If you're looking to do an international money transfer or deal with them frequently, you must have stumbled upon the term BIC, more commonly known as SWIFT code. There's a chance it could've made you scratch your head but let us clear your head now.

SWIFT codes are an integral part of international transactions. You could be a startup founder with distributed workforce or a friend looking to help another friend overseas. BIC or SWIFT codes hold the same significance. Let us look at what BIC / SWIFT codes mean, what they look like, and their significance!

What is a Swift Code?

Small world? We don't agree! Do you know there are over 44,000 banks and credit unions worldwide? Imagine their identity solely decided by just their names. It would be chaos.

That's where Swift codes come in. They are nothing but a unique identity of a bank or a financial institution. Technically speaking, It is an 8- to 11-character number used to identify a particular bank to make an international transaction.

Consider it a postal code for your bank, an easy way to ensure that your money goes to the right destination. SWIFT is short for Society for Worldwide Interbank Financial Telecommunication - a global network that allows transactions between countries.

Is BIC and SWIFT Code the Same Thing?

The answer is yes! BIC means Bank Identification Code, a three-word summary of the above info. BIC and SWIFT are interchangeable terms, but the function and meaning remain the same.

What does it look like - the BIC or Swift code?

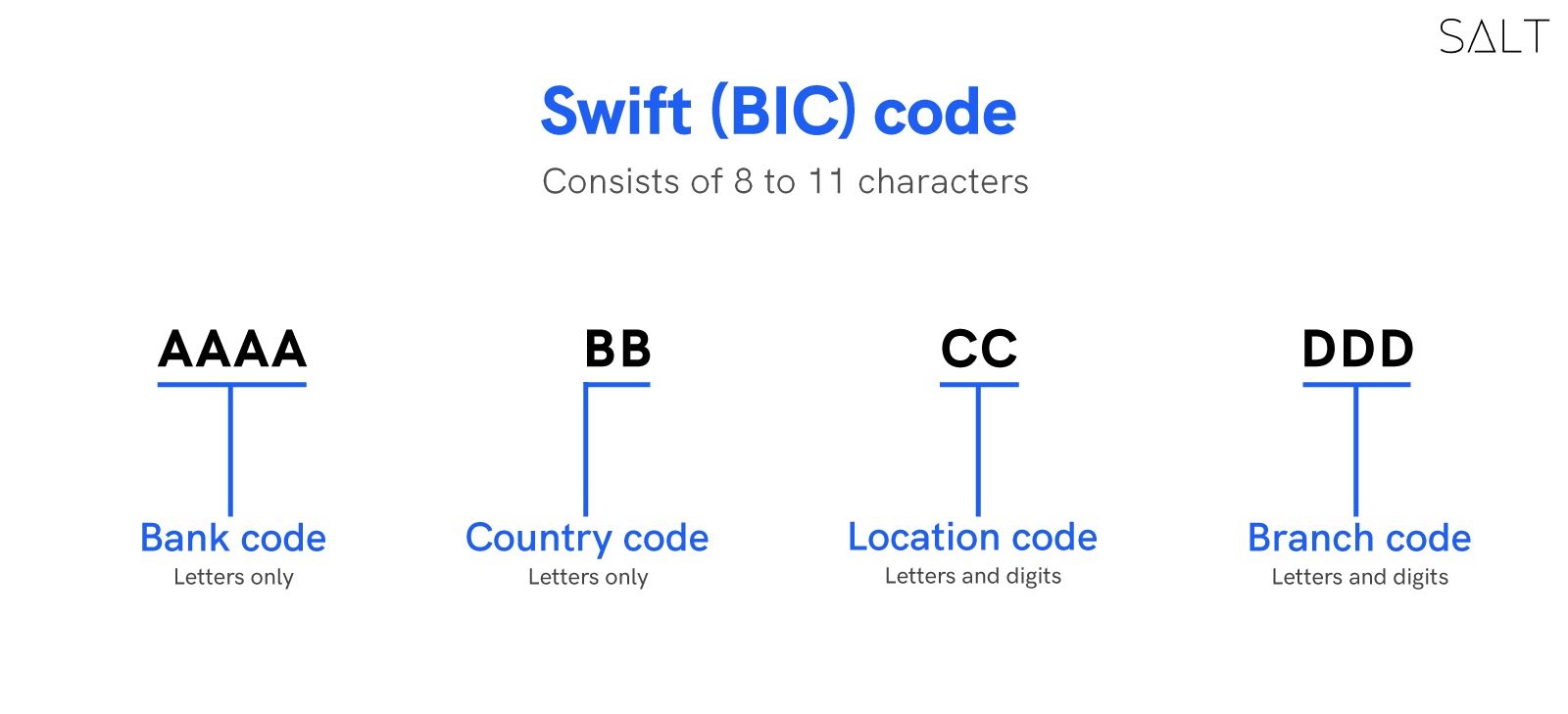

Every BIC or SWIFT code follows the same format, i.e., between 8 to 11 characters long arranged in the following manner:

- AAAA: First 4 letters represent the bank. It usually is a short form of the bank's or institution's full name.

- BB: 2 letters represent the country's code where the bank is present.

- CC/00: 2-character that can be letters or numbers represent the location/area of the bank's head office.

- DDD/000: 3-character branch code stating where the specific branch is situated. Banks that do not use 3-character branch codes have shorter (8-characters) BIC!

Where can I find my bank's BIC or SWIFT Code?

You can find it on your bank statements or log in to your online banking account or make a call to your local branch. But all this sounds a little bit exhausting. You can find your bank’s SWIFT/BIC code in your bank account statements or use a SWIFT/BIC finder to get the right code for your transfer.

When do we Need BIC / SWIFT Code?

Every International wire transfer asks for a BIC or SWIFT code. It's how money transfer services identify where to transfer money globally. However, a few exceptions exist when using an online banking service or third-party application. There's a chance you will be able to make the transfer without needing to enter the SWIFT code.

Why in the world do we Need BIC / SWIFT Code?

As mentioned earlier, BIC acts as an international postal code for a bank. Imagine sending a postcard without any postal code and within your state only. What will happen with that postcard? The chances of being delivered to the wrong destination are significantly high. And if not, it may be returned.

Either way, it would be impossible for the postcard to reach its destination. So you see, the postcard is your money, and BIC works as a postal code, and that too at a global level, making sure that your money reaches only the right destination.

Are there any Charges for using BIC / SWIFT Code?

There are no additional charges for using BIC or SWIFT codes. You are paying the same charges required by your bank whether you're using BIC or not for your international transaction charges like international transfer fees, exchange rates, taxes, etc.

With some banks, these rates could be very high. And there's a high chance that you will pay charges more than the amount itself while transferring a small amount internationally. That's why you need a banking service that offers low, transparent exchange rates, does not charge absurdly high fees and is fast and easy to use!

You can try SALT for an amazing global banking experience and easy international transfers with facilities such as multi-currency support, multiple bank accounts, and smooth foreign transactions across 50 countries.

For SMEs, especially, SALT opens up the delights of facilitating business across the globe seamlessly with its cross-border payments solutions, that helps businesses accept international payments using local bank accounts without incorporating their business overseas.

Head over to Salt for a hassle-free international business banking experience!