In today's globalised world, freelancers have long been taking advantage of digital platforms to offer their services to clients from around the globe. Of course, this means accepting international payments in the form of inward remittances too. With the rise of remote work and cross-border collaborations, freelancers must understand the significance of a Foreign Inward Remittance Certificate (FIRC) or Foreign Inward Remittance Advice (FIRA). These documents ensure regulatory compliance when it comes to international payments, and provide financial transparency.

In this comprehensive blog, we will look at the purpose and benefits of FIRC/FIRA for freelancers.

Understanding the Significance of FIRC and FIRA for Freelancers

FIRC (Foreign Inward Remittance Certificate) and FIRA (Foreign Inward Remittance Advice) are both documents that serve as evidence of receiving foreign funds into an individual's or business's bank account.

Let’s weigh various features of the two documents alongside each other:

Purpose

FIRC: This is issued by the Indian bank where foreign funds are received. It acts as proof of inward remittance and is often required for various purposes such as tax reporting, compliance with foreign exchange regulations, and verifying the source of funds.

FIRA: It serves a similar purpose as FIRC. The receiving bank issues it and provides details of the foreign inward remittance, including the sender's information, the purpose of the payment, and the amount received.

Country-specific

FIRC: It is specific to India and is required for individuals or businesses receiving foreign funds into their Indian bank accounts.

FIRA: FIRA is specific to India as well, but similar documents are used in countries other than India, and the specific terminology or document may vary depending on the country's regulations and banking practices.

Regulatory Compliance

FIRC: FIRC is an important document for regulatory compliance in India. It helps ensure that foreign funds are received through legal channels, comply with foreign exchange regulations, and enable accurate foreign income reporting for taxation purposes.

FIRA: Similarly, FIRA helps establish the legitimacy and transparency of foreign inward remittances made to India, assisting with regulatory compliance and maintaining financial transparency.

Information Included

FIRC: It typically includes details such as the remitter's name, address, the amount of inward remittance, the purpose of remittance, and the bank's stamp and signature. It serves as a comprehensive record of foreign inward remittance.

FIRA: It also provides similar information, including the sender's details, payment purpose, the amount received, and other relevant details specific to the country's regulations and banking practices.

Documentation Process

FIRC: In India, obtaining a FIRC usually involves submitting a request to the bank where the foreign funds were received. The bank then verifies the transaction details and issues the FIRC per the regulatory guidelines.

FIRA: The process of obtaining FIRA also typically involves submitting the necessary documentation and providing the required information to the bank to facilitate the issuance of the FIRA.

Consulting with a financial advisor or contacting the respective bank can provide more detailed information on obtaining FIRC or FIRA based on individual circumstances and location.

Advantages of FIRC/FIRA for Freelancers

As freelancers navigate the global landscape of remote work and international clients, understanding the advantages of obtaining a Foreign Inward Remittance Certificate (FIRC) or Foreign Inward Remittance Advice (FIRA) becomes crucial. These documents serve as valuable proof of receiving international payments, and offer numerous benefits for freelancers in managing their finances, ensuring compliance, and building trust with clients and financial institutions.

