Rapid globalisation has driven startups, SMEs and ambitious individuals to shatter geographic borders and expand all over the world. Such expansions mandate global transactions and cross-border payments frequently.

In recent times, Indian businesses and startups have levelled up to their global counterparts. Let's look at how Indian citizens and companies can accept foreign payments easily and efficiently.

Factors to keep in mind while making international transfers to India

International payments can be carried out in many ways, but they don’t come without costs. Here are a few things to consider so that cross-border payments do not cost a bomb.

Amount of money to transfer

As an early-stage startup, if you are to receive payments from abroad, some tax will be levied depending on the amount of money. The taxable amount will be discussed further after a few sections. It is recommended that SMEs or startups accept payments from abroad in a single tranche rather than several smaller payments to minimise the bank commission and GST slabs imposed on currency conversion.

Delivery time

The time taken to make cross-border payments is extremely crucial. When finalising the mode of international payments, do not forgo the urgency of money requirement, if any. When a sender and a receiver agree upon a transaction approach, the number of days that would be taken to complete the transaction should be prioritised. Be aware that money transfers do not occur either on the weekends, i.e. Saturdays and Sundays, or on public holidays.

Exchange rate

The foreign exchange market never shuts down, so the exchange rates keep changing. When making cross-border payments, it is ideal to lock a rate at favourable numbers to avoid sending money overseas at exorbitant rates.

Transfer fee

When international payments are received in India or any country, a fee is charged by the money transfer provider to execute the transfer successfully - both from the sender and the receiver. Banks and transfer companies markup prices at high rates. So, one must confirm any such fee associated with the cross-border payment.

Ways to receive international payments to India

With the world merging into a global community, we can send and accept payments from abroad in numerous ways. Here are some of the most popular ways to receive international payments to India:

Wire Transfer

Wire transfer is a popular method for SMEs and corporations to receive payments from abroad. Essentially, a wire transfer is transferring money from one bank account to another electronically without moving actual cash. For an international wire transfer, the required details to be submitted are:

Recipient's details - name, address and bank account number

IFSC code of the recipient bank

SWIFT (Society for Worldwide Interbank Financial Telecommunication) /BIC (Business Identifier Code) number of sender and receiver bank

Know more about wire transfers for cross-border payments.

Multi-Currency Account

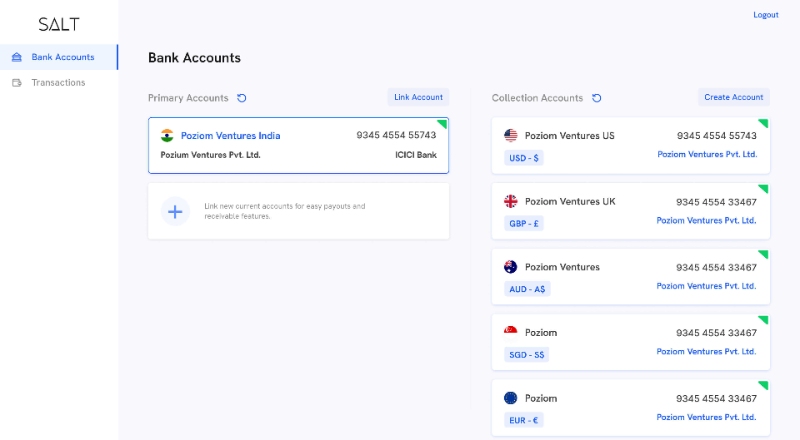

With a multi-currency account, individuals and companies can receive payments from abroad in several currencies without incorporating their business abroad.

Normal bank accounts may be unaffordable for SMEs and startups due to their high fees and tedious money transfer periods. With a multi-currency account like Salt you can receive payments in foreign currencies like USD, GBP, EUR, SGD, etc at a flat fee of 1.75 % of the amount only.

Salt provides a multi-currency account service for free and online convenience that aptly meets the demands of SMEs and early-stage startups. Learn more about the ABCs of multi-currency bank accounts for international money transfers here.

Payment Gateways

Online payment gateways like PayPal offer simple, transparent and lightning-fast fund transfer services. It is advisable to check out their technology and other supported features in addition to costs. Many payment gateways offer a variety of payment methods and support integration with third-party services and apps like credit or debit cards, other currencies, and even cryptocurrencies. Additionally, they offer recurring billing services, point of sale assistance, and subscription services.

However, payment gateways are known to add extra costs like - outrageous exchange rates, fixed fees or transfer fees per transaction, which is confusing and overwhelming for SMEs or early-stage startups. Also, there is not much support for customers looking for guidance during international payments.

Is money transferred from abroad to India taxable?

According to India's Foreign Exchange Management Act (FEMA), money received in India from a relative living overseas as a gift or for family support is not subject to tax.

However, international money from global clients and investors for SMEs or corporations does not fall under the above-mentioned category.

Money transferred from abroad to India as funds or payments is taxable. For instance, if freelancers receive payments from abroad, the amount is added to their annual income for the year and taxed accordingly. Taxes are imposed on any amount over Rs. 50,000 received by an individual from a client.

If a business, startup, or SME receives cross-border payments, income tax is levied on the company's profits, not the credited amount.

Conclusion

Receiving payments from abroad is one tricky and complicated process to see through. There are plenty of methods to ensure a secure money transfer across borders. Salt offers truly borderless solutions for global banking. With Salt, companies in India can collect payments from across the globe in different currencies in less than 24 hours at the most affordable rates.