Multi-currency accounts, like those by Salt, help facilitate international transactions by reducing complexity and removing foreign exchange commission charges.

Globalisation and digitalisation are two significant facets that businesses worldwide can’t overlook. While every startup’s or SMEs ultimate goal is to expand their operations globally, digitalisation has presented them with a new set of opportunities and challenges to work on. Various Indian startups and small and medium enterprises (SMEs) are exploring the broader sectors of the market abroad, which implies that the SMEs need to engage in frequent transactions with foreign companies. Not only that, FDI and other kinds of foreign investments trickle into India via various channels and remittances.

All these fundamentals and aspects in a foreign trade call for foreign-/multi-currency transactions. If these entities hold a normal bank account, the foreign inward remittance would first be received in the foreign currency and then converted into the local currency.

For facilitating such a conversion, banks often charge a fee. However, if a multi-currency bank account is in question, the stats could be different. Most of the import/export businesses or SMEs involved in global transactions prefer using a multi-currency account for the ease it accords to their day-to-day transactions. But what all entails in setting up s multi-currency account? What are the pros and cons - Let’s explore.

What is a Multi-currency Account?

As the name suggests, a multi-currency account is a bank service that allows one to receive, send or hold foreign currencies in a single bank account. The entities can choose to open a multi-currency account in a single bank rather than opening several normal accounts in various countries and bearing the expenses of maintaining them.

In simple terms, one account for multiple currencies, rather than opening a multitude of accounts for different currency transactions and keeping track of those account numbers. These accounts also save the foreign currency without converting them into local currency.

A multi-currency account is useful for any business that does cross-border transactions like imports and exports, online stores that sell products in multiple countries, a freelancer who works with companies abroad, or a business with branches in several countries.

Normal bank accounts charge exorbitant fees and take a long time to transfer the money, which may not be affordable for SMEs and startups. Multi-currency account service offered by Salt, a neobank solution, caters to the needs of these small and growing enterprises for minimal fees and at online convenience.

How does a multi-currency bank account work?

Multi-currency bank accounts perform similar functions to standard bank accounts but with support transactions and balances in several foreign currencies.

Similar to the bank charging a fee to maintain a standard account, multi-currency accounts also require a fee to maintain these accounts apart from transaction fees and open fees.

What are the Benefits of a Multi-currency Account?

Not all business entities require to open a multi-currency account. It's helpful for SMEs, startups, and businesses dealing with international clients, sending outward remittances in the form of salaries, payments, etc. If your organisation falls into any of these categories, then you should consider creating a multi-currency account due to the following benefits it provides:

1. Convenience: Most important feature of a multi-currency account is that it provides great convenience. You don't need to open several accounts to deal with different currencies. This saves time and money. It's efficient since all the currency balances are saved in a single account.

2. Single account number: Your SME will have a single account number for all international transactions. No need to give different account numbers to your clients in China, the US, and Canada.

3. Reconciliation is easy: With a single account for all your international transactions, month-end reconciliation is easy. You don't need to tally several accounts and manage lots of adjustments required due to the exchange rate difference.

4. Saves commission on foreign exchange: If you are dealing with multi-currency transactions and have a single home currency account, your bank will charge you a foreign exchange commission for converting the currency. A multi-currency account saves you from paying the hefty commission. Hence it's economical too.

5. Trade currencies: Even if you are an SME or a start-up, you can buy and sell currencies looking at the exchange rate is desirable at the right time. Most banks do not charge for these intra-account transfers.

How to Open a Multi-currency Account?

There are a lot of financial institutions that support multi-currency accounts. You can open it by visiting the bank branch or online.

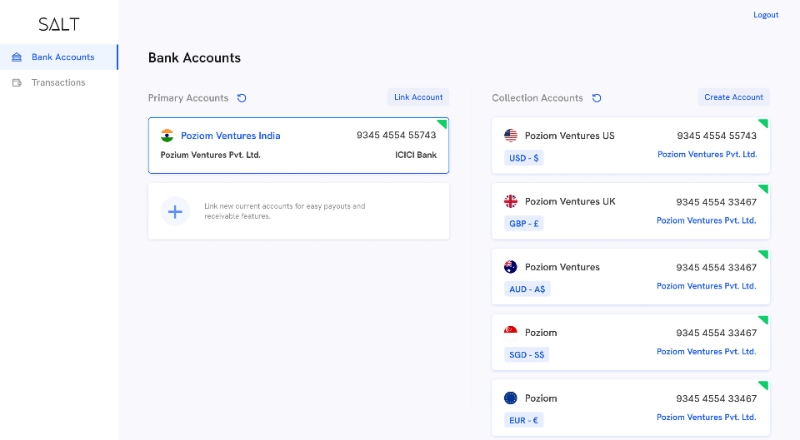

Mostly all the multi-currency accounts deal with the Dollar (USD), Pound (GBP), Euro (EUR), Australian Dollar (AUD), and other major fiat currencies. NRIs are offered international accounts, and several private banks may offer this service to individuals. However, opening multi-currency accounts in these banks requires a high minimum balance, and these accounts are mostly saved for premium clients.

While there are traditional banks that consider such accounts as a privilege meant for few, neo-banking solutions like Salt helps SMEs hassle-free international transfers using multi-currency accounts without the need to paying annual fee, hidden fee or additional charges on transfer.

Salt makes it easier to use multi-currency accounts for safe and secure cross-border transactions within 24 hours.

Conclusion

Multi-currency accounts tremendously help facilitate international transactions by reducing complexity and removing foreign exchange commission charges. In no time, such accounts managed digitally, like those provided by Salt, will be necessary for businesses dealing with foreign clients.

With a neobank like Salt, it becomes easier to create and manage multi-currency accounts from the convenience of your home. Tap into efficiencies of scale by percolating markets abroad as a startup or SME using the multi-currency account by Salt today.