for revenue, cost of goods sold, gross profit, operating expenses, and net income.

Create a projected balance sheet: Using the information from your income statement, create a projected balance sheet that estimates your company's future assets, liabilities, and equity. This will give you an overall picture of your company's financial position.

Create a projected cash flow statement: Based on the information from your income statement and balance sheet, create a projected cash flow statement that estimates the inflow and outflow of cash for your company. This will help you understand your company's liquidity position and identify any potential cash flow issues.

Identify key financial metrics: Identify financial metrics that are relevant to your business and will be useful for monitoring and evaluating your company's performance over time. This might include things like gross margin, net profit margin, return on assets, and cash conversion cycle.

Using Financial Projections

Once you've prepared your financial projections, the next step is to put them to use in making business decisions and communicating with investors and stakeholders. Here are some key ways to use your projections:

Setting goals and targets: Use your projections as a tool for setting goals and targets for your business. These might include things like revenue targets, profitability milestones, and cash flow objectives.

Making business decisions: Your projections can be used to inform a wide range of business decisions, such as product development, pricing strategy, marketing and sales efforts, and operations.

Communicating with investors and stakeholders: Investors and other stakeholders will often want to see your financial projections as part of their due diligence process.

Monitoring performance and making adjustments: Regularly review your actual financial performance against your projections to identify any variances.

Conclusion

Financial projections are an essential tool for any founder, helping to inform business decisions, communicate with investors and stakeholders, and monitor performance over time. In this article, we've covered the importance of financial projections, the different types of projections available, and how to prepare and use them.

To summarise, it is crucial to gather historical data, identify key assumptions, create a projected income statement, balance sheet, and cash flow statement, identify key financial metrics and use them in setting goals and targets, making business decisions, communicating with investors and stakeholders, and monitoring performance.

Just as financial projections, it's also important to know vital startup metrics, read here the founder's guide to vital startup metrics.

As a founder, it's important to be realistic about market conditions, stay up-to-date with industry trends, and regularly review and update your projections. In addition, you can seek professional help when needed. With the right approach and the right tools, you can create accurate and effective financial projections that will help you to build a successful and sustainable business.

Check out the Salt blog to learn much more about the world of finance.