Are you planning on making a transaction involving cash against documents (CAD)? Then you will probably need a routing number to complete the transaction. All banking or financial institutions have a routing number which indicates the bank and the branch in which a customer has their account. But what does a routing number mean, and how to find a routing number, you may ask.

Every country has a separate way of identifying bank accounts, and most financial institutions rely on the routing number. This number is essential even for international transactions, which is why you would be asked for it if you wanted to do a CAD transaction.

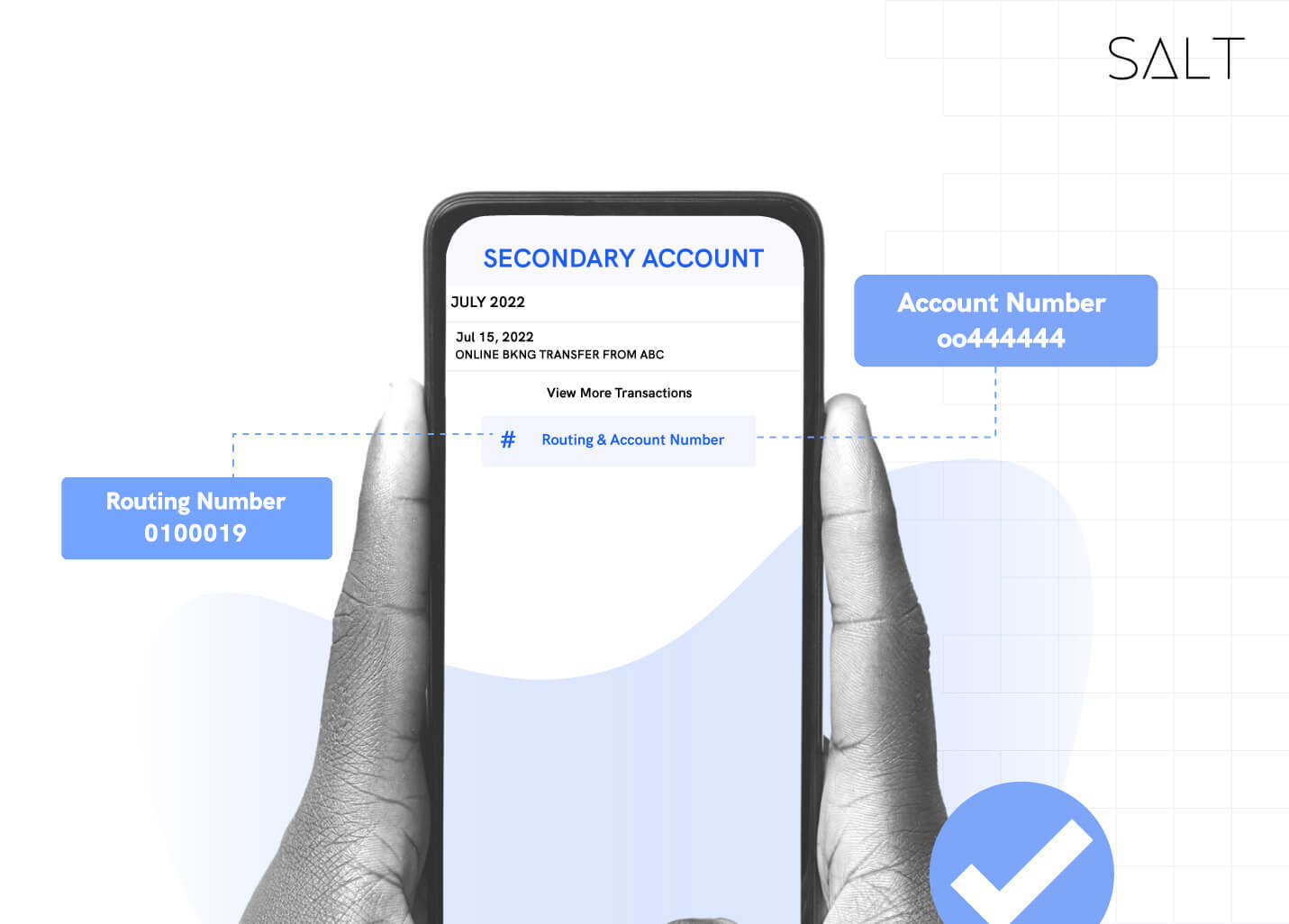

Source / Routing number for CAD transaction

Many people need to learn such financial terms, especially budding startups that await funding from abroad. So, you must wonder what this number is and how to find it for a CAD transaction. Let’s take a leap into this topic and learn how to find your routing number!

