Silicon Valley Bank (SVB) is one of the largest banks in the US. It manages a majority of local deposits in the Valley. As the name suggests, SVB Group also provided multiple services to technology companies and VC and PE. It was the heart of operations for many Indian startups with US Holding Company.

March 8, 2023: SVB started trending on the news after recording a loss of approximately $ 1.8 Billion from a sale of investments. It was followed by a fundraise of $2.25 Billion.

This resulted in their stock price moving down by 60%.

March 9, 2023: As the panic button was hit, the depositors started withdrawing their funds. $ 42 Billion worth of deposited withdrawal was done from the bank on March 9, 2023. There are billions worth of Pending requests!

Indian Companies have moved their money from SVB accounts via these routes

Transfer to other neo bank accounts like Brex, Mercury, Aspire

Transfer to Offshore accounts in GIFT City

Transfer via FDI

Transfer to any other entity as the priority being to move money from SVB to any other bank account.

March 10, 2023: SVB was shut down by the regulators.

The Federal Deposit Insurance Corporation (FDIC), which is in incharge of insured deposits, covers up tp $ 250,0000 per depositor, per bank for each account ownership category.

What’s Next:

The Silicon Valley Bank (SVB) shall reopen on March 13th, 2023 and all the insured depositors shall have full access to their insured deposits, i.e. $250 K only.

The Federal Deposit Insurance Corporation (FDIC) said the uninsured deposits will get receivership certificates for their balances.

Receivership certificate is a proof of the remaining uninsured deposit that the depositor holds in the bank. This certificate will help to get the remaining deposit post the bank’s asset liquidation.

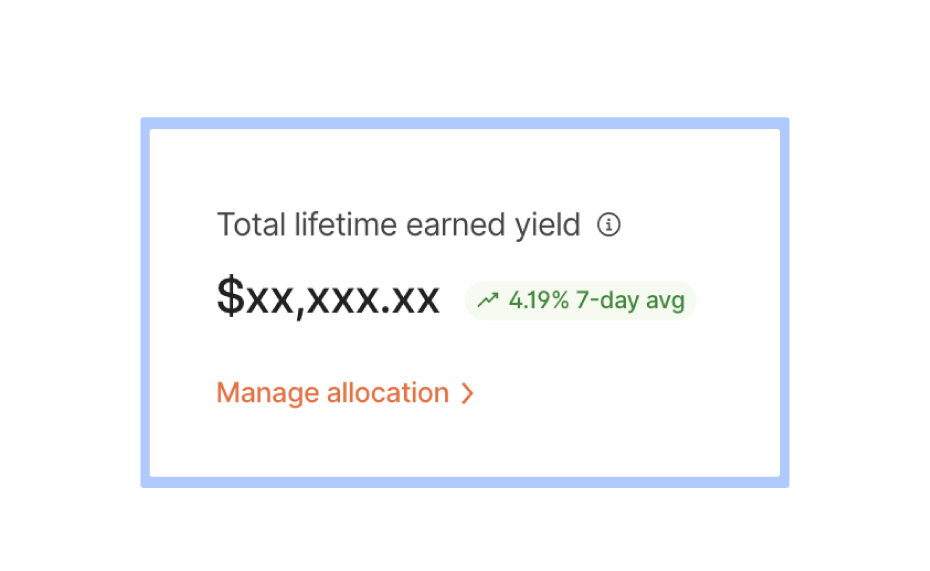

Brex cash is protected to $1 Million by allocating funds to 4 different banks. We have created a quick step by step guide to move funds from Money Markets to allocate it with Brex partner banks for FDIC insurance cover till $1 million!

Step 1:

Select Allocations from the Main Screen. This would be in the Yield Section

Step 2:

