Reportedly, at least one financial transaction is done every millisecond across the globe. According to data from 2021 alone, over 118 billion payment transfers occurred worldwide throughout the year, and the number is only expected to keep increasing rapidly.

These financial transactions require a smooth pathway to get credited to the right account- this is where payment gateways come in. Any wire transfer or online payments in general require payment gateways to get processed.

You might be curious about the huge payment gateway mechanism behind a digital transaction that takes a mere second to finish. To answer your queries, in this post we find out how payment gateways work, and how you can choose the best one for yourself.

First Things First, What is a Payment Gateway?

A payment gateway is a cloud-based software that helps to build a transactional connection between a customer and a merchant. Whenever a customer makes an online payment, this payment gateway-

processes the payment information,

cross-checks the account details from the issuing bank’s side,

and then completes the payment by crediting the amount into the merchant account.

Therefore, a payment gateway is what makes a fund transfer secure and seamless.

What are Merchant Accounts?

Merchants like SMEs, startups, and shop owners all need their own ‘merchant accounts’ to facilitate transactions. The merchant account provides a place to store and transact money through hardware methods like debit or credit cards or online payments.

To obtain a merchant account, you must submit the necessary paperwork (including name, DBA, contact information, tax details, business details, routing number, etc.) relevant to your company to the account provider. After peer review and proper risk calculation, the account provider would allocate you a merchant account for all payments related to your business.

What is a Payment Processor?

After a payment is initiated, a payment processor confirms all the details regarding the merchant account, payment background, and authorisation. Payment processors provide encryption to the transaction by issuing SSL certificates and hosting the payment through a secure network.

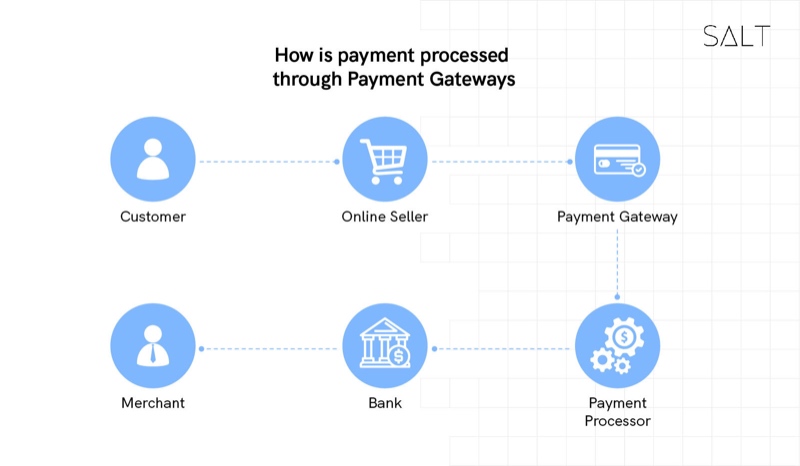

How a Payment is Processed Through the Payment Gateway

A transaction is processed through the following steps:

The payment gateway verifies all the customer details and runs fraud detection.

The payment details are sent to the acquiring bank, and the processor confirms the transaction.

After the due approvals, the payment gateway asks for confirmation from the credit/debit card company or the payment partner.

Once the payment partner approves the payment, the payment finally gets credited into the recipient’s bank account.

A merchant gets multiple options from the payment gateways to select their payment page. Most of the payment gateways offer the following options:

Hosted Payment Page: Once the customers confirm being directed to the merchant payment page after checkout, the payment gateway redirects them to an out-of-the-box page for the same. The hosted page receives transaction details from the acquirer. This method is useful in reducing the burden of storing card or payment partner details on a server.

Server to Server Integration: Generally in the case of SMEs and big firms, there are servers capable of storing the payment details, so server integration between the payment gateway and the merchant’s server is managed. The customers are requested for their payment partner details on the merchant’s page, and without being redirected anywhere, they can complete the transaction. While it is a faster way to transfer payments for the customers, it does require large server storage for the merchant.

Client Side Encryption: In this case, the merchant website receives encrypted data from the payment gateway with necessary transaction approvals and details. The client-side data is encrypted to prevent leaks while still completing fund transfers. It reduces the compliance requirements for the merchant.

Setting up a Payment Gateway

Here’s how a payment gateway can be set up:

Finalise the infrastructure: First you need to rent or purchase servers to store the payment data and verify the transactions.

Integrate a payment processor: The next step is to integrate a payment processor to verify and process the transactions. API documentation and its implementation on the payment page are also required for this collaboration, along with external API support for the customers.

Customer relationship management: A proper CRM will be needed to manage all the transactions on the gateway and store the payment details.

International approvals: If the payment gateway would be processing international transactions, approvals for the same would be needed.

PCI certification: Every payment gateway must have a PCI DSS certification to facilitate transactions.

Choosing the Best Payment Gateway

As an owner of a business or a startup founder, you will require a payment gateway for customer transactions. Here’s a checklist for factors you may want to look out for while choosing the best payment gateway for yourself:

Maximum digital security: Make sure the payment gateway is PCI DSS compliant, provides data encryption, and a sturdy fraud detection mechanism.

The onboarding time frame: It’s best to choose a payment gateway with shorter onboarding times, i.e. the time gateways take to secure bank approval for merchants.

Easy integration: Choose a payment gateway easy and quick to integrate.

A robust customer support: This goes without saying- choose a payment gateway that can provide instantaneous customer support.

A payment gateway is the backbone to all financial ecosystems around the world. It is an integral part of the functioning of a startup, SMEs, and any other businesses. Keep in mind that it’s important to weigh your options before picking the right payment gateway for your business.

We wish you good luck in your venture!