Exactly, what is GIFT City, and why should you care? GIFT City (Gujarat International Finance Tec-City) isn't just another urban development—it's a game-changer. Imagine a city designed to be a financial and technological powerhouse, a place where innovation meets infrastructure: that is what GIFT City is for you.

Source | What is GIFT city?

In this blog, we'll unravel the mystery of GIFT City, exploring its origins, key components, and the economic impact it's making. We'll delve into why this city matters on a global scale, examining its unique features and the special regulatory framework that sets it apart.

The vision of GIFT city

In recent years, India has witnessed significant economic strides, making it an attractive destination for foreign investments. Government initiatives like 'Make in India,' 'Digital India,' and 'Ease of Business' have played a pivotal role in fueling this growth, creating a business-friendly atmosphere. As part of the drive toward financial globalisation, India has established its first business district in the form of Gujarat International Finance Tec-City (GIFT City) in Gandhinagar.

Conceived by then Chief Minister Narendra Modi in 2007, Gandhinagar GIFT City aims to rival financial hubs like London and Singapore. Supported by both Central and Gujarat governments, the GIFT City of Gujarat spans 886 acres, featuring a Special Economic Zone (SEZ), India’s first International Financial Services Centre (IFSC), and a Domestic Tariff Area (DTA).

Boasting smart infrastructure, the city integrates residential spaces, schools, medical facilities, and recreational areas. As of June 2023, the Gandhinagar GIFT City boasts a vibrant ecosystem, hosting 23 multinational banks such as HSBC, JP Morgan, and Barclays. Additionally, it accommodates 35 fintech entities, operates two international stock exchanges with a robust daily trading volume of $30.6 billion, and proudly houses India's inaugural international bullion exchange, featuring a roster of 75 onboarded jewellers. Recent approval for foreign university campuses has garnered global attention, positioning GIFT City of Gujarat as a rising star in the world of finance, technology, and education.

Now, let’s discuss the benefits of GIFT city to understand why everybody is flocking to the GIFT city:

Benefits of GIFT City

Gandhinagar GIFT City unfolds a realm of advantages; the benefits of GIFT city include:

Special Economic Zones (SEZ)

SEZs are dedicated zones with developed infrastructure, offering built-up spaces, power, water supply, transport, and housing. These zones are designed to attract Foreign Direct Investment and boost economic growth through global exports. SEZs act as economic catalysts, fueling growth and transforming regions into business-ready hubs.

International Financial Services Centre Authority (IFSCA)

The International Financial Services Centre Authority (IFSCA), established in 2020 in GIFT City, consolidates a spectrum of financial services like stock exchanges, corporate banking, insurance, and risk management. This financial hub simplifies growth for businesses, offering tax incentives and regulatory benefits, making it an investor's haven. The impact is multifaceted, influencing the economy through tax benefits, fostering innovation, supporting startups, and connecting with international markets.

Domestic Tariff Area (DTA)

In the Domestic Tariff Area (DTA), local companies thrive under the umbrella of Indian laws and regulations. Positioned to serve the domestic market, businesses in this zone enjoy a spectrum of tax incentives extended by the Indian government.

The benefits of GIFT City make it a pivotal player in India's financial landscape, providing an environment conducive to growth, innovation, and international collaboration. For instance, owing to the unique advantages provided by GIFT city to investors, the US-based tech giant Google has announced a global fintech operation centre in GIFT city.

Benefits for startups in GIFT city

GIFT City tax benefits

In India, GIFT City opens its doors for startups, providing them with abundant funding prospects, a business-friendly atmosphere, and a culture that prioritises innovation. Its strategic location not only encourages partnerships and collaborations but also ensures a continuous influx of skilled professionals from diverse talent pools. SALT Fintech is the only startup in GIFT city operating with limited authorisation. Here’s why you should set up your startup in GIFT city too:

Infrastructure and administrative advantages include a Unified Regulator and Single Window Clearance, where the IFSC Authority serves as a centralised body for streamlined approvals, covering all aspects from allotment and planning to construction and occupancy.

The setup process is simplified with plug-and-play infrastructure, ensuring a swift and trouble-free initiation of businesses by having all necessary infrastructural clearances in advance.

