In the global economy we live in today, money is constantly moving across borders. Businesses and individuals send out and receive international payments recurrently, which is why it is necessary to understand the basics of what documents and certificates are behind international money transfers.

Contents

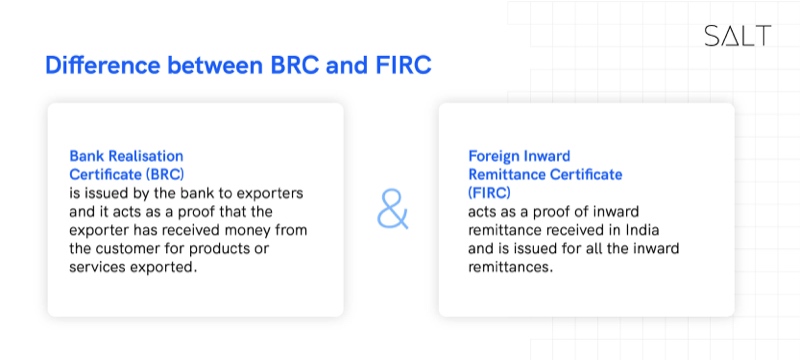

Bank Realization Certificates (BRC) and Foreign Inward Remittance Certificates (FIRC) are certificates issued by an authorised dealer bank to the customers to receive money from abroad. BRC, or a bank realization certificate, is issued by the bank based on the realization of payment against any export by an exporter. Meanwhile, FIRC, or Foreign Inward Remittance Certificates, are issued against any receipt of an amount from foreign countries (international money transfer) by a bank to their customers.

Where is the Reserve Bank of India (RBI) involved?

As the authority figure for all commercial, state co-operative, and urban co-operative banks, the RBI must look over these certificates. RBI not only governs international money transfers by keeping track of inflows and outflows, but it also monitors the transactions by businesses and individuals to understand the nature of imports and exports in the country. If you are a business owner and receive money from abroad, the RBI would be aware of it for it to line up with the tax and trade formalities. It also helps the governing body track any unknown/illegal activities in imports and exports, such as smuggling, money laundering, creation of black markets, etc.

Now that we know RBI’s role let’s delve deeper into how these certificates work.

First up,

Bank Realization Certificate

Any business applying to get benefits under Foreign Trade Policy must provide a valid BRC as proof of realization of payment against exports made and supporting documents to back it, such as invoices, shipping bills, custom clearance documents, etc. The benefits, such as import duty exemptions, custom rebates, duty drawbacks, and other financial assistance provided by the government or other export promotion agencies, are generally desirable to exporters, making the BRC a very important document. In India, exports are governed by entities such as DGFT, FEMA, Customs and Excise, and the RBI. The exporter is required to submit a money realization certificate to the RBI through their authorized banks. It is important to note that BRC is only used against export, and other international money transfers in advance payment will not be entitled to a BRC.

Next comes,

Foreign Inward Remittance Certificates (FIRC)

A FIRC is issued against a bank's receipt of money from foreign countries. Unlike BRC, it can be an advance payment against the export process, ocean or air freight, remuneration or wages under consultancy charger, or other reasons. You can obtain a FIRC whenever you receive international payments for various reasons under advance payments. The bank in charge then certifies that the exporter receives the money from a legal source and authorizes the international money transfer.

As the legal authority for banks, The Reserve Bank of India oversees international trade and the money transactions that come with it. Bank Realization Certificates and Foreign Inward Remittance Certificates are an essential part of this system since they provide proof of payment and help streamline the process.

Now that we know the role they play, you must be thinking..

How do we go about obtaining these certificates?

For a BRC, the exporter can approach their banks after they receive money from abroad after a shipment and submit the proof of export and their FIRC details to receive the certificate. Meanwhile, banks would issue an electronic FIRC at the request of the exporter and upon providing the necessary documents and details.

Salt helps businesses and freelancers to procure a FIRC for their international payments in a hassle-free way. Through SALT, you can receive your e-FIRCs through your account within 7 to 15 days of receiving payment for your transaction.

Want to take control of your finances in the best way possible? We’ve got you covered. Salt is a neo-banking platform that offers a seamless banking experience. Salt provides low-cost international B2B transfers and inward remittances to LLPs, private limited companies, startups, and other SMEs from across the globe.