Cross-border payments have typically been a time-consuming and expensive process, as evidenced by endless networks of middlemen and hidden fees involved. Fortunately, changes in the market over the previous several years mean that people and SMEs can now take advantage of quicker, inexpensive, and value-added foreign money transfer services. However, one must have proper information and knowledge about the prerequisites and steps.

Contents

What is WIRE transfer?

A wire transfer refers to electronically transferring money from one bank account to another. Such cross-border payments or domestic transactions are initiated by a person or company in favour of another while being in any part of the world. Popularly called wire payments, wire transfers are transfers of funds without any physical cash aided by a common banking infrastructure.

The cost of a wire transfer differs from bank to bank and increases with an increase in the amount of money transferred to another country from India. In case someone receives international payments from abroad, in the form of a wire transfer, in that case, the charges will apply on the sender’s side and will depend on the bank and their country of residence. For instance, in the US, a typical wire transfer can cost anywhere between $0 to $50, while in India, these charges may range between INR 500-1,000.

Types of WIRE Transfer

Depending on the geographical location of the sender and the receiver, wire transfers are classified into two categories: Domestic transfers and International transfers, both kinds being further categorised as inter-bank and intra-bank in nature.

Domestic transfers

Any wire transfer between two banks or other financial institutions in the same nation is referred to as a domestic wire transfer. To complete a domestic transaction, senders may need a code or the recipient's branch number.

Domestic wire transfers can be transacted within a few hours and are typically processed the same day they are initiated because these require passing through a domestic automated clearing house (ACH).

An intra-bank transaction signifies that the transfer's sender and beneficiary are customers of the same bank. Simply put, funds are transferred from one account to another within the same bank. An inter-bank transfer is between two different financial institutions or banks. Inter-bank domestic wires are transferred from one bank and deposited into another bank's account, which is the bank account of the recipient.

International transfers

International wire transfers start in one nation and are complete in another. Even when sending money to some party abroad with an account with the same bank, senders are required to send via international transfers. The routing or SWIFT (Society for Worldwide Interbank Financial Telecommunication) code is necessary for international wires.

Usually, such wire transfers arrive within 2-5 business days. The extra day is due to the mandate that international money transfers must clear a local ACH and its foreign equivalent.

When a cross-border payment is made from one country to another, and both the sender and the receiver bank are the same - such an international money transfer is categorised as an intra-bank international wire transfer. Banks often conduct inter-bank transactions using the SWIFT network, implying that transfers can be sent directly without needing a central bank.

An international wire must comply with all legal requirements of the sender’s country of residence, the intermediate bank, and the recipient’s country of residence. Due to this, the process can take a little longer than with other wire transfer services. Depending on the location of banks, several banking networks like the INET (Interbank Network for Electronic Transfers) can be utilised for inter-bank international wire transfers.

How to send a WIRE transfer?

You can find relevant details here if you have to send a wire transfer for your startup or corporation task in India. To send a wire transfer, you can fill in a form at your bank and fill in details such as:

Name and address of the recipient

Bank account details of the recipient

BIC (Business Identifier Code) /SWIFT code of recipient bank - These are international standard format codes for identifying banks and financial organisations, and they are frequently used interchangeably. 11-digit SWIFT codes include the bank, nation, city, and branch codes.

IBAN (International Bank Account Number) - Depending on the location, you can enter up to 34 characters. The first two represent the nation, followed by two cheque digits, then the bank account number (up to 30).

Example: IN 32 WXYZ 202485 123456

Are WIRE transfers safe?

Generally, a wire transfer is secure as long as you know the recipient well and fill in the details on the wire transfer form carefully. A trustworthy service will confirm the legitimacy of each party taking part in a transaction, making anonymous transfers impossible. Suppose a network of issuing, clearing, and receiving institutions is available. In that case, a member can instantaneously send a little or big amount of money across state lines or worldwide using a wire transfer. Wire transfers are a quick, dependable, and secure way to send money when done correctly.

How to track WIRE transfers?

