Every nation has its regulations governing inward and outward remittance. And in India, this is the responsibility of the Reserve Bank of India. Remittances in India are governed by the Foreign Exchange Management Act (FEMA).

FEMA specifies several reasons to receive international payments or to send money abroad. Individuals may receive inward remittance through donations, gifts, university fees, medical treatment, travel expenses, investments, proceeds from the sale of assets or domestic deposits, or even receive money from abroad as financial support. SMEs in India regularly receive international payments and send money in the form of outward remittances.

What are Inward and Outward Remittances?

- Inward Remittance

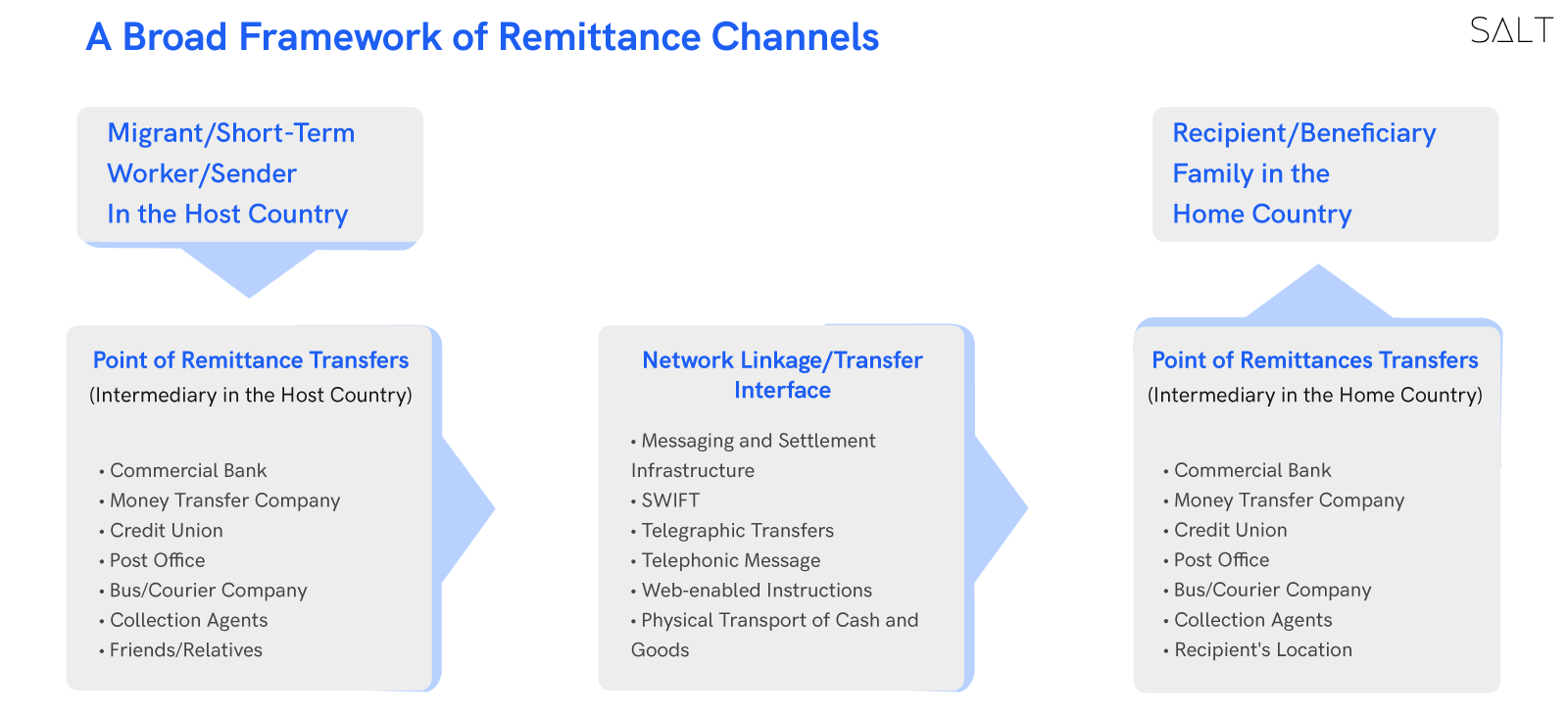

Remittances from overseas to domestic banks are referred to as inward remittances. Thirty inward remittances are the maximum allowed in a given year. Depending on the financial institution, inward remittances may also be subject to a fee.

- Outward Remittance

An outward remittance involves sending money in the form of foreign currency from a resident of one nation, like India, to a recipient who is in another nation (apart from Nepal and Bhutan) for any reason that has been permitted under the Foreign Exchange Management Act (FEMA).

FEMA (Foreign Exchange Management Act) Guidelines and Regulations for Remittances

FEMA covers all foreign exchange and remittance transactions. Individuals who want to transfer money into or out of India, SMEs and entrepreneurs who accept international payments and receive money from abroad. Let's understand these guidelines in some detail.

FEMA guidelines for Outward Remittances

The Liberalised Remittance Scheme (LRS) under FEMA deals with outbound remittances for Indian citizens. Interestingly, the programme is referred to as "liberalised" because, before its implementation, it was impossible to send money outside of India without the RBI's express consent. Since the program's inception, the regulations have been gradually changed to enable Indian citizens to send more money abroad without requiring further authorisation from the RBI.

- Indian citizens can transfer money to foreign bank accounts under the LRS without obtaining a specific permit. However, the money sent abroad can only be used for specific purposes, such as overseas education or medical treatment, tour and travel, etc.

- Outward remittances are only permitted up to an annual cap of USD 250,000, and remitters must submit their PAN card details for remittance transactions.

- Remitters are not permitted to send money to some organisations and nations prohibited under RBI guidelines. These are mainly nations the Indian government considers "non-cooperative" or organisations that may have ties to terrorism.

FEMA Guidelines for Inward Remittances

The RBI regulations for inward remittance differ slightly from those for outbound transfers. India is one of the nations that receive the greatest amount of remittances. This is partly due to a large number of NRIs who invest in businesses or real estate in India and the NRIs who live and work abroad and send money from abroad to support their families in India.

- The RBI provides the Rupee Drawing Arrangement (RDA) and the Money Transfer Service Scheme (MTSS) as alternative ways to send money back to India from abroad. The amount of inward remittance using the RDA channel is not capped, although there is a ceiling for commercial payments.

- Under the MTSS arrangement, a single receiver may receive 30 MTSS transfers annually at a USD 2,500 per transfer cap. Payments under the RDA and MTSS must be made through authorised dealer banks in India, and the procedure is strictly governed by the RBI. A remittee who receives international payments from abroad needs to procure a FIRC certificate to authorise the money received from abroad.

- FIRC or Foreign Inward Remittance Certificate is a certificate required under the regulatory process. This is essentially a receipt that banks issue to show that money has been transferred from abroad to India.

- It serves as evidence that the money you receive from abroad is from reliable sources, demonstrates that all necessary checks have been made, and establishes the legality of the inward remittance.

The Bottom Line

International payments received or sent outside the country are covered by the FEMA legislation. Whether you're an Indian citizen trying to transfer money abroad to pay for a family member's education or an NRI looking to send money home to your family in India, you need to be aware of these legislations.

For SMEs, sending and receiving money from abroad and accepting international payments can be a cumbersome task, considering the number of documents and formalities to be carried out while executing these transactions. So make sure to choose a bank that takes this load off your shoulders.

Salt, as a neobanking solution, offers international banking services to SMEs. With its multi-currency business account and remittance solutions, you can enjoy an effortless banking experience in countries across the world.