You own a company that has grown to capture the entire world. In such a circumstance, you conduct regular business abroad. It could be necessary for you or the recipient to exchange one currency for another. Which currency rate should I use in this situation—the bank rate or the mid-market exchange rate? Also, how do you keep the costs low?

To avoid any confusion, it is important to know whether the two rates listed above are the same or different in any way. If so, describe the differences and the operation of the exchange rate. The best option for your transaction with the lowest cost will be discussed at the conclusion.

What is the mid-market rate?

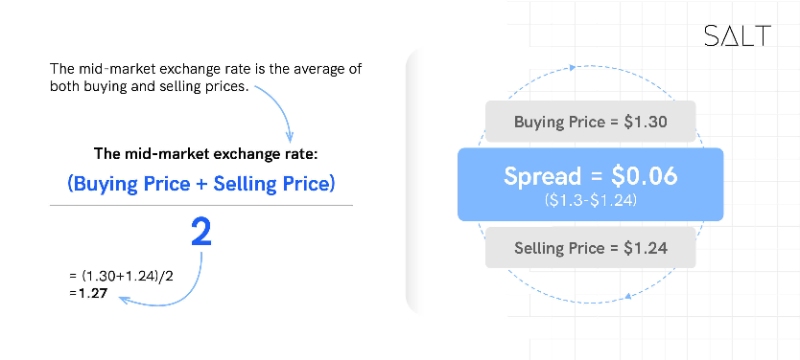

The mid-market rate, often known as the middle or interbank rate, is the price at which banks exchange currencies. In many other senses, the mid-market exchange rate is the price that, at any given point in time, lies at the halfway point of the cost of buying and selling currencies.

The mid-market rate of any currency pair is impacted by regional and global macroeconomic factors. Imports and exports, trade agreements, economic conditions, and a number of other factors are examples of these forces.

See this page for more information on the mid-market rate.

What is the interbank rate?

The interbank rate, often referred to as the interbank exchange rate, is a concept in finance that refers to the foreign exchange rates that banks pay when they exchange currencies with other banks. The terms "between banks" or "interbank" refer to a bank's relationship with another bank.

The interbank rates are implemented when money is sent to or received from abroad for transactions with banks of two different nations using foreign currencies.

One factor making this rate so unpredictable is that it is often set by currency brokers. Other factors that affect the price include supply and demand, which is a subset of the bid-ask spread; domestic and international trade deficits or surpluses; local interest rates and inflation; levels of political and economic stability, or lack thereof; and the size of the national debt.

What similarities exist between the two rates?

Different names with the same understanding

The interbank rate and the mid-market exchange rate are comparable as the mid-market rate is occasionally referred to as the interbank rate because banks are the main purchasers and dealers of currencies. This is the speed at which banks and other financial entities exchange money.

Most of the time, when you search for exchange rates on Google, you will get a common rate. However, the rate may change when you trade with banks or other businesses because of their profit margins.

What are the noticeable differences?

Different conceptual understanding

It is clear that the mid-market exchange rate is only the average of the asking and bid prices used to purchase and sell currencies; banks buy and sell currencies using interbank rates, which are the same as the mid-market rate.

Although the terms interbank rate and midmarket have similar meanings, they are employed differently depending on the situation, the necessity, and the time and location of the transaction.

How does the interbank rate/mid-market rate work?

Banks and other financial institutions need to have enough reserves or funds in order to preserve liquidity for their customers' simple withdrawals. But if they get into trouble, they withdraw from other banks, which brings the lending bank additional revenue in the form of interest. This short-term lending's interest rate is determined by the interbank rate.

From the perspective of the consumer, these rates are employed by them while engaging in an international transaction that involves buying and selling currencies. The currency rate is based on the mid market exchange rate there. This helps them in their international business too.

The federal rate is sometimes referred to as the interbank rate. The interest rate paid on the money kept by the banks is based on the current federal funds rate. The banks themselves determine this.

Although it is not "established" by the Federal Reserve, the one rate that the Fed does set—the discount rate—has an impact on it.

A federal funds rate that is low promotes bank lending and borrowing, whereas a rate that is high has the reverse impact. While these benefits are only available to financial institutions that borrow from and lend to one another.

Where are these exchange rates used?

Not everyone accepts the mid-market exchange rate. This is due to the fact that banks and other suppliers of currency exchange rates set their own, slightly different exchange rates for customers known as "exchange rate margins" to profit from global money transfers.

As a general rule of thumb, you should transfer money as closely as you can to the mid-market exchange rate if you want to save money on international money transfers. When business owners interact often in foreign currencies, it can be challenging and expensive to pay significant amounts as transaction expenses.

SALT specialises in assisting businesses in streamlining their transactions at a minimal cost. For all the paperwork necessary for currency transfers, SALT offers business owners a one-step solution at a very low cost.

Using an account like SALT, can help you transfer money in multiple currencies at mid-market exchange rate without hidden fees or markup charges, since Salt solely believes in offering the simplest solution possible to its customers and not charging extra, it only charges one transaction fee.