If your business is about to receive inward remittance through international money transfers to India, you may want to learn about Foreign Inward Remittance Advice (FIRA) first. FIRA serves as a document that informs you about the foreign remittance made to your account, allowing you to keep track of your incoming funds and ensuring that you receive them promptly.

Contents

In this article, we will examine the purpose and process of FIRA in detail so that you can better understand this important document.

But first, the basics of inward remittances:

What is Foreign Inward Remittance?

Foreign Inward Remittance (FIR) is a term used to describe the transfer of money from a foreign source to an individual or entity in India. It can be a fund transfer from a foreign bank account to an Indian bank account or a transfer of cash or other financial instruments from a foreign entity to an Indian entity. FIR can be used for several purposes - personal or business transactions, investments, or even as a gift from a companion or family member living abroad.

Foreign Inward Remittance plays a vital role in the Indian economy, as it contributes to the country's foreign exchange reserves and helps promote trade and investment between India and other countries.

How can inward remittances be made to India?

Inward remittances to India can be made through two RBI-mandated methods, known as the RDA (Rupee Drawing Arrangement) and MTSS (Money Transfer Service Scheme). Let’s find out a little more about them:

RDA

RDA (Rupee Drawing Arrangement) is a facility that enables Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) to remit money to India in Indian Rupees. Under this arrangement, the overseas bank debits the remitter's account in foreign currency and sends the equivalent amount in Indian rupees to the beneficiary's account in India. RDA is a simple and convenient way of sending money to India, eliminating the need for currency conversion.

MTSS

On the other hand, MTSS (Money Transfer Service Scheme) is a cross-border remittance service that allows individuals to send money to India from abroad through authorised money transfer agents. The Reserve Bank of India governs MTSS and aims to facilitate the flow of small remittances from overseas Indians to their families in India. The maximum amount that can be remitted under MTSS is USD 2,500 per transaction, and any person can avail of the service, irrespective of their nationality. It’s important to note that you’re only allowed to receive up to 30 MTSS-facilitated inward remittances in a year.

Both RDA and MTSS are popular channels for inward remittances to India. The channel choice depends on the remitter's preference, the amount of money to be sent, and the purpose of the transaction. It is important to note that any inward remittance to India must comply with the guidelines and regulations of the Reserve Bank of India.

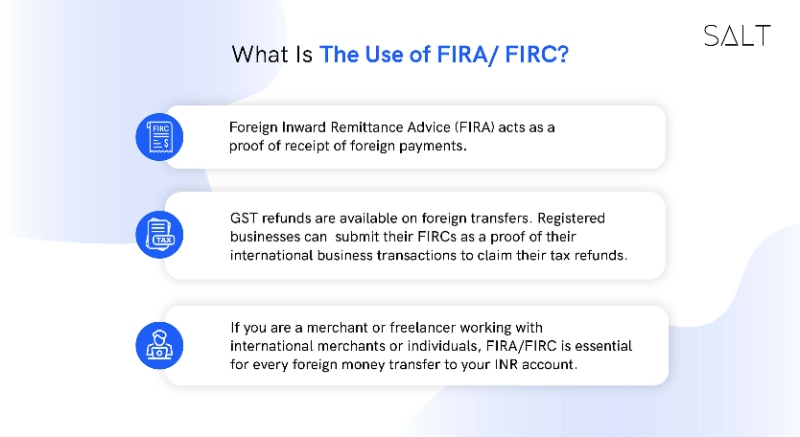

Purpose of Foreign Inward Remittance Advice

The purpose of Foreign Inward Remittance Advice (FIRA) document is to:

Inform the beneficiary in India about the foreign inward remittance made to their account from abroad.

Provide details about the inward remittance, such as the amount, the currency, and the sender's details.

Serve as proof of the inward remittance, which can be useful for various purposes such as tax filings or compliance with foreign exchange regulations.

Allow the beneficiary to keep track of their incoming funds and ensure they are received promptly.

Facilitate compliance with the foreign inward remittance RBI guidelines and reporting requirements for foreign remittances.

Help the authorised dealer banks to maintain proper records of foreign exchange transactions.

Assist in monitoring and regulating foreign exchange transactions in India.

Process for Foreign Inward Remittance Advice

The process for Foreign Inward Remittance Advice (FIRA) involves the following steps:

Step 1:

Remittance:

The first step is the inward remittance of funds from abroad to the beneficiary's account in India. This can be done via various tracks, such as wire transfers, online banking, or a correspondent bank.

Step 2:

Reporting to RBI:

The next step is reporting the foreign inward remittance to the RBI by the authorised dealer bank. This is done through the Electronic Reporting System (ERS). The authorised dealer bank must report the remittance within two working days of receiving the funds.

Step 3:

Generation of FIRA:

After the inward remittance has been reported to the RBI, the authorised dealer bank generates the FIRA. The FIRA contains details such as the beneficiary's name and address, the remittance amount, the currency, and the sender's details. The FIRA is then sent to the beneficiary's registered email address or by post to their registered address.

Step 4:

Delivery of FIRA:

Once the FIRA has been generated, it is delivered to the beneficiary. The beneficiary can download and print the document if the FIRA is emailed. The beneficiary will receive a physical copy of the FIRA if it is sent by post.

Conclusion

Foreign Inward Remittance Advice (FIRA) is an important document for beneficiaries in India who receive foreign inward remittances. It serves as proof of the remittance and helps the beneficiary keep track of their incoming funds. The process of FIRA involves inward remittance, reporting said remittance as per RBI guidelines, generation of FIRA, and delivery of FIRA. By understanding the purpose and process of FIRA, you can ensure that you receive foreign inward remittances promptly and hassle-free.

Are you a business in India looking for ease of global banking? SALT can help you out! We are a fintech focusing on making global banking easy for Indian businesses.

Salt fintech provides

Give our website a visit today to find out more!