Are you a freelancer based in India, eager to explore the vast world of international clients? If you have been considering a PayPal business account in India, we're here to demystify the process of setting up a business account for PayPal!

In this guide, we'll walk you through the nitty-gritty, making sure you're equipped with all the essential information to smoothly navigate domestic and cross-border payments. Further, we’ll also be discussing alternatives for your freelancing business account!

How can Freelancers in India Create PayPal business accounts?

Before we delve into the "how-to," let's tackle the "can you?"

Freelancers in India, rejoice! You're absolutely eligible to open a PayPal business account and tap into a world of opportunities. However, there are a few essentials you'll need to have in place:

A Registered Business: To get the ball rolling, you'll need to have a registered business. It's the foundational step that sets the stage for your PayPal journey.

A Business Category: Select a business category that best aligns with the nature of your freelancing endeavors. It's all about categorizing your awesomeness!

A Business PAN: Your Permanent Account Number (PAN) is like your freelancing fingerprint. Make sure it's at the ready, as it's a vital piece of this puzzle.

A Business Bank Account: Sync things up by having a business bank account that shares the same name as your PAN. It's all about keeping things streamlined and smooth.

Annual Sales Volume: Get an idea of your annual sales volume – a peek into your freelancing business’s growth.

However, if you are a new freelancer looking to go global, you may need to look at some other options since PayPal won’t be much of a help. A neobank like SALT Fintech, for example, can help you manage your finances better!

How? We learn that later on.

Setting Up Your PayPal Business Account: A Step-by-Step Guide

Coming back to the topic at hand, let's dive right into the heart of the matter – setting up your very own PayPal business account. Don’t worry, we're here to guide you through every twist and turn.

Business Account PayPal: Get it Running

Freelancers in India: got all the eligibility requirements in check? Fantastic! You're on your way to traversing borders seamlessly. We’re now ready to open a PayPal business account, and here are the steps that would get you started.

1. Getting Started

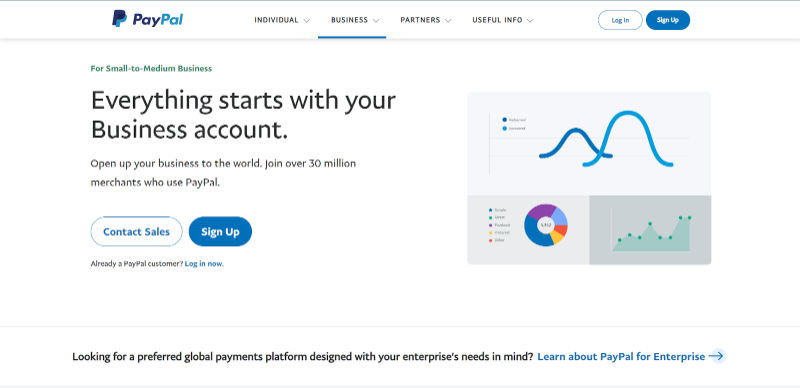

Head over to the PayPal India website and look for the "Business" option, conveniently located on a bar at the top of the page. Click on it, and let's kick-start your registration process for a business account PayPal.

Source| Open PayPal business accounts for freelancers in India

2. Choosing Your Account Type

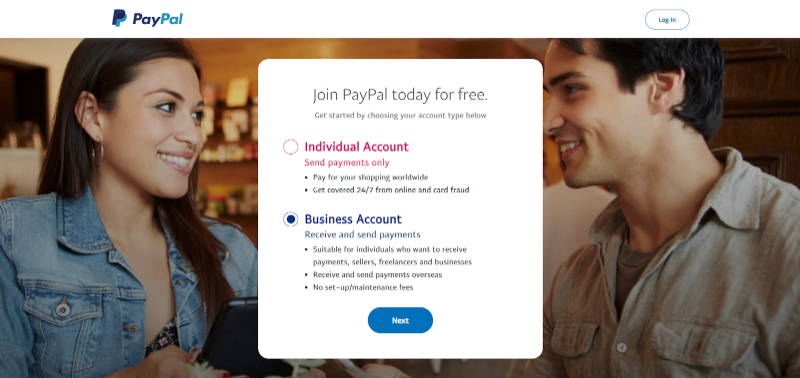

You'll be presented with two options: "Individual Account" and "Business Account." Here's where your freelancing aspirations take center stage – go ahead and choose the "Business Account."