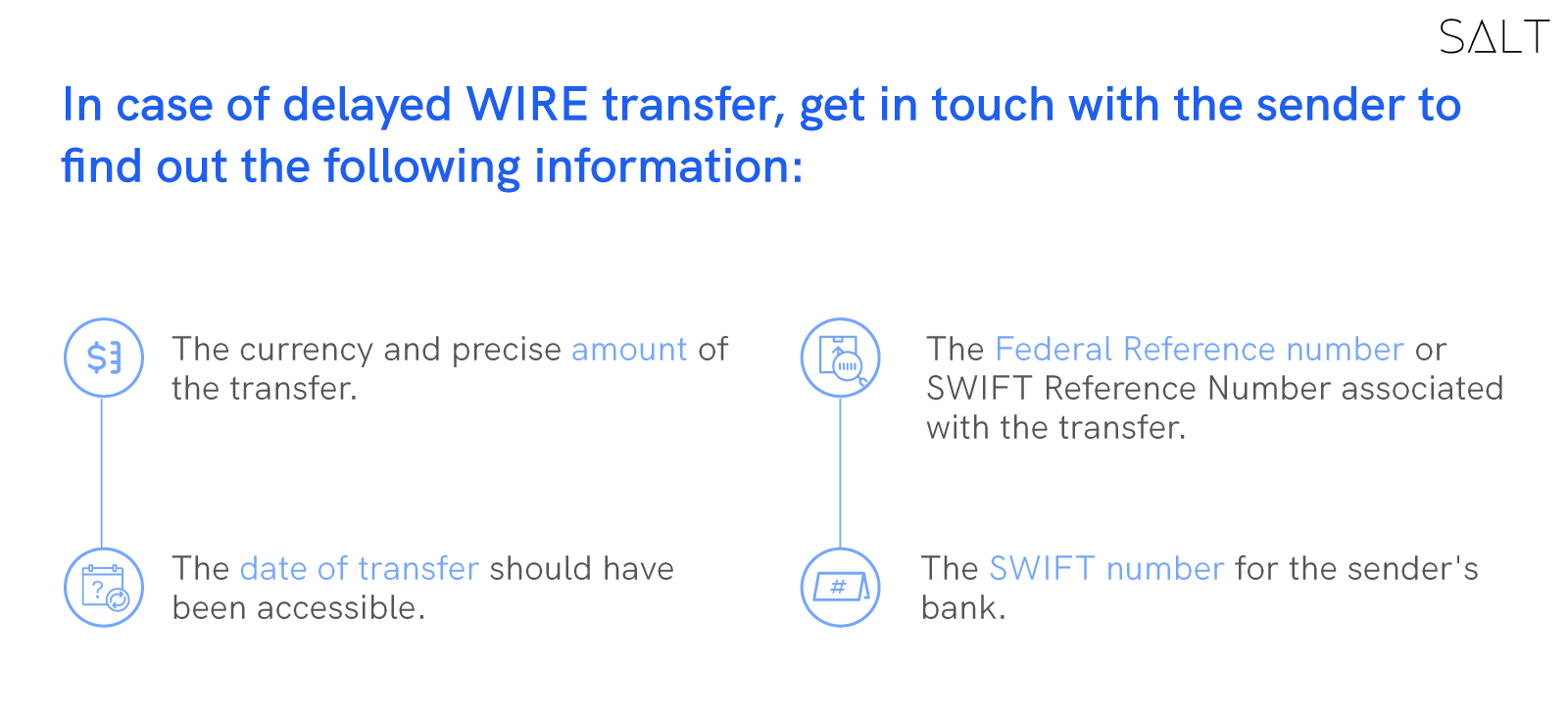

If you have sent across a wire transfer for your SME, you can ask for a wire recall if you detect that your wire isn't being posted to the appropriate account. In such cases, your money gets deposited in your account. As it becomes more difficult to recover funds once they have been credited to another account, it is best ot inform the bank as soon as you find the issue.

If you are looking for smooth international money transfers and financial services for your SME or startup at the most affordable rates, SALT offers trustworthy services across the globe. You can create a truly borderless account and receive payments from abroad to your Salt bank account at the lowest rates and in multiple currencies. For both SMEs and independent contractors who operate and transact internationally, Salt aims to simplify money transfers and compliance handling.