The liberal policies at GIFT City grant it a deemed foreign jurisdiction status from an exchange control perspective, exempting it from various intricate domestic policies, contributing to a conducive environment for business operations.

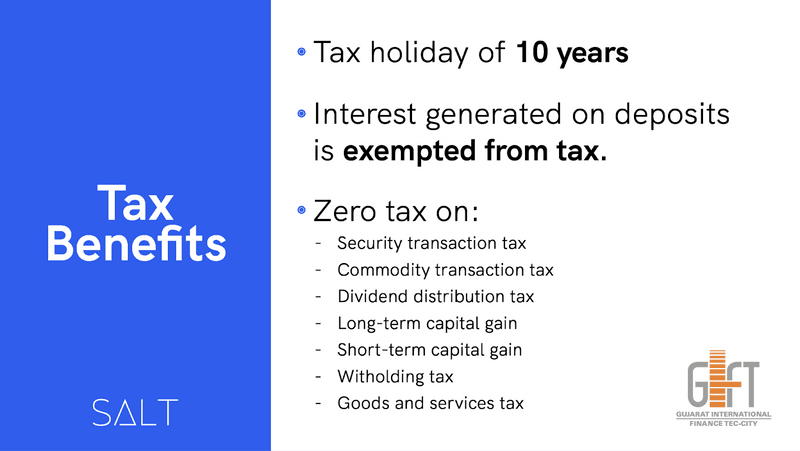

Many GIFT City tax benefits exist including: startups can enjoy a 100% tax exemption for any 10 years within a 15-year period. The Minimum Alternate Tax (MAT) for companies, or the Alternative Minimum Tax (AMT) for other units in the IFSC, stands at a competitive rate of 9% of book profits.

When it comes to dividend income, the tax responsibility falls on the shareholder, with a 10% tax rate for those residing outside India, along with applicable surcharges and cess.

Furthermore, services received by a unit in the IFSC are exempt from Goods and Services Tax (GST), on the other hand, GST is applicable to services provided to the Domestic Tariff Area (DTA).

In addition to these benefits of GIFT City, startups can also leverage state subsidies on lease rentals, provident fund contributions, electricity duty, and more.

GIFT City for FinTech

As a fintech, what is our take on GIFT City?

While many GIFT City tax benefits make it attractive to startups, the fintech sector is especially empowered in the GIFT City. Firstly, in a bid to foster innovation within the financial services sector, the IFSCA (International Financial Services Centres Authority) has introduced specialised fintech sandboxes to encourage growth in the space. These sandboxes serve as a playground for fintech startups within GIFT City, allowing them to operate in a controlled regulatory environment. This is one of the biggest benefits of GIFT City you can avail as a fintech.

This sandbox offers a live setting with a select group of actual customers for a defined period, enabling fintech startups to test and refine their ideas and solutions in a real-world scenario. It provides a unique opportunity for startups like SALT Fintech to validate their innovations and navigate the complexities of financial regulations in a secure and controlled space.

GIFT City takes Indian economy to new heights

GIFT City in India stands as a commendable launchpad for startups (especially in fintech), offering a unique blend of innovation and infrastructure that propels businesses toward unparalleled growth. The simplified administrative processes, GIFT City tax benefits, and a culture fostering innovation make it an ideal hub for startups.

However, it's essential to navigate potential challenges, such as adapting to a dynamic regulatory environment and addressing infrastructure needs, to fully harness the city's potential for entrepreneurial success.

SALT Fintech is overjoyed to be a part of the growing economic ecosystem of GIFT City, and we plan to magnify our services in the coming times to serve your financial needs as an international corporation better! Visit our website today to know more about us.

FAQs (Frequently Asked Questions)

Q1. How does GIFT City contribute to financial globalisation?

GIFT City is India's response to financial globalisation. It houses the IFSC that simplifies financial transactions, attracting foreign investments and promoting ease of doing business on par with global financial centres like London and Singapore.

Q2. Who is eligible to open an account in GIFT City?

Various accounts under the GIFT City initiative are accessible to Resident Indians, Non-Resident Indians (NRIs), foreign nationals, as well as corporates and partnership firms. Both Resident and Non-Resident individuals have the opportunity to open accounts within GIFT City.