Source| Open business account on PayPal for freelancers in India

3. Providing Your Business Details

Next, it's time to share a little bit about your freelancing business for a PayPal business account. Enter your email address, select the relevant business category that best mirrors your line of work, and note down the date when your business set sail.

4. PAN and Business Details

In this section, you’ll be required to enter your PAN details. Make sure that the name on the PAN matches the name of your business as freelancers in India.

5. Financial Information for Compliance

Time to hoist the compliance flag! You'll need to share financial details to ensure smooth sailing through Indian tax waters. It's all about ensuring your business is in top shape in terms of conforming to relevant rules.

6. Verify and Activate Your Account

Once all details are given, PayPal will send you an email to verify your account. Click on that link – it's your ticket to the next leg of this journey to open a business account PayPal.

7. KYC Procedures

Now it’s time for the KYC (Know Your Customer) protocol. This step involves submitting identification documents, a necessity from the government to ensure you’re who you say you are, and to prevent other frauds.

8. Banking Information

Navigate to the "Banking" section and put in your bank details. It's like setting your compass to guide your hard-earned treasure right into the coffers of your PayPal business account.

9. Verification

Time to seal the deal! PayPal will deposit two small yet unique amounts into your bank account. Keep an eye on your account and enter those amounts to verify your bank account with PayPal.

10. Ready, Set, Sail!

With verification complete, you're ready to sail the seas of seamless cross-border payments. Your PayPal business account is officially your vessel for receiving payments from across the globe.

PayPal Personal vs. Business Accounts: Which One is Better for Freelancers in India?

Time for some considerations! If you would remember, we clarified just a while ago that you need to be registered as freelancers in India if you want a business account on PayPal, and you must present data regarding an annual sales volume. However, would a personal account let you delve into global business as you build your company up from scratch, and gather up the documentation for the business account?

Let’s compare the two types of PayPal accounts and see the pros and cons they might give to freelancers in India:

If you look at this table comparing PayPal business accounts with individual ones, you can see that they don’t really differ in terms of benefits much, except as a registered business having a business account is more convenient for you, since you can send invoices and generate payment links to send to customers or add to an option on your website.

However, there’s still the factor that PayPal can only be of help when you are an already established business. There are considerations to be accounted for too, namely associated costs and fees

Weighing the Anchor: PayPal Costs and Fees

Before you launch your ship into the sea of international freelancing, let's weigh the anchor and discuss the practicalities. Opening a PayPal business account is a breeze for sure – it's free! However, keep in mind that there are fees associated with using the account for transactions.

The transaction fees consist of two components: a percentage of the transaction value and a fixed fee. The fixed fee varies based on the sender's originating country. So, if you're receiving payments from different parts of the world, be prepared for a bit of variability in these fees.

Additionally, there's something to consider when it comes to exchange rates. PayPal charges an extra 4.0% on top of the exchange rate. This can impact the final amount you receive in your local currency, as it is lower than the rate you see on platforms like Google.

Exploring an Alternative: SALT's Solution

Imagine a world where your international money transfers are as smooth as a gentle ocean breeze. Enter SALT, an Indian fintech startup that's rewriting the rules of cross-border payments. Co-founded by Udita Pal and Ankit Parashar, SALT aims to address the common challenges faced by businesses when navigating international waters.

Whether you are a beginner or veteran among freelancers in India, SALT can help you out!

What sets SALT apart?

