The global market size for fintech (financial technology) is expected to continue growing, becoming a $1.5 trillion industry by 2030. 2023 was a significant year attesting to this extensive growth; fintech in 2023 was not limited to just digital payments, it also explored innovative areas like voice-enabled payments, virtual cards, and enhanced cybersecurity. These advancements continue to open up new avenues for fintech applications beyond traditional financial services.

In this article, let us look at the top trends that dominated cross-border payments and fintech in 2023.

G20’s impact on cross-border payments

After the G20 Leaders endorsed specific requirements to enhance cross-border payments in 2020, the FSB (Financial Stability Board) has come up with a progress report in 2023 to reveal the industry's initial performance against the benchmarks set, providing unprecedented transparency.

The G20's initiatives on enhancing cross-border payments have focused on improving speed, transparency, cost, and accessibility. The goal is to have 75% of cross-border payments credited to their beneficiaries within an hour by 2027. This initiative can benefit economies by supporting economic growth, international trade, global development, and financial inclusion. Reducing the global average cost of sending remittances is also a key target, aiming to bring it down to no more than 3% by 2030.

On that note, at SALT Fintech we simplify international transactions and compliance for businesses in India. We help you manage foreign exchange risks, reduce costs associated with international payments, and ensure compliance with international financial regulations.

Rise in digital money transfers

One of the fintech trends In 2023 was the preference for digital money transfer over cash. This was influenced by several factors, including the COVID-19 pandemic that acted as a major catalyst, accelerating the adoption of digital payments.

Even with a return to in-person commerce, the trend towards digital payments not only sustained but, in some cases, grew even further. This shift was driven by consumers' increasing openness to new technologies, with convenience and improved user design playing a crucial role in advancing adoption. This trend was highlighted in McKinsey’s 2023 Digital Payments Consumer Survey, which revealed that 9 out of 10 consumers had used some form of digital payment over the year. The survey also showed a trend toward consolidation of digital wallets and a shift in trust towards large tech firms from banks in the realm of digital payments.

Neo-banking (for example, SALT Fintech is a neo-bank) emerged as a significant trend, offering online banking services with no physical branches, leading to savings on infrastructure costs and the ability to provide customers with lower fees and higher interest rates. This further fueled the preference for digital transactions over traditional banking methods.

The US and cross-border payments

One of the fintech trends in 2023 was the significant push towards digital payment innovations in the US cross-border payments landscape. This was influenced by global e-commerce growth and business expansion needs. Updates in regulatory frameworks, such as PSD2/3, influenced the US cross-border payments landscape, pushing traditional banks to compete with digital disruptors.

Increasing B2B payments

The B2B payments landscape is being transformed by the adoption of innovative technologies, including the rise of cross-border payment solutions to facilitate international e-commerce, and the increasing integration of embedded finance within B2B platforms.

There's also a significant shift towards virtual cards, offering enhanced transaction security and control. The focus on real-time payments is enhancing cash flow and business responsiveness. These trends in fintech development are collectively driving us to a more efficient, secure, and user-friendly B2B payment ecosystem.

The Latin American opportunities

Latin America is experiencing a fintech boom, driven by high mobile penetration, a young population, and a significant unbanked segment. The fintech industry in Latin America has undergone significant growth and transformation in 2023, marked by a surge in venture capital investment and the emergence of innovative digital financial services. The following are the fintech trends in 2023 in Latin America:

Neo-banks have seen remarkable growth. They have challenged traditional banking practices by offering more customer-friendly services, such as lower account minimums and fees, and easier account-opening processes. Brazil leads the region with the highest number of neobanking community.

The preference for alternative payment methods in Latin America has been driven by factors like limited access to credit cards, lack of financial inclusion, and high smartphone penetration. Digital payments and e-commerce have grown significantly, with instant payment solutions like Brazil's Pix playing key roles.

Digital wallets have become increasingly popular, contributing to financial inclusion in the region. Digital wallets are extending financial services to previously unbanked or underbanked populations, enhancing customer engagement, and offering functionalities like peer-to-peer transfers and bill payments.

Cloud technology and Software-as-a-Service (SaaS) solutions, such as Wallet-as-a-Service (WaaS) and Banking-as-a-Service (BaaS), have emerged as key drivers in the fintech industry. These solutions enable businesses to offer banking and financial services without significant infrastructure investments. They also facilitate process automation and faster, more secure payments.

Blockchain and cybersecurity

Blockchain technology is increasingly being leveraged for enhancing cybersecurity in the fintech sector. Its decentralised and transparent nature offers robust security features, making systems less prone to hacking and data breaches. In fintech in 2023, blockchain technology continued to evolve and play a significant role. Key developments include:

2023 saw the introduction of various zero-knowledge (zk) roll ups like zkSync Era, Polygon’s zkEVM, Linea, and the =nil; Foundation. These rollups aimed to make blockchains operate more efficiently by executing more transactions off-chain, thereby reducing transaction costs and enhancing privacy and security.

Significant improvements in blockchain interoperability were witnessed, facilitating better communication and liquidity transfer between different blockchain networks. This was achieved through methods like token burning and minting on different chains, and bridging tokens between source and destination chains.

There was a growing trend in using blockchain for tokenizing real-world assets like cash, gold, real estate, and treasury bonds. This process helps bring more liquidity on-chain and allows these assets to be used as collateral in decentralised finance (DeFi) protocols.

There was a focus on using blockchain-as-a-service (BaaS) platforms, which made it easier and more affordable for businesses to adopt blockchain technology.

Moreover, the public sector started to adopt blockchain technology more extensively, replacing traditional paper-based systems with distributed ledger technology (DLT). This transition offered advantages in terms of credibility, transparency, and security through cryptographic validation capabilities.