What Is A Routing Number?

So what does a routing number mean? In every country, banks and financial institutions have a separate identity from normal business entities. This is to ensure that the financial system of the country operates smoothly. Countries have a specific way of recognising such financial institutions, called the routing number. Every financial institution uses the routing number to process fund transfers and cheques. But how to find a routing number?

In countries like Canada, India, and the US, the routing number is essential for all financial transfers. Routing numbers used by banks and financial institutions within the country help process bills and business invoice payments. Neobanks like Salt also use such routing numbers to recognise the bank account with which it is associated. Usually, the routing number is a combination of eight to nine digits. The first three digits denote the bank in which the account holder has an account, and the last five to six digits denote the branch in which that account is located.

How To Find A Routing Number?

There are multiple ways that a person can find the routing number associated with their bank account. For a transaction involving cash against documents, the routing number bank provides is required to ensure that the transfer gets credited to the right account.

There are several ways to find the routing number bank provides for cash against document transfers. If your business imports from foreign countries or requires multiple assets from elsewhere, you will need cash against document transfers. The goods are released by a seller only when they receive the payments from the buyer. So, the routing number plays a crucial role in assigning the transaction to a specific account and completing the CAD transaction.

Look at the Cheques

The most basic way of finding out the routing number of any account is to look at the cheques. At the bottom of every cheque, there is a numeric arrangement which signifies the routing number if you have its knowledge. The first five digits of the arrangement give the transit number, while the next 3 to 4 digits give the institution number. You can get the routing number for your CAD transaction by combining these values.

Following the transit number and the institution number, there is also the account number of the user - written on the cheque. If you require the account number, you can also look at the cheques from the seller. It would help if you got a cancelled cheque scanned and sent to you from the seller so you can confirm their routing number for the transaction.

It’s easy to mix up routing number and account number for those not in the know, so how does routing number vs. account number shape up? Essentially, while a routing number points out the institution that your account is with, the account number clarifies your particular account among all the ones created with the institution. We do hope this clears up the routing number vs. account number debate for you.

Check the internet

Financial institutions often list the routing numbers of their branches on their official websites. You can search for the keywords, including the routing number, the bank's name, and the branch where you wish to send the money. You may even search for how to find a routing number for a specific bank and branch. For a CAD transaction, you must present the payment as a prerequisite. This means you must be sure of the routing number to get the goods released in your name from the seller. Multiple finance websites keep a directory of the routing numbers of all the banks; you can also check these websites to get the routing numbers.

Online Banking

All the financial institutions, including the neobanks like Salt, upload crucial information related to a bank account on their online banking login. Customers can just log into their accounts and check for the routing number of their accounts. This means you can ask the sellers for their routing number through the online banking method. Enterprises and startups generally use it all over the world.

Monthly Statement

Every bank account is managed through bank statements, and users can get them printed on a statement book/passbook. The statements book has the routing number printed on it. In some countries, banks print them on the upper right corner of the statement copy. But, it may change for different banks or regions. So, try to find the transit number and institution number from the book of the statement. Using these two, you can form the routing number for the CAD transaction.

This was related to CAD transactions, if you are doing transactions in EUROs, you should read about Single Euro Payments Area (SEPA) as well!

Conclusion

We do hope this post has helped you understand what a routing number means. For cash against document transactions, transferring funds on time to the seller is important for all businesses and startups. CAD transactions are usually used in international trades. The routing number plays an important role in the recognition of the bank account of the seller.

We do hope this post helped you understand where to find the routing number for a CAD transaction. Even though the conventional banking system still lags, neobanks like Salt have already turned completely digital to facilitate such transactions. So, it is best to use digital methods to complete CAD transactions and have easier operations in business.