SALT Fintech is a one-stop solution that takes care of the complexities of international money transfers so you can focus on your freelancing adventures. Let's take a closer look at the advantages that make SALT a superior alternative:

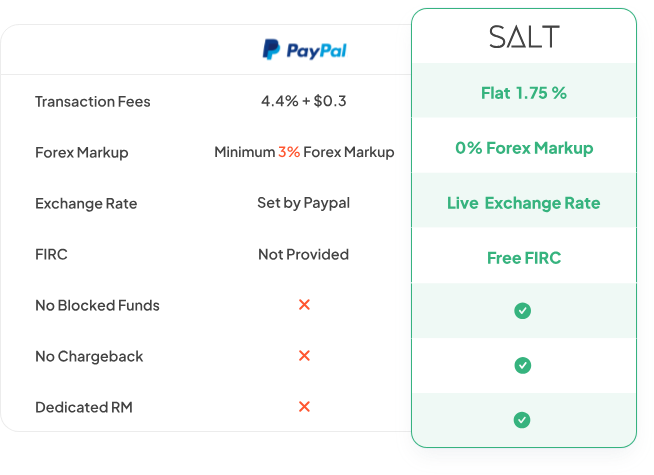

1. Competitive Fees: With SALT, your hard-earned money stays in your pocket. SALT's fees are a mere 1.75%, offering a cost-effective way to handle your international transactions. This means more of your earnings find their way to you.

2. No Exchange Rate Markup: Say goodbye to hidden costs. SALT doesn't impose any markup on exchange rates- what you see is what you get. Further, SALT Fintech follows the live exchange rate on Google when it comes to currency conversions: this transparency ensures you're not left guessing about the value of your transactions.

3. Free FIRC: FIRC (Foreign Inward Remittance Certificate) is a crucial document for cross-border payments. Unlike PayPal and most other options, SALT provides this document free of charge. It's a small detail that can make a big difference in streamlining your financial processes.

4. Transparent Processes: At SALT, transparency isn't just a buzzword. It's at the core of everything we do. From processes to fees, every aspect is crystal clear. No surprises, no fine print – just straightforward operations.

5. Superior Customer Service: Navigating international waters can be daunting, but SALT's customer service is like having a knowledgeable captain by your side. With a commitment to understanding your needs and providing swift solutions, SALT's customer service is designed to ensure your journey is as smooth as possible.

Further, SALT brings the freelancers in India dedicated relationship managers to ensure a smooth experience, and you are free forever from the hassle of blocked funds and chargeback!

If you consider PayPal vs. SALT, here’s yet another perk: SALT is designed specifically to make global finance smooth for your business, so you get a smoother UX with us, as compared to the multi-faceted PayPal!

So, as you set your sights on expanding your freelancing horizons, consider the streamlined services of SALT Fintech. It's like having a seasoned captain guide your ship through the intricacies of international transactions. With SALT by your side, you're not just setting sail – you're embarking on a journey backed by cutting-edge technology and a commitment to making your cross-border payments as seamless as possible.

Setting Sail with Confidence with Salt Fintech

Armed with insights into SALT's innovative approach and a clear understanding of PayPal's costs, you're ready to set sail with confidence. As freelancers in India seeking the best route for your international transactions, weigh your options wisely. Whether you choose PayPal's established platform or opt for the tailored solutions of SALT, your journey is bound to be smoother and more successful after due consideration of the various aspects of both!

Bon voyage on your freelancing journey!

Frequently Asked Questions

1. Can I open a PayPal business account if I'm not a registered business in India?

No, PayPal's business accounts require you to have a registered business, a business category, a PAN, and a business bank account in the same name as the PAN. These requirements ensure that the account is linked to legitimate business operations.

2. Is there a minimum annual sales volume required to open a PayPal business account?

While PayPal doesn't specify a minimum sales volume, having a track record of business operations and sales can strengthen your application for a business account. Established freelancers with consistent sales are more likely to meet the criteria.

3. Can I use a PayPal business account to shop online like I did with a personal account?

No, PayPal's business accounts are primarily designed for receiving and sending payments related to your business or freelance services. The ability to shop online with a business account is limited compared to personal accounts.

4. What happens if my bank information doesn't match the name on the business PAN card for my PayPal account?

It's crucial for the name on your bank account to match the name on your business PAN card. Mismatches could lead to issues with verification and transactions. Make sure all your business-related documents are consistent.

5. Are there any transaction limits on PayPal business accounts for freelancers in India?

PayPal doesn't explicitly mention transaction limits for business accounts in their provided information. However, they may have certain limits in place to prevent fraud and ensure security. It's advisable to reach out to PayPal's customer support for specific details about transaction limits.