Are you seeking to expand your business globally or tap into international markets? Look no further, as we have the perfect solution for you!

In today's interconnected world, international payments are crucial for business growth, but they can be quite complex for the uninitiated. But don’t worry! In this article, we will explore the best methods for international payments, and how Salt Fintech (a neo-banking solution) simplifies the process of cross-border transfers for you. So, let's dive in and discover how you can unlock the true potential of global commerce!

Best International Payment Methods

The demand for dependable international payment methods is rising, benefiting both businesses and individuals engaged in online transactions. Case in point, as per Statista, the share of goods sold in cross-border e-commerce trade increased from 15% in 2016 to 22% in 2022.

However, selecting the ideal international payment method can be challenging. To assist you in making a decision, here are various cross-border money transfer options you can choose from for all your business-related transactions.

Payment Gateways

Payment gateways serve as intermediaries between buyers and sellers, facilitating online payments. These services can be integrated into websites or online stores, allowing customers to purchase conveniently.

Payment gateways typically charge transaction fees and may impose additional charges for international payments. They are particularly beneficial for businesses with online stores, digital invoicing systems, or websites that cater to a diverse consumer base.

However, you need to consider the disadvantages of payment gateways like PayPal before you choose them for cross-border transactions. Some of these considerations include a monthly fixed fee, a percentage fee based on the transaction amount, a fixed fee per individual transaction, and also the merchant fee by the user's bank or gateway bank for credit purchases, which can add up over time.

SWIFT Payments

SWIFT (Society for Worldwide Interbank Financial Telecommunication) payments are a traditional transfer method between banks globally. This system enables direct transfers from one bank account to another, typically through the bank's online banking platform or at a local branch.

While SWIFT payments are cost-effective, they are not the fastest option available for international transactions. Its drawbacks include delayed payments, uncertain fees, and a lack of transparency.

Debit Cards

Debit cards, often associated with Visa, Mastercard, or other processing companies, provide a straightforward means of purchasing using funds directly from a bank account. Whether used for online transactions or at physical point-of-sale terminals, debit cards may require a PIN and must have sufficient funds in the linked bank account.

However, when used for international payments, debit cards can incur transaction fees, currency conversion fees, and exchange rate markups.

Credit Cards

Credit cards, such as Visa, Mastercard, and American Express, offer users a line of credit that must be repaid, often with interest. Credit cards are widely accepted worldwide and provide a seamless payment experience without the need for a bank account.

However, the convenience of credit card payments for international transactions often comes with additional, sometimes hidden, fees and markups on top of the interest rate.

Mobile Money Apps

Mobile money apps provide a convenient way to send and receive money securely, even without a traditional bank account or card. The money is transferred to a secure electronic account linked to your mobile phone number, accessible through an app. You can make payments from anywhere, anytime, with just a few clicks. These apps are user-friendly and often offer messaging trails to track transactions effectively.

However, there can be limitations between mobile money networks, resource constraints, and even restrictions on handling significant sums of money.

If you are with us so far, you would have realised by now that none of these solutions can offer you a foolproof way to conduct cross-border transfers. However, this is where Salt Fintech comes in.

At Salt, we have developed a convenient and easy international payments method to solve the drawbacks of the aforementioned modes of international transactions. Let’s see how!

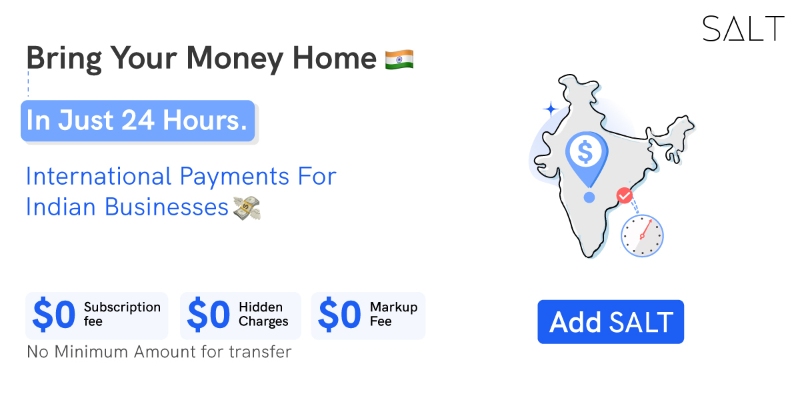

Streamlining International Payments with Salt!

Salt Fintech is an Indian startup, and our goal is to provide international money transfer solutions tailored for all Indian businesses. Our comprehensive suite of services simplifies the complexities involved in cross-border transactions.

SALT's offerings include automated filings for regulatory bodies such as RBI, MCA, and FEMA, ensuring seamless compliance. We further assist with pre-funding and post-funding compliance management, expedite FIRC and FCGPRS form filings, and provide support in generating valuation reports and operating a capital bank account.

With a transparent fee structure of 1.75% and no forex markup, SALT Fintech ensures cost-effective transfers using live exchange rates from Google. With us, you benefit from free FIRC, unblocked funds, zero chargebacks, and dedicated relationship managers, making SALT an ideal partner for hassle-free international money transfers. What’s more, with SALT, you get to receive international payments in over 6 international currencies, and the money is immediately processed upon receiving to your bank account with no holdup!

Our services have facilitated a substantial number of secure transactions for our clients: streamlining international payments, simplifying compliance, and enabling Indian businesses to expand globally with confidence. We can be just the ideal partner for all your cross-border transfers too!

Visit us today and unlock convenient global banking from the comfort of your home!

FAQs

Why are international payments important for businesses?

International money transfers are vital for businesses as they enable expansion into new markets, broaden the customer base, and enhance revenue prospects. By accepting payments from customers worldwide, businesses can tap into global opportunities and establish their presence across different countries, driving growth and unlocking the full potential of global marketplaces.

What are the common challenges associated with international payments?

International payments come with challenges such as handling various currencies, complying with complex regulations, ensuring security, and managing efficient payment processing across various methods. Businesses must navigate these obstacles to avail seamless cross-border transactions, mitigate risks, and maintain compliance, enabling them to engage in international payments successfully.