While starting a business, an entrepreneur should be completely aware of the whims and fancies of a business's difficult journey. Entrepreneurs often fall prey to certain problems due to unawareness of common issues. One common problem that businesses regularly face lies with understanding the differences when it comes to voluntary vs. involuntary churn. Let’s find out how voluntary vs. involuntary churn shapes up in this article, shall we?

Voluntary Vs. Involuntary Churn

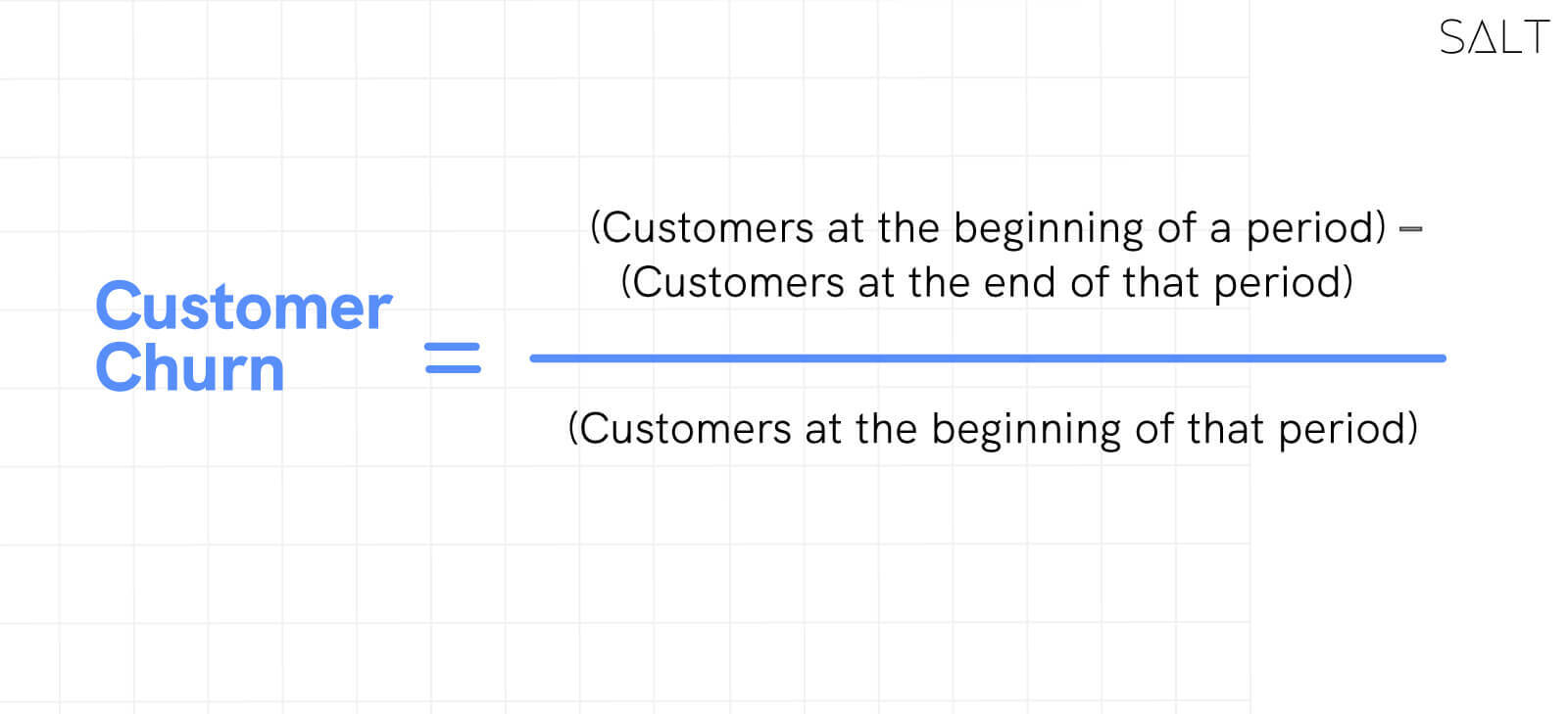

A business can't have the same customers forever. Due to some issues, businesses and start-ups lose customers periodically. This rate of losing customers is called customer churn. Many large corporations, specifically those that depend on subscription models, have previously fallen victim to high customer churn rates. On the contrary, reports have claimed that those companies who monitor their customer churn rates regularly and take timely actions to reduce the rate have done much better over time. Let us dig deeper into the two main types of customer churn.

