With globalisation, cross-border transactions have become an integral part of businesses and individuals across the world. For India, with the advent of technology, transferring money across borders has become a lot easier, faster and more convenient with the help of neobanks in India.

However, despite all the advancements, several challenges still persist when it comes to international money transfers. Two of the most significant problems include the time it takes for the outward or inward remittances to reach its destination and the associated compliances involved.

This is where SALT, an Indian fintech startup and among the top fintech companies in India, comes into the picture. In recent years, Indian fintech startups have been disrupting the traditional financial services sector with innovative solutions for businesses and individuals.

SALT and PayPal both offer solutions for cross-border payments. In this article, we will compare SALT and PayPal to understand the key differences between the two and what sets them apart.

What is SALT?

SALT is an Indian fintech startup that aims to solve two major problems faced by businesses while carrying out international money transfers: the time it takes for the remittance to reach you and the associated compliances. SALT was founded in 2020 by Udita Pal and Ankit Parashar, both of whom have had firsthand experience with the difficulties of international business banking. The company offers a one-stop solution for all international money transfer needs and helps businesses with effortless cross border payments and the legal compliances at the least possible costs.

Services Offered by SALT

SALT offers a comprehensive solution for small businesses and startups looking to deal with international money transfer. SALT's services include automated RBI, MCA, and FEMA filings, management of pre-funding and post-funding compliance, and faster filings of FIRC and FCGPRS forms. SALT also helps businesses with generating valuation reports and operating a capital bank account.

Key Features of SALT

Automated legal compliances

Effortless cross border payments

One-stop solution for all international money transfer needs

Best possible rates in the least possible time

No markup on conversion

Follows Google rates for converting currency to INR

What is PayPal?

PayPal is an American multinational fintech company that operates a worldwide online payments system. It was founded in December 1998 and quickly grew to become one of the world's largest international money transfer companies. PayPal offers a wide range of services, including online payments, mobile payments, peer-to-peer (P2P) payments, and online cross border payments. PayPal is widely used by businesses and individuals for making cross border payments and is considered to be one of the most popular payment solutions globally.

Services Offered by PayPal

PayPal is an online payment platform that allows individuals and businesses to send and receive money, make payments, and withdraw funds. PayPal's services include personal payments, online shopping, invoicing, and international money transfer. PayPal also offers credit and debit card services, as well as payment gateway solutions for businesses.

Key Features of PayPal

Online payments

Mobile payments

Peer-to-peer (P2P) payments

Online international money transfer

Widely accepted globally

How is SALT different from PayPal?

SALT and PayPal are both platforms that offer cross border payment services, but there are some key differences between the two platforms. These differences are listed below:

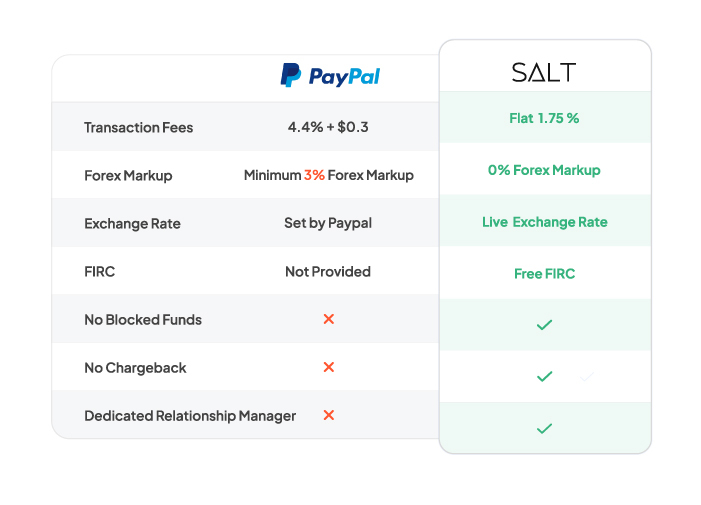

Fees: One of the biggest differences between Salt and PayPal is the fees that they charge for their services. PayPal charges a fee for each transaction, which varies depending on the country, the currency, and the amount being transferred; PayPal charges a minimum 3% of forex markup too. In contrast, Salt does not charge any markup on conversion, and usually follows the Google rate for converting currency to INR. Usually, the transaction fees charged by PayPal amount to 4.4% of the amount transferred with an added $0.3, while SALT charges a flat rate of 1.75%.

User Experience: Another difference between Salt and PayPal is the user experience. Salt is specifically designed to make international transactions easy and effortless. The platform helps businesses with legal compliances at the least possible costs, making it a convenient solution for those who frequently engage in international transactions. PayPal, on the other hand, has a wide range of services that cater to various needs, including online shopping and international money transfers to bank accounts. However, this versatility may come at the cost of a more complicated user experience.

Target Market: Salt and PayPal also differ in terms of their target market. Salt is primarily focused on helping Indian SMEs, startups, freelancers, agencies, and consultants with their international money transfer needs. PayPal, on the other hand, caters to a much broader range of customers, including individuals and businesses of all sizes.

Features: Another way that Salt and PayPal differ is in terms of the features that they offer. Salt's platform is designed specifically for cross border payments, offering automated legal compliances and effortless payments. PayPal, on the other hand, has a wider range of features, including online shopping, money transfers, and security features such as fraud protection.

Currency Conversion: SALT deals in 6 major currencies (USD, EUR, GBP, AUD, HKD, SGD) and provides currency conversion at the lowest FX rate of 1.75% of the transaction. On the other hand, PayPal allows users to deal in more than 20 different currencies but charges a higher fee for currency conversion.

No Blocked Funds or Chargeback: At SALT, you can sit back and relax knowing there will be no blocked funds or chargebacks in the processing of your transactions. Again, PayPal can not guarantee that.

Compliance Management: SALT offers a complete compliance management solution for businesses dealing with foreign investments, including pre-funding and post-funding compliance. For example, SALT helps with FIRC acquisition if inward remittance is a regular part of your business transactions. PayPal does not offer any compliance management services. Further, at SALT, you get to avail the services of a designated relationship manager for your global banking needs. Needless to mention, PayPal does not offer that.

Conclusion

In conclusion, both Salt and PayPal are platforms that offer cross border payment services. However, there are a lot of differences between the two platforms that may make one platform more appealing to a particular customer.

SALT is specifically designed for Indian businesses and is one of the top fintech companies in India dealing with international money transfer, offering a comprehensive solution for cross border payments and compliance management, while PayPal is a well-established online payment platform. SALT's services include automated RBI, MCA, and FEMA writings, management of pre-funding and post-funding compliance, and faster writings of FIRC, FCGPRS forms. On the other hand, PayPal offers personal payments, online shopping, invoicing, and money transfers, but does not offer compliance management services.

For those who frequently engage in international transactions, Salt may be the better choice due to its focus on legal compliances and its effortless payment system.

Check out the Salt blog to know more!