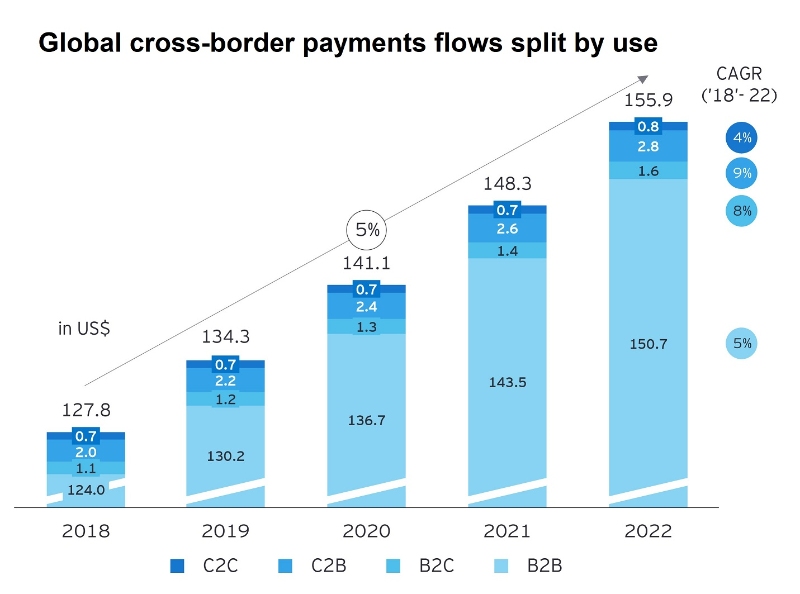

Global transactions have increased with the rise in international trade, and the world is returning to normal after the pandemic. The year 2020 suggested a global hit on international trade. But according to the current scenario, cross-border payments are again increasing at 11% in emerging markets. Some experts attribute this increase in international transactions to borderless payments, cross-border payments in B2C, and internet-based businesses.

This increase has also raised the demand for payment providers to improve their services. This means faster international transactions, lower costs, safety and transparency, and more to be given to the users. Multiple digital innovations are taking place in this domain to ensure all these.

Source / The CAGR of cross border payments sector wise

Application Programming Interfaces Promoting Backend Treasury

The global market is filling up with startups and SMEs. Every company or business has a treasury managed by the finance department. Startups and SMEs also have such departments to manage their funds. For international trade, they require foreign exchange rates to provide quotations to the clients and also understand how their finances are impacted.

Using multiple payments-based application programming interfaces (APIs), such businesses can access real-time foreign exchange visibility. Financial analysts and accountants can use this feature to check the best way to transfer payments from one account to another internationally. Also, they get to understand and accelerate the reconciliation due to having access to foreign exchange rates in real time. Treasurers in the company also lock in the FX rates for a predetermined time to price the company's services in the best currency to manage the funds.

Improvement in Visibility through Technology

With the world moving forward in technology, multiple options have come up to enhance international transaction visibility. Apart from just the conventional wire transfer, options like SWIFT GPI, virtual accounts, API connectivity, etc., help improve the transaction experience and manage beneficiaries.

Businesses, startups, and SMEs are partnering with banking institutions to leverage local solutions instead of wire transfers for cross-border payments. New banking solutions like the neo banks are also helpful in improving international remittances. Options like the Salt neo bank provide international transactions through digital accounts, and that too at an optimised speed. API connectivity helps with managing the visibility of the payments. The software can track the payment and receive real-time updates if any issue arises. Overall, new technologies help in improving cross-border payments through digital innovations.

Centralised Account Management

Earlier, businesses had to set up their local accounts with banking partners in every place they wanted to do business. With the introduction of virtual accounts, the need to open up local accounts is eliminated. This has helped startups and SMEs the most since they do not have to incur the extra costs of managing multiple accounts.

Virtual accounts are like normal bank accounts but with existence only on digital platforms. A company can open up virtual accounts from one central account to manage payments from multiple sources. This way, the treasurer and accountants do not have to check for multiple account statements for remittances. This also helps startups, SMEs and corporations easily transfer funds from one account to another in different currencies. Through this method of managing one central account and multiple virtual accounts, companies maximise the liquidity of funds and reduce exposure.

The Blockchain Technology

Since blockchain technology works on distributed ledgers and is updated through the validation of blocks, real-time payments are easier to manage using them. International transactions will not take days to clear as the nodes on a blockchain will actively work to validate the transactions in the least time.

Multiple digital innovations are going on to integrate blockchain technology with international transactions. Moreover, tracking a transaction on the blockchain is easy and the most secure form of transferring information. Blockchain technology will make clearing cross-border payments faster and more efficient. Also, globalised partnerships between corporate and distributed ledger providers will help offer ways to make cross-border payments in real time. This can be done through smart contracts and managing the transactions one-on-one with the partners instead of the end recipients. This means the businesses can create a contract to pay the blockchain partner, who will release funds to the recipient. In the meantime, businesses pay the partner's fees and the required amount to the payment partner.

Learn about the cross-border payments landscape in India in detail.

Conclusion

You have now learnt more about cross-border payments and how digital innovations are helping to revolutionise them. Numerous other technical advancements are also taking place to help with international finances. The thing to focus on the most is how corporate, startups, and SMEs are all trying to get more transparent, faster and secure cross-border payments. Trusting digital innovations and digital banks like Salt can be the ace of trade for businesses and help them get better remittances.

Neo banks like Salt provide hassle-free cross-border payments with a lot of benefits. Such a platform provides easy access to low-cost and secure international transactions.