Involuntary churn occurs when a customer stops using a company's services involuntarily, mostly unaware of the same. Sometimes while in a subscription mode, a customer's card may expire, or due to insufficient funds, the subscription may stop. The customer might only be aware of the issue if the company notifies them. If the company fails to do so, it loses out on the payments made by the customer, facing involuntary churn.

On the other hand, voluntary churn happens when a customer genuinely gets unimpressed by a product and decides to stop using it actively. The reasons may vary, from a poor product to bad customer service, but the customer is directly responsible for cancelling the company's subscription in the case of voluntary churn.

How Involuntary Churn Silently Impacts Your Business

A company is directly responsible for reducing voluntary churn. It strives to provide customers with the best product and services and use effective sales and marketing strategies to reduce voluntary churn rates. Customers usually tend to complain if they initially face a problem with the product. Therefore, a company can always make amends, making small changes to the product immediately or solving the problems of the customer through great service,

But, the involuntary churn of a company often goes unnoticed by both the customer and the company. A customer may not necessarily be unsatisfied with the product to cancel their subscription but may be affected by silly problems that directly impact their company transactions.

The most common issues include the expiry of cards, network problems, changes in the regulation of cards in particular countries, insufficient funds or crossing credit limits. Companies that initially get massive popularity often receive regular inflows through subscriptions, and small reductions in such inflows go unnoticed. The major issue is that such reductions may get compounded, and once it is too late, the company fails to acquire their customers again.

Companies and start-ups need to recognise that they can completely avoid involuntary churn. A business should mind even if a single customer stops dealing with them, get to know the root cause of the issue, and try to solve it. When a customer doesn’t even have issues with the product and cancels their subscription unmindfully, it is the company which suffers permanent damage.

Three Ways To Reduce Involuntary Churn

Companies can reduce involuntary churn in the following ways:

Constantly monitoring the involuntary churn rate: This includes monitoring how many customers stopped paying due to payment declines or regulatory issues. A dedicated team or tool should be allotted this job so that the churn rate doesn’t go unnoticed.

Automate payment retries: Failed payments via cards should be retried automatically after a period of time. The customer can allow this to happen once the company informs them beforehand. It ensures efficiency for both parties.

Send regular emails and app notifications to customers: Companies should regularly send app notifications or emails to customers to inform them about failed transactions. Bringing such issues to their notice may reduce the involuntary churn rate.

Three Ways To Reduce Voluntary Churn

To reduce voluntary churn , one can resort to the following ways:

Building an efficient and user-friendly product: This is the primary step to ensure customers don’t stop using your product. The product is the main reason customers may stick to a company.

Ensure excellent customer service: A 24*7 dedicated customer service teams should always respond promptly to queries and solve customer complaints. Efficient customer service can go a long way in securing a loyal customer base.

Provide flexibility to the customer: A customer should be provided flexibility in pricing and payments. Since customers from all spheres of society may cater to your product, the customer should be provided flexibility in choosing from a wide array of flexible payments, and they can be provided flexible dates for making payments. This ensures that customers don’t stop using a product due to inconvenience or lack of affordability.

Conclusion

We hope this blog helped explain the two different types of customer churn rates, and the differences of voluntary vs. involuntary churn. Learn more on how to retain your clients.

Knowing the nitty-gritty of running a business helps in the sustainable growth of the business in the long term.

Want to manage your global business’s financial activities with the convenience of local accounts? Give our website a visit today to find out more!