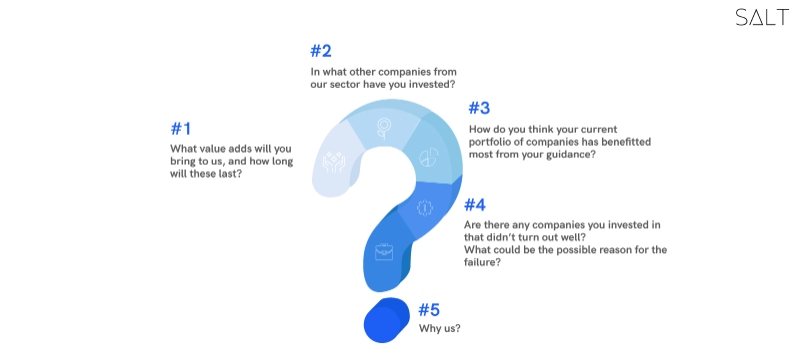

Here are the five most essential questions that founders of startups need to ask their investors and VCs during an investment round.

How often have we heard investors bombarding the founders with questions during pitch decks and investment rounds - questions that unsettle them and, if not answered satisfactorily, cost founders their chance to crucial investment. Founders, too, need to brace themselves to answer all kinds of questions, from product-market fit to traction strategies.

We talk less about the concerns founders face, and the questions founders want to ask their potential VCs and angel investors. Why does a disbalance exist in the power equation between founders and investors?

Maximilian Fleitmann, CEO at BaseTemplates and partner at Richmond View Ventures, considers this VC/angel/FDI investment a marriage. You cannot marry a stranger, and you would like to learn about your partner as much as you can before you marry them. The same goes for the investor-founder relationship.

Communication is vital to any relationship, and more critical is that both parties stand on an equal footing. Let’s talk about the five most essential questions that founders of startups need to ask their investors and VCs.

#1 What value adds will you bring to us, and how long will these last?

This is the first question every startup should ask their potential investor. As founders, you must realize that the success rate for startups is pretty low, and getting an A-lister of an investor in every position can be a great boost for your startup’s future prospects. An investor doesn’t just bring funds; they bring special skills and add-on services that can support you in your startup journey.

No one-size-fits-all model of investment will ever ensure great success. Startups should ask investors if they are ready to customize their policies and add-ons to suit your organization's specific needs. Ask clearly about how the association, if materialized, would bring benefits to your firm and help you achieve the set goals and pivot at the right time.

Investors and VCs bring with them great networks and connections. An investor can also help you align your hiring process with your organizational goals and help you in hiring the right talent. They can also help decide the marketing approach, supply chain, business development and scaling, pricing models, etc.

#2 In what other companies from our sector have you invested?

It is always good to gauge your investors' experience and work profile. By getting to know about founders and startups, they have worked with and succeeded in, you get a good opportunity to conduct due diligence and background checks on your investors. Most investors won’t divulge these details unless asked to do so.

The question is critical and relevant because if the investors have already invested in one of your competitors’ businesses, your chance of getting an investment is null. It is against the general practice to fund competing businesses simultaneously.

At times, the investors contemplate the market space to know the potential investment options available. In that case, the VC or investment firm will reach out to you just like your competitors. Ultimately, you decide whether you want to place your bets and compete for the investment.

#3 How do you think your current portfolio of companies has benefitted most from your guidance?

Ask the investors for some examples where they brought significant value-adds to the companies they invested in. Though past performance isn’t a guarantor of future success, it will surely let you know about the investors' future behaviour and how they will help you accomplish your startup goals.

Ask for particular examples of benefits the investor bought to the company it previously or is currently backing. Ask for references of founders the investors have worked with in the past.

An investor of substantial caliber would have some great references and examples to share of how they brought benefits to the startup's business during their association. This question and the subsequent task of cross-checking the references will help you measure the worth of the investor and the depth of their backing.

#4 Are there any companies you invested in that didn’t turn out well? What could be the possible reason for the failure?

If you are wondering why this question needs to be asked, just remember that the real test of the people is in the worst of the times. While you ask this question, you may come out to be an informed and sophisticated founder, and the investor would also know that you are ready for the best and the worst.

At the same time, you get a reference that will provide you with a first-hand account of the investors’ behaviour and perspective during difficult or conflicting times.

#5 Why us?

This may be the ending note of your question-answer round during the pitch deck, but it is an excellent question to ask your potential investors. You will know beforehand what to expect and, conversely, investor expectations from the relationship. You will also know the risks and concerns investor perceives or sees in your venture. You can discuss and clear out these concerns during the investment process.

The feedback can also be vital to look at your business from a new perspective and understand your shortcomings. The investors also get an impression of your openness to feedback and readiness to change and can become better invested in your business later on.

Also, you will immediately get an idea of whether the meeting will lead to the investor funding for your venture or not. If the investor asks for a follow-up meeting, they are interested in your business, and you should consider preparing yourself for the next round of conversations. Who knows, the next meet-up may be the day you end up with the cheque from the investor or VC.

While founders would be tempted to accept the first check offered to them, they must realize that capital comes at a cost. You are exchanging a part of your company's equity for that capital and entering into a long-term relationship with your angel investor or VC. The due diligence and background info digging become even more pertinent if startups access funds via FDI.

Table by Salt can help your startup manage the banking and legal processes involved in fundraising via foreign capital. The startups get all the required assistance with RBI and MCA filings, opening a capital bank account, and transferring funds.