When it comes to cross border payments, people from all across the globe have been looking for a safe and secure way to transfer their funds as international trade develops. An intermediary institution is frequently needed in international money transfers for banks and other financial institutions to make sure everything proceeds as planned. This is where the SWIFT network comes into play.

If you want to send inward remittances to India, have you ever wondered how to accomplish that with minimum complications? Here’s your guide to SWIFT international money transfers to India!

What are SWIFT payments?

The Society for Worldwide Interbank Financial Telecommunications, or SWIFT, facilitates a payment technology that enables instantaneous messaging and secure communication on cross border payments among banks all over the world. The SWIFT system offers incredibly secure communications, and is able to integrate with the numerous and diverse activities of commercial banks in relation to international money transfers.

SWIFT was established back in 1973 in 15 countries and is currently operating in over 200 countries, being over 11,000 consumers strong.

A SWIFT code is provided by the network to associated banks. The SWIFT code is like an international bank code or ID, it helps the financial institutions across the globe ensure that cross border payments are reaching the correct bank. A SWIFT code consists of 8 to 11 characters representing the city, country, bank, and branch.

How to use IBAN code?

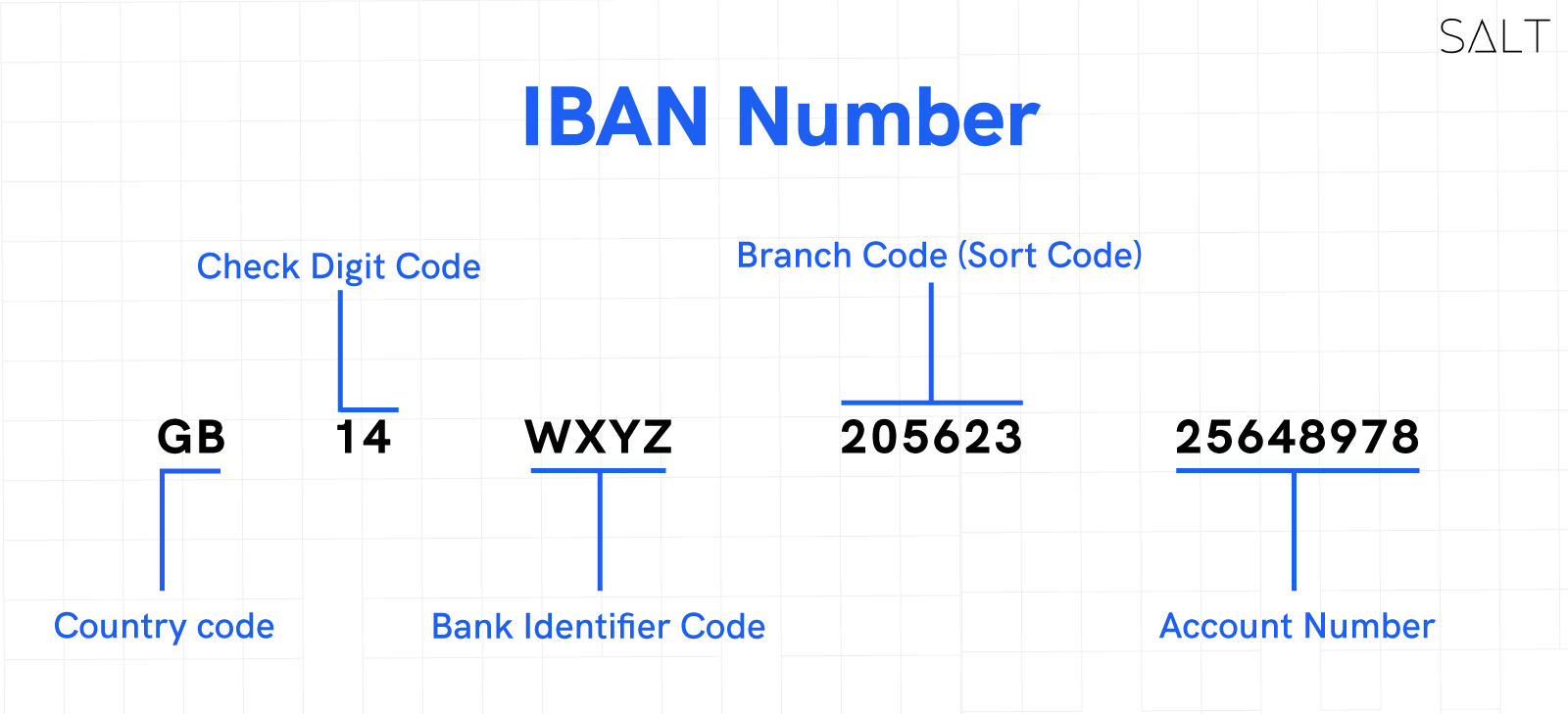

IBAN, which stands for International Bank Account Number, is a special identification code that banks use to handle cross border payments. It is utilised to avoid transcription errors and simplify getting account information for faster processing of international money transfers.

An IBAN code contains a maximum of 34 characters. IBAN uniquely identifies a customer's account and bank information, and particularly the nation to which money is being delivered. It is an ISO-accredited system that has received SWIFT registration.

Keep in mind that the IBAN and the SWIFT codes are completely different codes. The IBAN or the International Bank Account Number is a particular individual’s unique bank account number registered with a cross border bank for international money transfers. The SWIFT code, on the other hand, identifies the exact location of a bank across the globe.

Charges for SWIFT payments:

The bank you use will determine the SWIFT fees. The charge for using the SWIFT system is sometimes known as a transaction fee or a wire transfer fee. For outgoing transfers, each bank sets its own cost, which varies depending on the bank and the destination.

These rates could be exceedingly high with some banks. When you do international money transfers to an Indian bank, there may even be an additional hidden fee. You might notice this difference if you compare it to the exchange rate you receive from your bank. This is due to the fact that banks frequently dilute the currency rate they provide to you, so they may pocket a portion of the funds during currency conversion.

How long do SWIFT payments take?

In most circumstances, a SWIFT cross border payment to India can take 1–5 working days. Depending on where the money is coming from and leaving, the duration may vary. Additionally, your international money transfer may be cancelled if there are any errors in the transfer details.

Salt rising to the cause for smooth cross border payments

Salt is a fintech with experience in international banking; we offer convenient international money transfers with services including multi-currency support, multi-currency bank account support, and more. With our cross border payments solutions, we offer up the delights of doing smooth business transactions around the globe for all kinds of organisations, including startups and SMEs.

Our neobanking solutions help businesses in India accept international money transfers super fast without incorporating their operations abroad, or paying high transaction charges.

Conclusion:

When it comes to international money transfers to India, traditional banks may choose to facilitate these services without registering with the SWIFT network. However, with its strong security aspect and fast services, the SWIFT payment system is definitely one of the most trusted options for cross border payments. We do hope this post has helped you learn about the workings of the SWIFT payment network, so when you are making an international money transfer to India, you know just how it is done with SWIFT.

Interested in doing business through Salt’s business banking services and trying seamless cross border payments? Give our website a visit today!