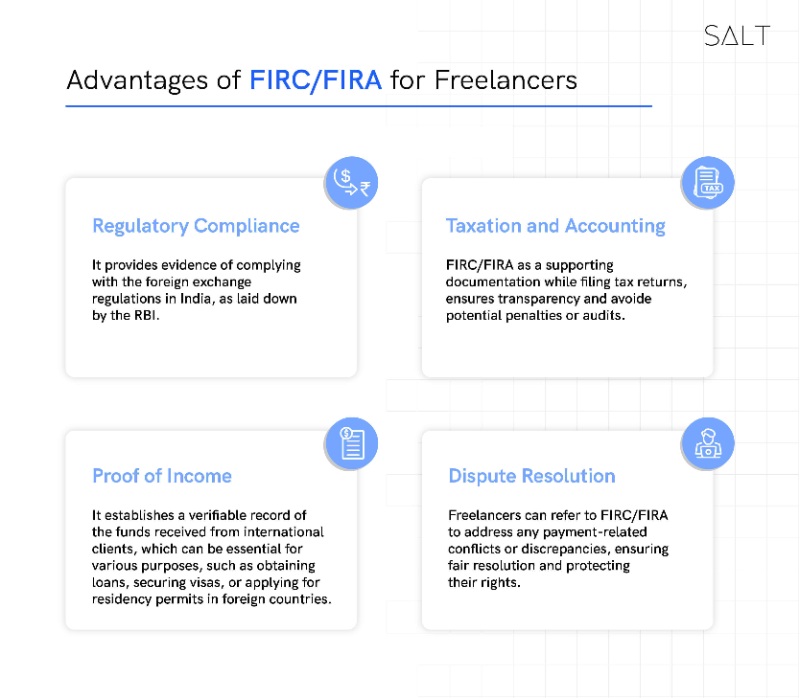

Regulatory Compliance

FIRC/FIRA is a crucial document demonstrating that freelancers have received funds from international clients legally. It provides evidence of complying with the foreign exchange regulations in India, as laid down by the RBI.

Taxation and Accounting

FIRC/FIRA is pivotal in simplifying tax reporting and accounting for freelancers. It provides a clear record of the international payments received, enabling accurate reporting to tax authorities. Freelancers can use FIRC/FIRA as supporting documentation while filing tax returns, ensuring transparency and avoiding potential penalties or audits.

Proof of Income

FIRC/FIRA serves as proof of income for freelancers, especially when dealing with financial institutions or government agencies. It establishes a verifiable record of the funds received from international clients, which can be essential for various purposes, such as obtaining loans, securing visas, or applying for residency permits in foreign countries.

Dispute Resolution

In case of any disputes or discrepancies related to international payments, FIRC/FIRA acts as strong evidence to resolve the issue. It provides a detailed breakdown of the inward remittance, including the client's information, payment date, and purpose. Freelancers can refer to FIRC/FIRA to address any payment-related conflicts or discrepancies, ensuring fair resolution and protecting their rights.

How to obtain FIRC/FIRA?

The general steps to receive FIRC/FIRA in India for freelancers receiving inward remittances would be:

Provide Relevant Information

Freelancers must provide necessary details, such as the client's information, payment details, the purpose of the transaction, and supporting documentation, to the authorised bank or financial institution.

Application Submission

Freelancers should submit an application requesting the issuance of FIRC/FIRA to the designated bank. The application may require specific forms, identification documents, and supporting evidence per the bank's requirements.

Verification and Approval

The bank or financial institution will verify the provided information, conduct necessary checks, and approve the issuance of FIRC/FIRA if all requirements are met.

FIRC/FIRA Issuance

Upon approval, the bank will issue the FIRC/FIRA to the freelancer in electronic format, generally. The document will contain essential details regarding the received inward remittance.

Conclusion: FIRA and FIRC Are Essential for Freelancers

For freelancers engaging in cross-border assignments, understanding the significance of a Foreign Inward Remittance Certificate (FIRC) or Foreign Inward Remittance Advice (FIRA) is crucial. These certificates are evidence of legal and authorised receipt of inward remittance through international payments, ensuring regulatory compliance, taxation transparency, and financial accountability.

By obtaining FIRC/FIRA, freelancers can simplify their tax reporting, enhance their professional reputation, and maintain trust with clients and financial institutions.

If you're a freelancer looking for a reliable platform to receive international payments and simplify obtaining FIRC/FIRA, consider exploring SALT Fintech. By leveraging our services, you can streamline your global financial operations, comply with regulations, and focus on professional growth!

FAQs

Who requires a foreign inward remittance certificate?

Goods and service exporters, individuals, and organisations receiving international payments or money transfers from abroad require a FIRC to prove they have received inward remittances from outside India.

Can all banks issue physical FIRCs?

Since 2016, physical FIRC was discontinued, unless it is against FDI or foreign direct investment, and FII or foreign institutional investment. Now banks can only issue an e-FIRC. However, not all banks are authorised to issue e-FIRCs. Only AD Category-I banks authorised and monitored by RBI can issue e-FIRCs.