What is DGFT BRC online? How to complete e-BRC download?

Is your business involved in exports in India? If you are, the DGFT BRC or the e-BRC is a vital document for you, since it serves as a proof of payment from the buyer’s end in return for your exports of products or services.

If you are yet unaware of the functions of e-BRC, worry not! This article aims to cover the importance of DGFT BRCs for you, along with answering important questions like ‘what is the e-BRC full form?’, ‘how to obtain the e-BRC certificate?’, and ‘how to accomplish e-BRC download?’!

DGFT BRC: e-BRC details and e-BRC full form

The e-BRC full form is Electronic Bank Realisation Certificate. The e-BRC certificate is issued by authorised banks in India under the guidance of the RBI. Its primary purpose is to validate the repatriation of export proceeds to the country and ensure compliance with foreign exchange regulations.

DGFT BRC replaces the traditional paper-based Bank Realisation Certificate (BRC) and embraces a more streamlined and efficient electronic format.

How Does DGFT BRC Work: How to Obtain e-BRC on DGFT?

Here’s the entire working process of obtaining e-BRC on DGFT at a glance:

You as an exporter should be receiving payment on shipping bills for exports within nine months of the date on the bill.

Upon receiving the payment, you would submit the eFIRC or the Electronic Foreign Inward Remittance Certificate you should have received from your bank and the relevant export documents with your bank.

The bank will generate the DGFT BRC in an XML file upon the receipt of export payments, and digitally sign it.

The e-BRC is then uploaded on DGFT’s (Directorate General of Foreign Trade) server one or two times everyday at a fixed frequency.

The bank would further upload the equivalent amount to the foreign exchange in rupee based upon the exchange rate set by the CBEC or the Central Board of Excise and Customs.

Upon the XML file for DGFT BRC being uploaded, the server would inform the bank.

Now, you can view and print BRC for yourself from the DGFT website to claim the export incentives you are liable to.

What are the key features of DGFT BRC

As you wonder about e-BRC details and downloading e-BRC certificate, you must know the core attributes of DGFT BRC:

Digital Format and Electronic Storage: Initially, DGFT BRCs were put out manually, and you had to submit them as physical documents to your Regional Authority of DGFT. This long and tedious process was done away with when DGFT introduced the online BRC or e-BRC certificate and transfer of information related to the realisation of foreign exchanges from banks to DGFT’s servers directly. Now electronic DGFT BRC is generated and stored digitally, eliminating the need for physical documents. This ensures easy accessibility, reduces paperwork, and enhances data security.

Secure and Tamper-proof Nature: Online e-BRC certificates are digitally signed and encrypted, making them tamper-proof and providing assurance of their authenticity and integrity.

Integration with the Foreign Exchange Management System (FEMS): DGFT BRC seamlessly integrates with the RBI's Foreign Exchange Management System, enabling efficient monitoring and analysis of foreign exchange transactions.

Obtaining e-BRC on DGFT: Check e-BRC Status, and View and Print BRC

BRC download: check e-BRC status, and view and print BRC

Here’s how you should go about a BRC download:

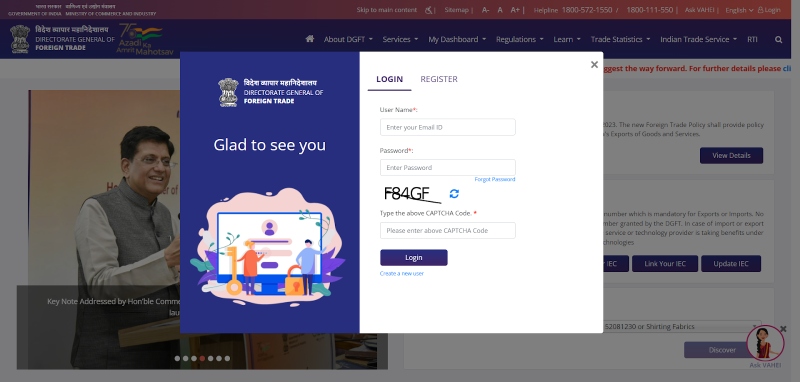

Log-in to the DGFT website pictured above.

Head over to your dashboard and select ‘Repositories’.

Now you should find a ‘Bills Repositories’ tab, tap the ‘Explore’ option you should see.

Select ‘Bank Realisations (e-BRC)’ from the drop-down that should appear when hovering over ‘Select Bill’.

Now enter the particular timeframe you are looking to check e-BRC status for, and then search for it.

You should now find all DGFT BRCs that have been uploaded.

Select the Bank Realisation Number for the e-BRC status uploaded from that particular bank. You should now be able to find options to view and print BRC.

Click on the ‘print e-BRC’ option to save the DGFT BRC you have been looking for.

How to Claim Export Incentives After e-BRC Download:

So now you are down with e-BRC download, but how do you claim export incentives with your DGFT BRC?

Remember to link the shipping bill particular to a DGFT BRC to claim any export incentives.

Submit the shipping bill online on to the ICEGATE or Indian Customs Electronic Data Interchange Gateway (ICEGATE).

ICEGATE now shares all relevant information about the exports with DGFT.

Once your claim is filed, DGFT will calculate the incentive value for you. They will match up the FoB or Free on Board value of the products you have exported on the shipping bill and the total realised value with the export the DGFT BRC has noted, and release your incentives.

Do remember to check if your bank’s reported DGFT BRC value reflects the total realised value, and if not, have it corrected.

How Indian Fintech Salt Helps Your Business-Related International Transactions?

If your business is involved in export, the DGFT BRC is a crucial document since it acts as concrete proof of repatriation of export proceeds, and proves that you are complying with foreign exchange regulations and demonstrating the legitimacy of funds. Further, e-BRC on DGFT facilitates hassle-free access to various export incentives and benefits offered by the government, while also enhancing the transparency and credibility of exporters in the global market.

Now, the e-BRC on DGFT is just one of the many, many regulatory factors you need to be aware of if your business works globally. International finance can be pretty complicated after all, what with all the compliance measures you need to be aware of, along with currency conversion and exchange rates. However, this is where SALT Fintech can be a comprehensive solution for you!

With SALT Fintech, you have the convenience of enjoying global finance with local accounts! We take care of automated filings for several regulatory bodies including the RBI, FEMA, and MCA, so you can stay stress-free on the compliance aspect. Further, we have a transparent fee structure of 1.75% with no forex markup, and we use live exchange rates from Google while letting you receive international transactions in seven foreign currencies!

What’s more, the cross-border transfers you receive are processed immediately to your linked bank account with no holdup!

Visit us today to find out more about the services of SALT Fintech, and take your business to new heights!

Frequently Asked Questions (FAQs)

Is e-BRC mandatory for all export transactions?

e-BRC is mandatory for all export transactions as per the notations set by the Reserve Bank of India. It is crucial for exporters to obtain and submit the e-BRC on DGFT to demonstrate compliance with foreign exchange regulations and validate the repatriation of export proceeds.

Can e-BRC be obtained for past export transactions?

Authorised banks can issue e-BRC for past export transactions upon submission of the required documents and fulfilment of applicable regulations. This allows exporters to rectify any previous gaps in documentation and ensure proper compliance retrospectively with DGFT BRCs.

What is the FIRC?

The FIRC or Foreign Inward Remittance Certificate acts as a legal proof of inward remittances made to India in foreign currencies. Authorised banks issue it upon uploading the receipt of payment on the EDPMS or Export Data Processing and Monitoring System.