We’re all well past the point of acknowledging how rapidly tech is evolving. Because it already has - enough to reinvent how we go about nearly every daily task and chore.

Including managing business finances.

Electronic payments are popular because their advantages are hard to ignore - they are convenient, cost-efficient, and easy. And while there are many ways to transfer funds from one person to another, the easiest methods today are Automated Clearing House (ACH) and WIRE transfer.

But how are they different from each other, and which is the best option?

To determine which bank transfer method is superior, it is important to understand the workings of both and then contemplate the pros and cons.

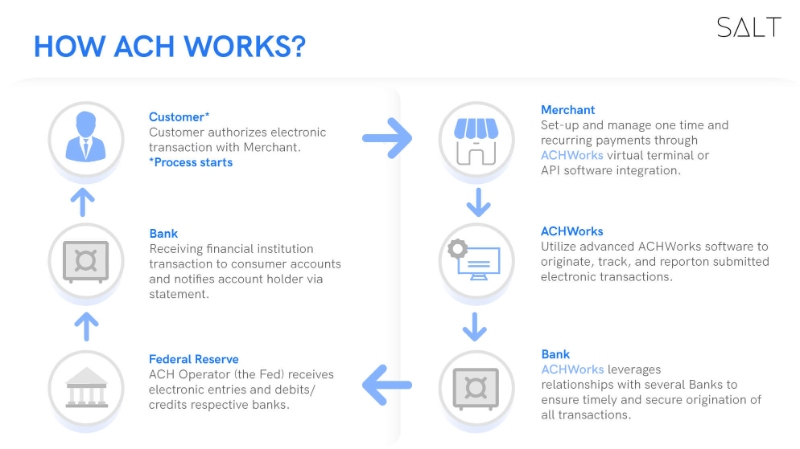

(Source) | How does ACH work?

ACH refers to a digital money transfer process through the Automated Clearing House network. It enables both personal and commercial transactions and direct bank-to-bank payments. ACH transactions involve any digital payment made by one individual to another or to any business. For example, recurring utility bills, subscription fees, tax refunds, B2B transactions, etc. Any ACH transaction can’t be processed without the following parties:

1. The Originator:

The originator is the person who initiates a payment request.

The Originator’s financial institution: The Originating Depository Financial Institution (ODFI) refers to the bank where the originator has their account.

2. An ACH operator

3. The receiver’s financial institution:

The Receiving Depository Financial Institution (RDFI) refers to the bank where the receiver has their account.

4. The Receiver:

The receiver is the person who is meant to receive the payment on the other side.

Types of ACH payments

There are two types of ACH payments; credit transfer and direct debit payment. ACH credits are the payments where one ‘pushes’ out money from their bank accounts. Examples of ACH credit can be any retail payments made by a customer, organisations rolling out the salaries and pensions, providing dividends to the shareholders, non-urgent business-to-business payments, and more.

ACH debit payments are the payments where the money is ‘pulled’ from your account, in the cases of utility dues, insurance premiums, interests, mortgages, etc., without any intervention. The decided amount gets deducted from the account on its own each month.

What is WIRE?

WIRE transfers allow an individual to transfer money electronically even when they are in different geographical locations. The money is transferred from one bank account to another without the involvement of cash. Instead of cash, the following information is shared with the bank:

Name, address, and bank account number of the recipient

IFSC code of the recipient’s bank

SWIFT (Society for Worldwide Interbank Financial Telecommunication) /BIC (Business Identifier Code) number of sender and receiver bank

The amount that is to be transferred

The reason for the transfer

Wire transfers are typically used to transfer large amounts of money quickly, and that requires a certain fee to be paid for the use of the services.

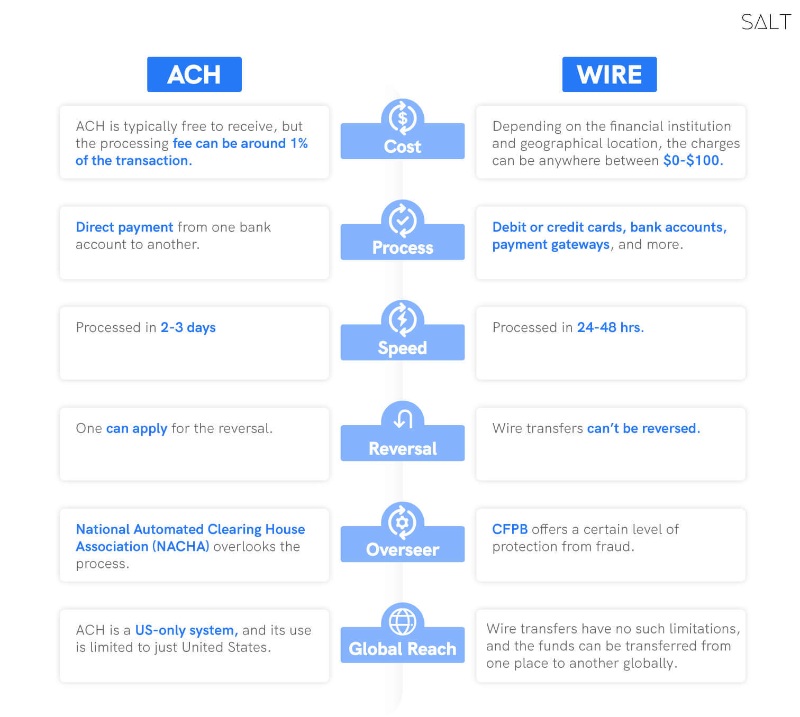

ACH Vs. WIRE

The following is the side-by-side comparison of ACH and Wire transfers. Comparing the two options in this manner will make it easier to contemplate which one is better under what circumstances.

ACH Vs. WIRE: Which is the best option for USD Payments?

Both ACH and WIRE facilitate payments in USD. Wire transfer is better in situations where a huge amount of funds are to be transferred urgently. These transfers are initiated by the banks, which makes it easier, but a fee is to be paid for the use of the services.

On the other hand, ACH is ideal for smaller transactions that are non-urgent. They might take some time to get credited but are usually free of cost. Hence, both of them are important and helpful in different ways and can help expedite the process of money transfer.