Picture yourself planning a trip to a foreign country. You're excited about the new experiences, sights, and sounds you'll encounter, but there's one thing you need to sort out before you leave - foreign currency. That's where AD Category-1 Banks come in - the financial superheroes authorised by the Reserve Bank of India to deal in foreign exchange transactions. They offer convenience, competitive rates, safety, and speed, making your foreign exchange transactions a breeze. So, if you want to make your international travel stress-free, it's time to get to know these AD Category-1 Banks a little better.

What is an AD Category-1 Bank?

The Reserve Bank of India (RBI) gives an AD Category-1 Bank permission to deal in foreign exchange transactions. AD stands for Authorised Dealer, and Category-1 is the highest authorised dealer category in India's foreign exchange transactions.

These banks are allowed to carry out a wide range of activities related to foreign exchange, including buying and selling foreign currency, outward remittance of funds abroad, and issuance of letters of credit and bank guarantees. They act as intermediaries between the buyers and sellers of foreign currencies and help to provide liquidity in the foreign exchange market.

AD Category-1 Banks are considered the most important banks in the Indian banking system regarding foreign exchange transactions and outward remittances. They are crucial in facilitating trade and investment transactions between India and other countries by providing necessary foreign exchange services to businesses and individuals.

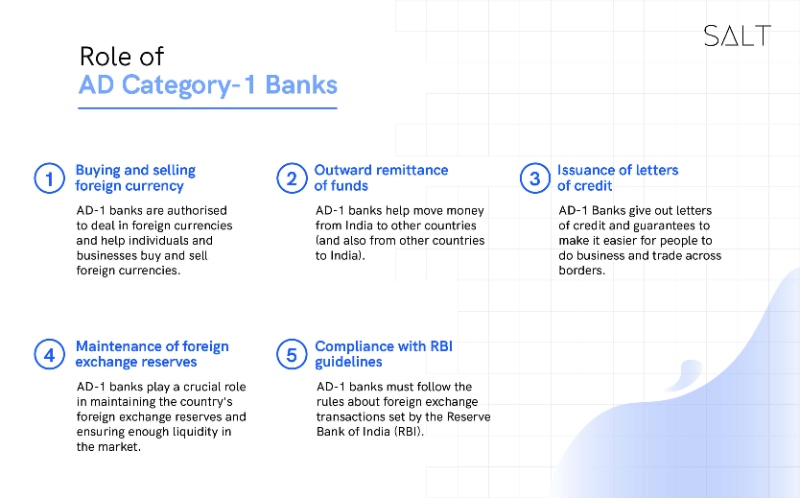

Role of AD Category-1 Banks

The primary role of AD Category-1 Banks is to facilitate foreign exchange transactions. These banks act as intermediaries between the buyers and sellers of foreign currencies and help to provide liquidity in the foreign exchange market. Some of the critical functions of AD-1 banks include the following:

Buying and selling foreign currency: AD-1 banks are authorised to deal in foreign currencies and help individuals and businesses buy and sell foreign currencies.

Outward remittance of funds: AD-1 banks help move money from India to other countries (and also from other countries to India).

Issuance of letters of credit: AD-1 Banks give out letters of credit and guarantees to make it easier for people to do business and trade across borders.

Maintenance of foreign exchange reserves: AD-1 banks play a crucial role in maintaining the country's foreign exchange reserves and ensuring enough liquidity in the market.

Compliance with RBI guidelines: AD-1 banks must follow the rules about foreign exchange transactions set by the Reserve Bank of India (RBI).

Benefits of AD Category-1 Banks

AD Category-1 Banks offer several benefits to individuals and businesses involved in foreign exchange transactions. These benefits include:

Convenience: AD-1 banks provide a one-stop solution for all foreign exchange transactions. Customers can buy and sell foreign currencies, remit funds abroad, and obtain letters of credit and bank guarantees from the same bank.

Competitive Rates: AD Category-1 Banks are known for offering competitive rates for foreign exchange transactions. Customers will find it easier to get the best transaction rates this way.

Safety: AD-1 banks are authorised by the RBI, which means they are subject to strict regulatory oversight. This ensures that customers' funds are safe and secure.

Speed: AD-1 banks offer fast and efficient services for foreign exchange transactions. Customers can finish their transactions effortlessly and quickly without having to wait.

Conclusion

AD Category-1 Banks play an essential role in the Indian banking system regarding foreign exchange transactions and outward remittances. The RBI authorises these banks and is responsible for facilitating foreign exchange transactions, maintaining the country's foreign exchange reserves, and ensuring enough liquidity in the market. AD-1 banks offer several benefits to customers, including convenience, competitive rates, safety, and speed. If you are involved in foreign exchange transactions, it is worth considering using the services of an AD Category-1 Bank.

We trust that this article has given you a thorough grasp of AD Category- 1 Banks and what they do. If you're interested in delving deeper into the realm of finance, we invite you to explore the Salt blog for further enlightening content.

FAQs

What is the difference between AD Category-1 Banks and other authorised dealers in foreign exchange?

The RBI authorises AD Category-1 Banks to deal in foreign exchange transactions and they are considered the most important bank in the Indian banking system regarding foreign exchange transactions and outward remittances. Other authorised dealers in foreign exchange, such as AD Category-2 Banks, can undertake only limited foreign exchange transactions, such as the remittance of funds abroad or issuance of traveller's cheques.

How do I identify an AD Category-1 Bank?

The RBI publishes a list of all AD Category-1 Banks on its website. You can also find this information on individual banks' websites or by contacting their customer service departments.

Can individuals use the services of AD Category-1 Banks?

Yes, individuals can use the services of AD Category-1 Banks for their foreign exchange transactions, such as buying and selling foreign currency or outward remittance of funds.

Can an AD Category-1 Bank limit the amount of foreign currency I buy or sell?

There are restrictions on the amount of foreign currency that can be bought or sold through an AD Category-1 Bank. The RBI determines these restrictions, which are subject to changes occasionally.