Payment acceptance, often referred to as decline rate or authorisation rate, is the proportion of payment attempts that are successful. Since low payment acceptance would result in low revenue yields, it is a crucial metric for optimising customer revenue. The rate is usually displayed as a percentage.

What Is Payment Acceptance?

Payment acceptance is the percentage of payment attempts that are successful, as mentioned above.

It is often a concern for e-commerce and marketplace businesses, but it is also important for software as a service (SaaS) companies to track. This is because various factors in the SaaS model, such as the increased likelihood of payment failure for online transactions and the need to accept international payments, can affect payment acceptance.

Additionally, SaaS and subscription businesses depend on retaining customers and smoothly processing recurring payments to prevent customer churn, so low payment acceptance can result in lost revenue.

It is an essential aspect of any business, as it allows the business to receive the funds it needs to operate and grow.

Why Is Payment Acceptance Important?

If your payment acceptance rate is low, it can result in lost revenue from potential customers attempting to purchase your service and from existing customers trying to continue or expand their use of your service.

By analysing payment acceptance data, you can identify the causes of payment failure, which are often due to insufficient funds in the customer's account or expired or lost cards. If a payment fails during a first-time purchase, it can result in the loss of the customer.

At the time of renewal, a failed payment can cause unintentional customer churn, resulting in lost revenue for the current and future billing cycles. Improving payment acceptance by just 2% in the case of monthly subscription renewals can increase revenue by 21% over the course of a year.

How Is Payment Acceptance Calculated?

To calculate payment acceptance, divide the number of successful payments by the total number of payment attempts and then multiply it by 100. You can obtain this data by exporting it from your payment processor as a CSV file.

However, there are more specific ways to calculate payment acceptance that can provide insight into the various factors influencing it. One way is to look at unique payment acceptance or the number of payment attempts during checkouts compared to the number of individual payment attempts. This can help you identify areas where you can take action to improve payment acceptance.

Why Should You Care About Payment Acceptance?

There are several reasons why businesses should care more about payment acceptance. Here are some of the main ones:

Customer Convenience:

In today's digital age, customers expect to be provided with the option to pay for goods and services in a variety of ways. By accepting a range of payment methods, businesses can make it simpler for customers to make purchases and increase their chances of making a sale.

Increased Sales:

By accepting more payment methods, businesses can appeal to a wider range of customers and improve their chances of making a sale. For example, a business that only accepts cash may lose out on potential sales from customers who prefer to pay with a credit or debit card.

Improved Cash Flow:

Payment acceptance helps businesses to receive the funds they need to operate and grow. This can be especially important for small businesses, which may have limited access to credit or other forms of financing. By accepting a range of payment methods, businesses can improve their cash flow and have the financial resources they need to meet their expenses and invest in their operations.

Reduced Risk:

Payment acceptance can also help businesses to reduce their risk of fraud or chargebacks. By using secure payment systems and processes, businesses can protect themselves and their customers from financial losses.

Customer Loyalty:

By providing convenient and secure payment options, businesses can increase customer satisfaction and loyalty. Users who have a good experience with a business's payment acceptance processes are more likely to return and make repeat purchases.

How Can Payment Acceptance Be Improved?