Open-banking

Open banking is revolutionising financial services by enabling data sharing through APIs (Application Programming Interface) between banks and third-party providers. This fosters innovation, enhances customer experience through personalised services, and promotes competition in the financial sector. Open banking in the fintech sector in 2023 is characterised by a few key trends and developments. Let’s look at them:

Europe is leading the industry in open banking, with the UK being a trailblazer, boasting 7 million open banking users. The UK, followed by Germany, Spain, the Netherlands, and France, is also advancing in open finance.

Asia is also witnessing growth in open banking, with China having the largest market. Japan, South Korea, and India are developing market-led approaches, while regulatory development is gaining momentum in other Asian countries.

In Africa, countries like Nigeria are leading the move into open banking, with an emphasis on addressing financial inclusion.

Latin and South America are experiencing major developments in open banking, with Brazil leading the way.

In North America, the US and Canada are witnessing new developments in open banking, driven by consumer demand. However, regulatory implementation is still a work in progress.

Rise of BNPL (Buy now, pay later)

One of the fintech trends in 2023 is the rapid growth of BNPL (Buy Now, Pay Later). This offers consumers an alternative to traditional credit by allowing deferred or instalment-based payments for purchases. This trend is gaining popularity due to its convenience, ease of use, and flexibility. The rise of BNPL in fintech in 2023 marked a significant trend, impacting both the retail and e-commerce sectors. Here are some key aspects of this rise:

In April 2023, 16% of U.S. consumers (equivalent to 40.5 million people) used BNPL for at least one payment due to high inflation and rising costs.

Millennials and bridge millennials were the most frequent users, with nearly half using BNPL at least once a month.

BNPL, offering short-term, interest-free loans, emerged as a potential competitor to credit cards. Younger consumers, who generally dislike high-interest debt, found BNPL more appealing.

Merchants implementing BNPL observed increased customer loyalty and higher conversion rates.

The BNPL market is expected to continue growing, with fintech innovations potentially merging with BNPL systems.

Governments worldwide, including the U.S. and the EU, started contemplating stricter regulations for the BNPL market to align it with traditional credit laws.

Embedded finance

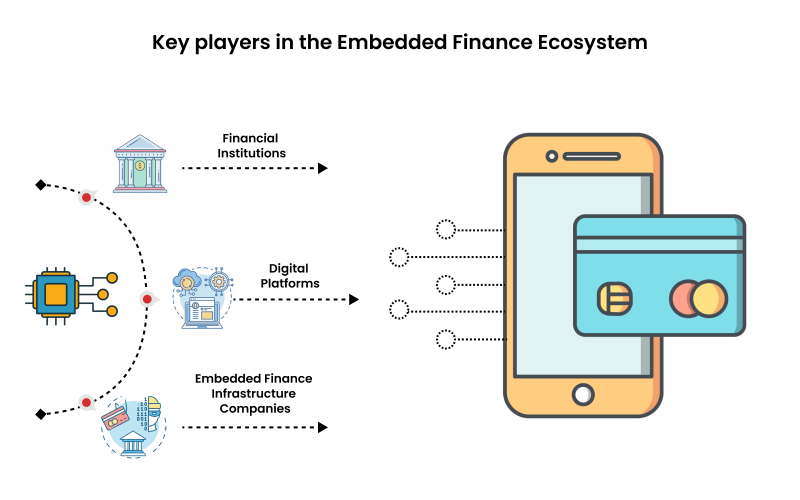

Embedded finance integrates financial services into non-financial platforms and apps. It democratises finance, enabling virtually any company to become a financial services provider. This trend allows companies to offer customised financial products directly within their ecosystems, enhancing customer experience and creating new revenue streams. Embedded finance in fintech in 2023 represents a significant shift in how financial services are delivered and experienced. Here are the key aspects of this trend:

Small and medium enterprises (SMEs) benefit from increased conversion rates and improved cash flow management. It also offers personalised financial solutions based on data-driven insights.

Traditional banks can engage a wider customer base and understand changes in customer behaviour through partnerships with embedded finance providers.

The adoption of embedded finance is expected to lead to groundbreaking solutions, including the growth of blockchain technology and development of competitor digital wallets.

SALT Fintech joining the fintech growth

As the fintech in 2023 trends dictate, the future of global fintech appears bright and poised for substantial growth. In the coming times, the fintech growth will be driven by the introduction of favourable government policies and incentives, as well as ongoing technological advancements. Overall, the overview of cross-border payments and fintech in 2023 underscores the potential of fintech to continue its rapid ascent and significantly reshape the financial services landscape, driven by innovation and an increasing shift towards digital financial solutions.

SALT Fintech is excited to be a part of this steadily growing sector! We take care of international payments and relevant compliances for Indian businesses of all sizes so you can put your mind to innovating. The benefits of business banking with SALT are endless- give our website a visit to learn more today!

Frequently Asked Questions (FAQs)

What is the future of cross-border payments?

The future of cross-border payments is expected to be influenced by new technologies such as blockchain and artificial intelligence, leading to faster and more efficient transactions. This shift is moving away from traditional banking systems, with fintech solutions offering lower fees and quicker processing times. For example, by 2026, B2B cross-border payments could exceed USD 42.7 trillion, and the overall market might reach over $250 trillion by 2027.

2. Is there a future in fintech?

The future of fintech is promising, characterised by rapid technological advancements and evolving market dynamics. Key trends for global fintech include the integration of AI, machine learning, and data analytics, with generative AI poised to revolutionise banking by enhancing customer experiences. The sector, currently a small fraction of global financial services, is projected to grow significantly, potentially reaching $1.5 trillion in annual revenue by 2030, comprising a substantial portion of banking valuations worldwide. So the answer would be yes, joining the fintech industry would be a good choice for you with future prospects in mind.