Financial institutions and traditional banks have always viewed technology as an enabler to business growth and propositions rather than building new business propositions themselves.

However, Financial Technology (Fintech) companies are changing this role by utilizing digital technologies to make new business propositions and target new market sectors, which were previously not possible.

Fintech: A Convergence of Financial Services and Technology

Fintech, in its truest form, is the application of technology to provide new financial services and products to new market areas in an economically viable manner.

From the perspective of a business model, the Fintech sector is marked by tech companies that are either looking to partner with incumbent banks and financial institutions or disintermediate based on strategic narrative and market landscape.

Therefore, Fintech is becoming more and more of an important focus for all the key stakeholders in India’s financial services sector - traditional banks, regulators, investors, payment service providers, and many more Fintech players.

Powered by advanced data, analytics capabilities, near-zero processing costs, and asset-light platforms, Fintech companies are complementing and, in some cases competing head-to-head against traditional banking and financial services institutions.

Factors Driving the Growth of the Indian Fintech Sector

India remains one of the largest markets in the world where Fintech companies have come together strongly, and the reasons fueling this growth of the Indian Fintech industry in the medium to long term are:

Innovation in Technology and Data - Big data and detailed analytics offer tremendous potential to Fintech companies for understanding the needs of customers and providing more personalized products and services while also driving operational cost efficiencies that give rise to alternate and perhaps better business models.

- Asset light models with near-zero transaction costs - Due to advances in technology and adoption of cloud-based services are leading to asset-light models that have almost zero unit costs at the transaction level, which enable subsidization without building scale.

For this, Fintech companies are passing on the benefits of lower transaction costs to end-users, thereby improving their propositions. This aspect is further accentuated by the legacy free environment that most Fintech companies operate in, thus relying on cloud services to align their overall cost structures. - Regulatory Tolerance Towards Fintech - Regulatory authorities in India, including RBI, IRDA, and SEBI, has adopted an accommodative stance towards the emerging Fintech sector without bringing forth prohibitive guidelines that overregulate the sector.

- Big Sector Banks and Insurers Lagging Behind in Market Growth - On an overall basis, Public sector banks and insurance firms are slowly but continuously losing market share to private insurers and banks, respectively, all because of their inability to outgrow the market.

In the coming future, new private sector banks, including new differentiated banks, will probably be the beneficiaries of these emerging market opportunities. In addition to differentiated banks, Fintech players in the payment, lending, and investment management sectors are also likely to benefit from low penetration and focus on nice areas.

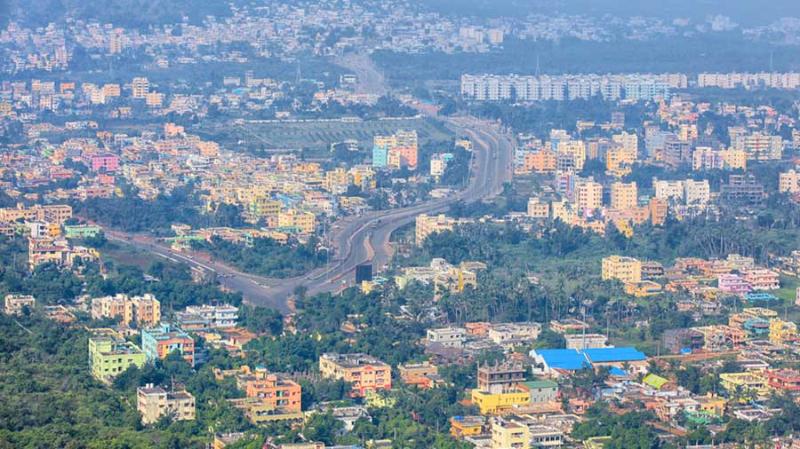

Move of Fintech towards Tier-II Cities and Beyond

The boom of Fintech has provided a dramatic shift in the way we transact in India. With the country moving towards digitization, Fintech companies have also erupted from beneath India’s surface. Meanwhile, existing players are seeing an increase in their users. Although most of these users were previously restricted to only the Tier I cities in the country, they’re not anymore.

Fintech companies are ready to turn their attention to Tier-II cities and beyond in order to penetrate deeper into the country. Being highly untapped markets with big potential, these cities bring a more prominent opportunity for the players.

Startups that have raised funding have also spoken about the need to pay more attention to the smaller markets. Take, for instance, Paytm, which made its app available in regional languages to facilitate transactions from smaller cities.

Another example would be Coverfox, the insurance company that raised $22 million US Dollars in Series C funding to expand insurance coverage into Tier-II and Tier-III cities.

The smaller cities have a huge population, and they’re ready to adopt digitization. The spending power and amenities of these cities are also rising, which is further attracting players to cater to them.

There exists a huge market opportunity in Tier-II and Tier-III cities, and the big players are aggressively looking forward to expanding there.

Conclusion

The opportunity for Fintech companies lies in extending their market reach, focusing on and reshaping customer behavior, and implementing effective and long-term strategies in the financial industry.

Fintech companies will have to create a more diverse, stable, and secure financial services landscape since they are less homogenous than incumbent banks. And the answer to this problem can be found in the expansion of their market network while also working on additional equally important issues like improving quality and reducing costs at the same time.

Tier-I has for a long time been the main focus for almost all big Fintech companies, but Tier-II, Tier-III cities, and beyond have so much pure market potential in them, which these companies need to realize and tap into as fast as they can.

By doing so, the Fintech industry will be able to reach heights hitherto unseen and make a far bigger and powerful impact than ever before.