![Storytelling In Fundraising: 8 Non-Negotiable Rules To Follow [Ultimate List]](https://assets.superblog.ai/site_cuid_ckunzpgt125001pphuz4n48xp/images/1-15-1652685929989-compressed.jpg)

Fundraising is often one of the most challenging parts of running a startup, even more so when working with unconventional business models. If it is your first time fundraising for your startup, there is a high probability of making mistakes when presenting your pitch, most of which are easily avoidable with the right guidance.

Upon looking up “how to deliver a fundraising pitch,” you will be greeted by dozens of articles, each preaching something different from the others, with no consensus in sight. To cut through the murky waters of fundraising for startups, we’ve compiled the ultimate list of the eight non negotiable rules for making your pitch to a potential investor.

Summarize Your Pitch

You finally get to make your pitch to an investor. A key point to keep in mind at this stage is to get rid of repetition and keep your investors engaged by keeping non essential to a minimum. Your product might be the next Tesla, but if you fail to keep an audience of one, i.e., your investor, engaged, you’ll have a tough time keeping up with the attention spans of regular people. Keep the specifics to a minimum unless pressed for details, saving you effort and your investors' time. Therefore, condensing your pitch into a simple message that you wish to get across while fundraising remains best.

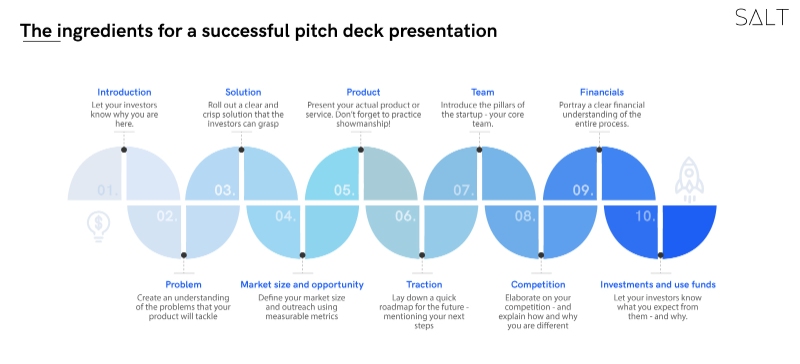

A Picture Is Worth A Thousand Words

A picture, whether a graph or a diagram, is much more effective at getting your point across than words. Often your vision might get lost in a torrent of words, and visual cues can prove very productive in eliciting a response from your audience. Graphics or images make your story much more memorable and accessible, forming a connection with investors and establishing the core ideas. Likewise, infographics are an excellent way to summarize information. Fundraising campaigns without any imagery are dull and show a lack of preparedness. Visual storytelling can be a powerful tool to engage the audience and spark dialogue when done correctly.

Connect With Your Audience

The main questions that run through an investor's mind before providing capital start with a “why.” While numbers matter in assessing performance, your audience will likely be indifferent to long drawn out displays of statistics as the sole reason to invest. Providing a solid reason for your startup is essential and is helped immensely with a strong narrative that connects with your audience.

#1 What need is this going to meet?

#2 Why is this specific product the best possible candidate?

#3 What changes does this idea make?

#4 What makes it special?

Structure Your Pitch

Any public oration, whether a pitch for fundraising or a speech, needs an appropriate structure to be adequately understandable to the audience. Your pitch should begin with an introduction to the business and the product or service, followed by a quick rundown of your performance in the market so far. Keep the first point in mind, and skim over the technical details unless they are necessary to gain a complete understanding of the business. A basic structure to follow can be introduction, content, conclusion, QnA round.

Practice Makes Perfect

When you first get the opportunity to pitch potential investors for your startup’s fundraising, most of your effort will go into creating the perfect pitch deck. Keep in mind that the pitch you deliver represents not just your business but it's also a representative of your ability to explain your business to others. While giving the pitch, never refer to the slides or notes. Your eyes should be focused on the investors and their reactions. To ensure you don't forget any important details, practice your pitch until you’ve learned it by heart.

What Problem Is The Product Solving?

A product should only exist if it either solves an existing problem or serves to combat a future problem. Before looking at revenue or quarterly reports, your investors will focus more on the product’s usefulness. A product with no long-term use case has a short life cycle, which forces the company to diversify or suffer losses. If your product solves a problem, begin with talking about the problem and then introduce the product and its utility to the investors.

Add Context To Your Pitch

Context matters, especially when making a pitch for fundraising. This point ties in with the fourth point, “structure your pitch.” When talking about your startup’s revenue or future plans, it is very important first to lay the groundwork, talking about the industry, the issues in your competitors, and last but not least, how you intend to be an improvement over existing solutions. Providing context to your investors makes it much easier for them to understand your business.

Inspiring Protagonists

Every pitch deck needs a case study to explain the product and its target demographic. A case study needs a relatable protagonist who will allow potential investors to become emotionally immersed in your pitch. Investors are more likely to identify with a fleshed-out character with dreams and aspirations than with an anonymous business owner talking about statistics and finances. The character can be real or imagined, but the only thing that matters is that they are sympathetic and relatable. Hence it is good to create a well defined character before giving your fundraising pitch.

Conclusion

These eight tips are some of the most effective on the internet and have been tried and tested throughout countless pitch meetings. Hopefully, your next pitch will be much more effective with the help of these tips.