Under centralised financial frameworks, international money transfers usually occur through banks and other such financial institutions. The large network of financial institutions globally requires specific ways of recognition so that they can authorise transactions when initiated from a source at the other end of the world. This is where SWIFT codes come into play.

A SWIFT code is the method of recognition generally used by banks as a Bank Identifier code. The SWIFT network assigns every bank or other financial institution a specific code that can be used to recognise where the transaction request and information is coming from. It is very essential in cross border transactions through the SWIFT network, as banks use it to verify whether or not the transaction initiated is legitimate. The SWIFT code has an important purpose in the banking industry, which you might not be aware of. Let’s see how the SWIFT system facilitates international money transfers, shall we?

What Are SWIFT Payments?

We introduced you to what a SWIFT code does, and how it came into existence and how payments get completed through the SWIFT network is what we will be discussing next.

SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunications. As the name suggests, it is a method for banks and financial institutions to stay connected for sending and receiving financial information. The SWIFT system can help with verifying the bank and specific account location of the participants in a transaction. It is a vast network of more than 11,000 members currently.

The SWIFT system is important for all sorts of international banking solutions. Whether sending inward remittances from another country or doing cross border transactions for startup funding or business payments, they can all go through the same banking system which requires a SWIFT code to verify the transaction. Each member has to pay a joining fee to be allocated this code. Apart from that, SWIFT also charges the members for the messages and information transfer that takes place through it.

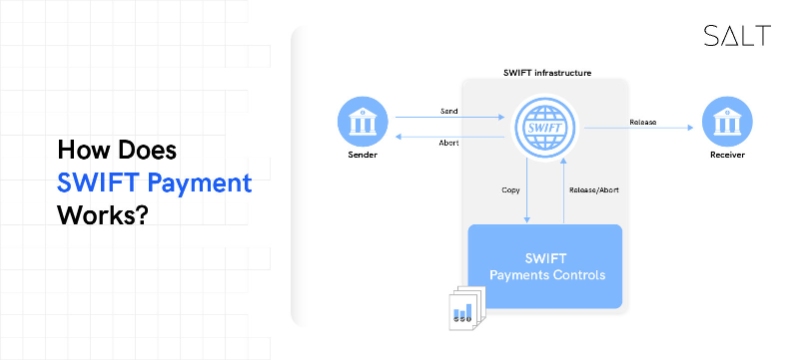

How Does SWIFT Payments Work?

A SWIFT code is generally of 8 to 11 digits; the first four characters are the institute code, the next two are the country code, and the next two characters allocate the city or location of the bank. Lastly, three optional characters might also be used by banks at the end to specify the branch of that bank.

SWIFT offers various services related to international money transfers, such as instructions matching for forex transactions, payment processing instructions between banks, settlement of derivative transactions, etc. Apart from the interconnectivity, SWIFT has also started to provide business analytics for member institutions and compliance services.

How Long Do SWIFT Payments Take?

During the initial days, SWIFT had significantly fewer members, and thus international money transfers took a lot of time. Now, with the help of better communication technologies, SWIFT payments usually take 2 to 5 business days if all things go smoothly.

Traditional banks can choose to facilitate cross border transactions without using the SWIFT payment method, but it will take nearly thrice as much time to allocate the funds to the recipient's address. The SWIFT payment network is much more effective and fast.

Challenges Relating to SWIFT

The SWIFT network is, of course, not without its issues. Challenges the network faces include:

The biggest issue SWIFT faces is the lack of automation of transaction entries. With the growing community, the organisation requires proper automation through software to add all the details related to the transaction to the ledger. Currently, it is not the case, and thus SWIFT is facing it as an issue.

The SWIFT network is overseen by the central banking institutions in G10 countries, which makes it hard for the whole organisation to stay neutral to any major socio-political or economic events around the world.

Conclusion

We do hope this post has been informative enough to help you understand how SWIFT makes international transactions easier. We can easily conclude that the SWIFT network is a necessary organisation for international money transfers and being affiliated with this organisation makes traditional banks and other financial institutions offer faster cross country transactions related solutions to their customers.

Salt is a business banking solution dedicated to facilitating smoother and faster cross border transactions. Interested in learning more about what we do, and doing international money transfers with us? Give our website a visit today!