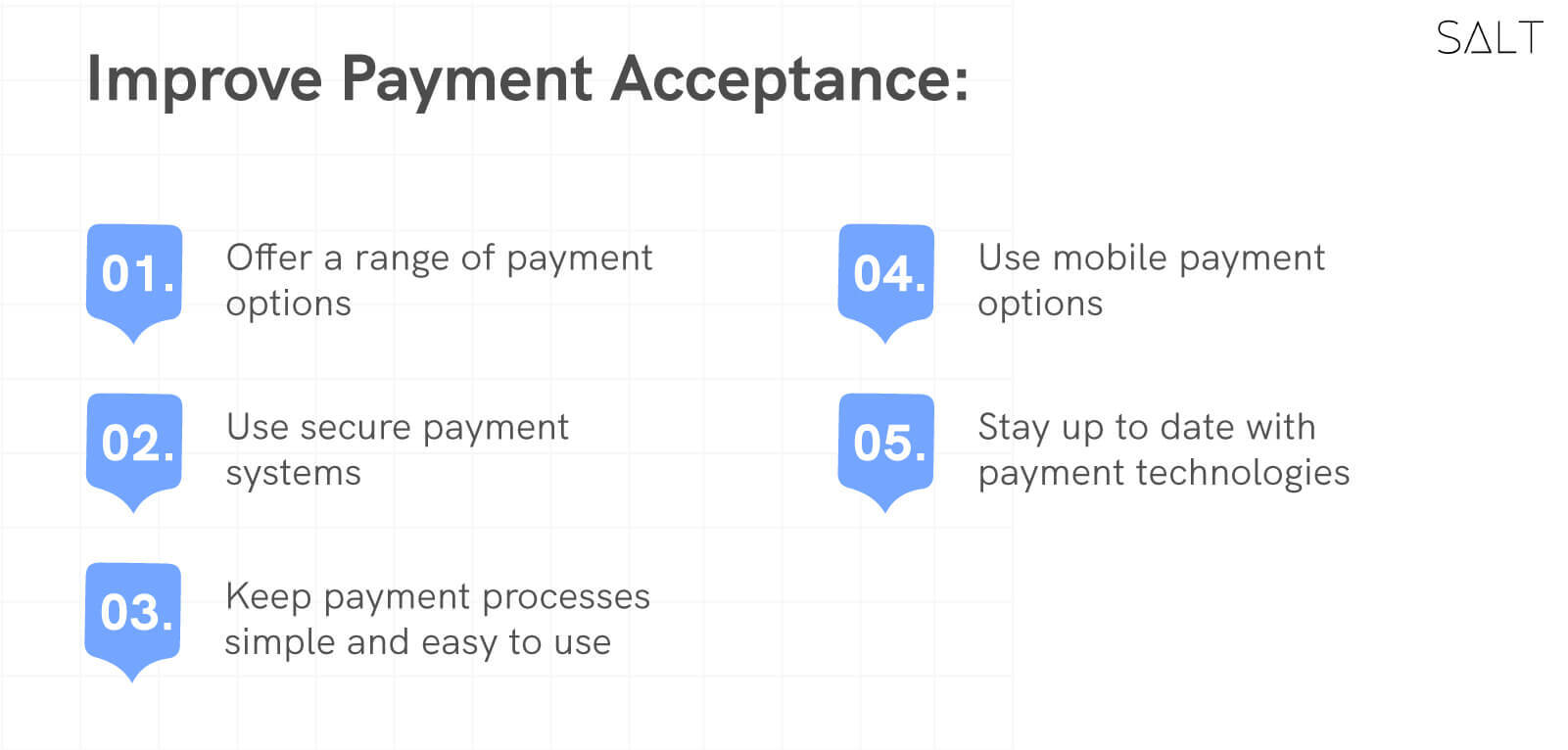

There are many ways businesses can improve their payment acceptance processes. Here are some tips:

Offer a range of payment options:

As mentioned above, it's important to offer a variety of payment options to appeal to a wider range of customers. This may include cash, credit and debit cards, online payments, and mobile payments.

Use secure payment systems:

To protect both the business and the customer from fraud or chargebacks, it's important to use secure payment systems and processes. This may include using encrypted payment portals, verifying the identity of the customer, and using fraud detection tools.

Keep payment processes simple and easy to use:

Users are more likely to go through a purchase if the payment process is straightforward and easy to use. Businesses should aim to minimise the number of steps involved in the payment process and make sure it is clear and user-friendly.

Use mobile payment options:

Mobile payments are becoming increasingly popular, especially among younger consumers. By offering mobile payment options, businesses can appeal to this group and make it easier for customers to make purchases on the go.

Stay up to date with payment technologies: Payment technologies are constantly evolving, so it's important for businesses to stay up to date with the latest developments. This may involve implementing new payment systems or integrating new technologies into existing systems.

Conclusion

In conclusion, payment acceptance is an essential aspect of any business, as it allows the business to receive the funds it needs to operate and grow. By accepting a range of payment methods, businesses can increase their chances of making a sale, improve their cash flow, reduce their risk of fraud or chargebacks, and increase customer satisfaction and loyalty.

We hope this article helps you understand payment acceptance in complete detail. Want to read more informative articles about the world of finance? The Salt blog is just the place for you!