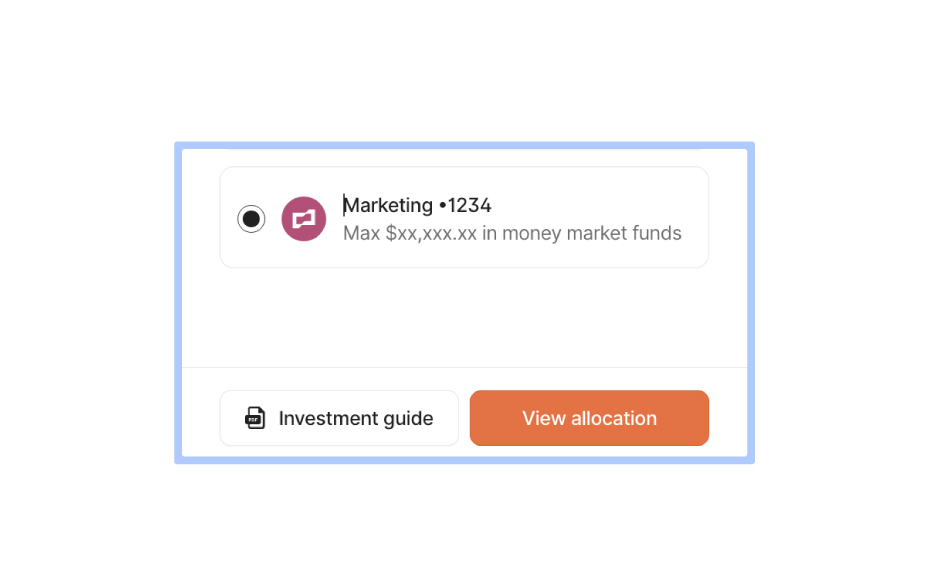

Select the account you want to manage the allocation of

This takes you to the allocation page.

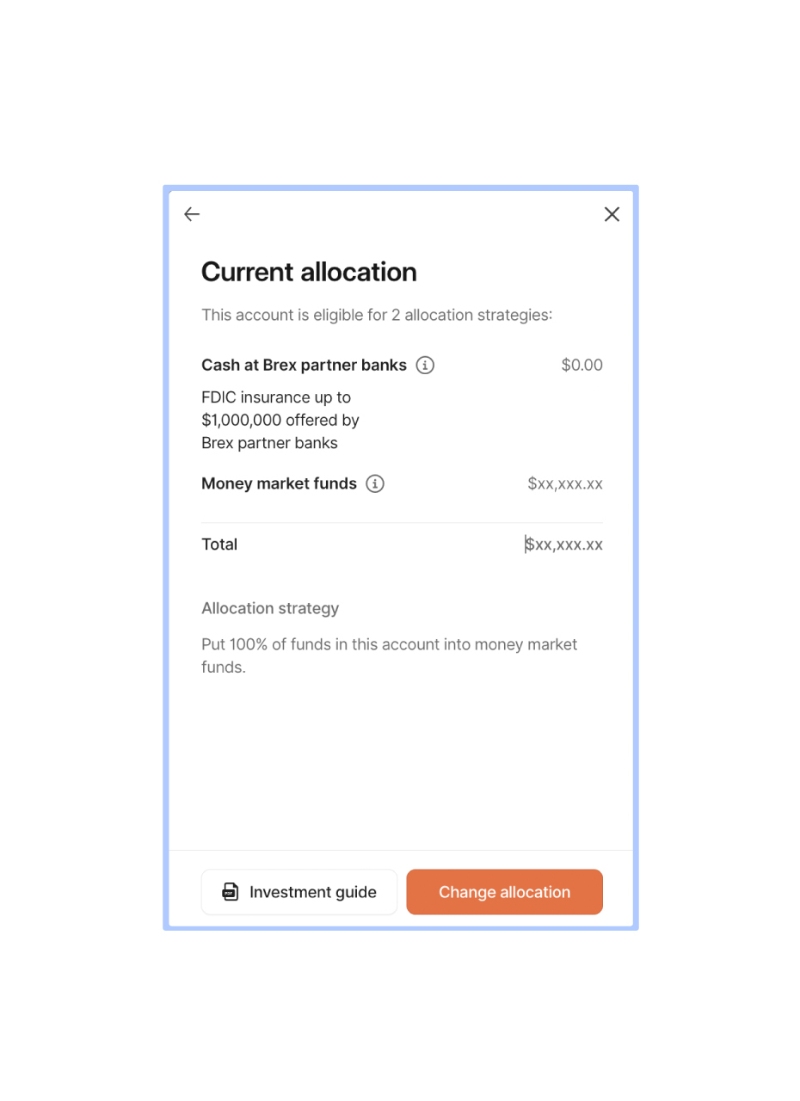

Step 3:

Select the Change Allocation Button

Step 4:

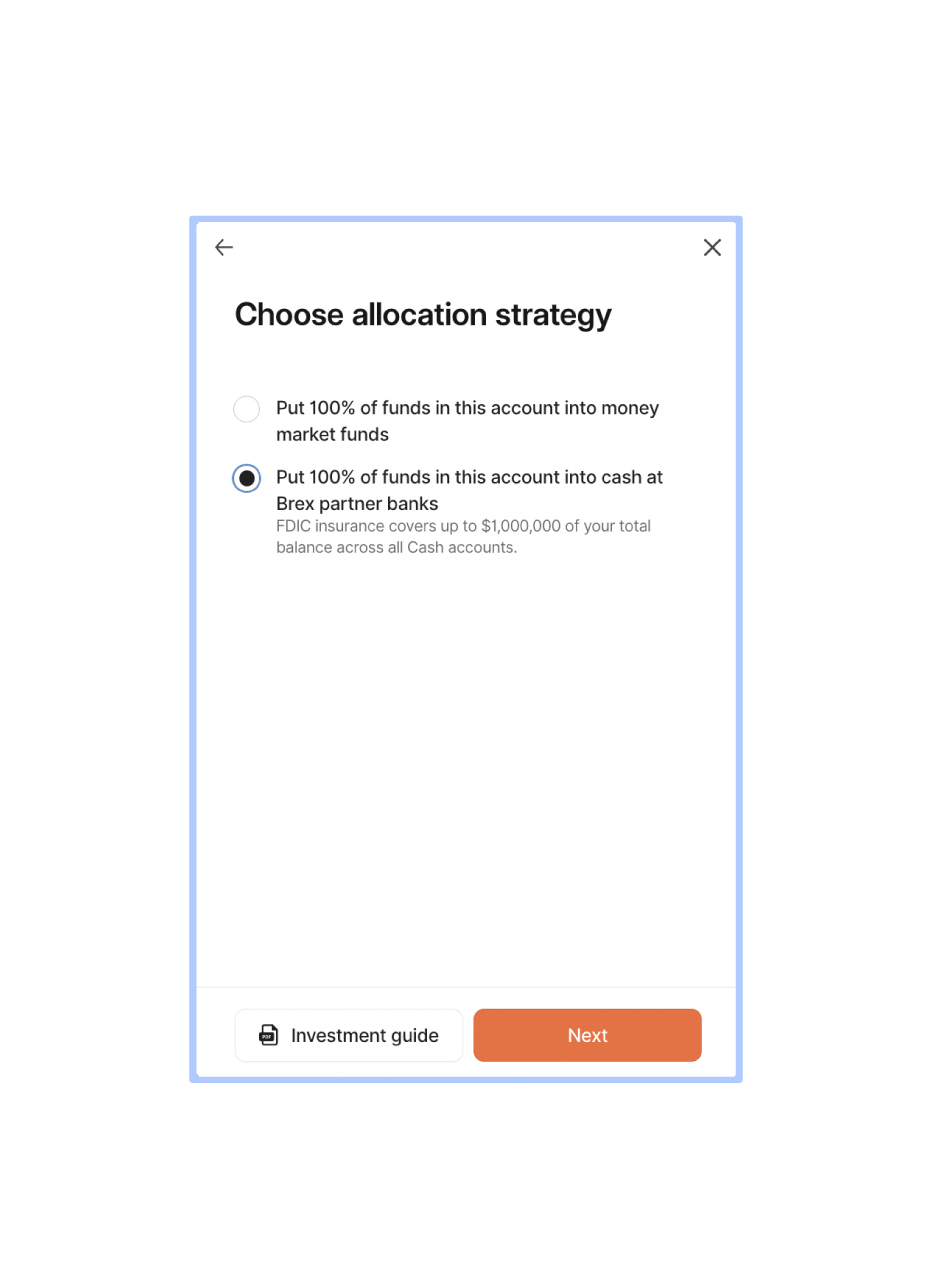

Change the allocation to FDIC Insured Partner Banks option.

Step 5:

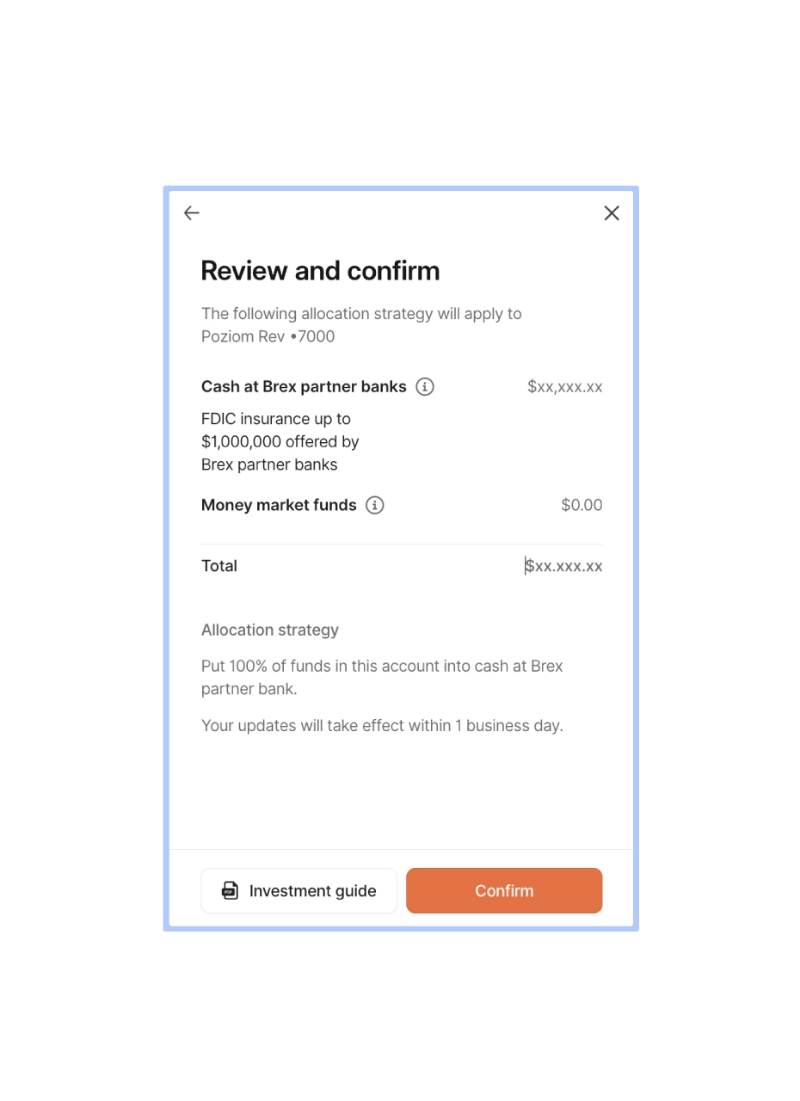

Select confirm.

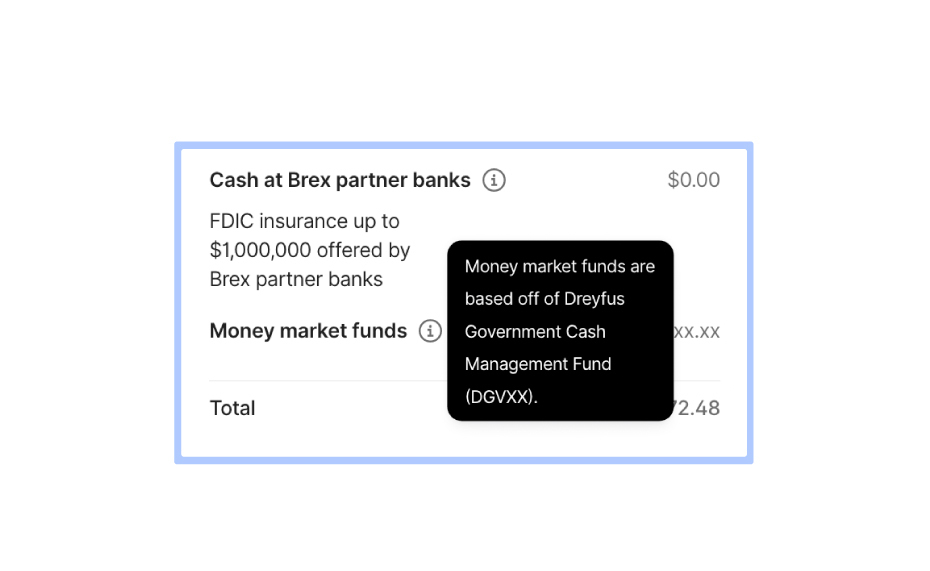

Note: The Brex Partner bank allocation is insured up to $1m as it’s allocated into multiple partner banks, also the Money market funds are invested in Dreyfus Government Cash Management Fund

This document has been created by the team at Salt , a cross-border fintech based in India.

This document is no way endorsed or created by Brex. We are not associated or endorsed by Brex in anyway or form. Please review official guides by Brex as well for further information.

If you need some assistance in any form of fund transfers to India including FDI to India, or any assistance whatsoever, kindly contact us at sudhanshu@salt.pe / ankit@salt.pe