Startups, SMEs and large-scale businesses require dealing in various currencies if their operations are spread internationally. The need for exchanging foreign currency has risen from this very root. Global businesses rely on the currency exchange network due to the need to interact in monetary terms while dealing with clients residing in different geographical regions transacting in a currency different from theirs. For any LLP, private limited company or startup dealing in international transactions, it is essential to know the currency exchange rates. By exchange rate, we refer to the value of the home currency in relation to its foreign counterparts. Being abreast of the exchange rates helps proprietors, founders, and investors determine the worth of the asset priced in any currency other than the home currency and, thus, make informed decisions.

Economic Importance Of Currency Exchange Rate

Investors like to put their money after assessing the currency risks. As their investment grows, a declining currency rate and increasing business for a startup are great signs for angel investors. Every year, trillions of dollars worth of international trade occurs, which gives rise to changes in the international exchange rates. For a proprietor, company, or startup, these rates help define and determine the terms of the contract and monetary dealings with investors and clients likewise.

According to one report, global international trade in 2021 rose to around $28.5 trillion. It has been observed that the countries seeing a rise in exports and substantially lesser import dependency have stronger currencies as well. International trade from all sources, including big industries, SMEs, and local exports, account for a currency’s stand in the international exchange market.

How Are The Exchange Rates Determined?

Trade between countries and the growth of a business depends highly on the currency exchange that occurs in all parts of the world. The impact of changing international exchange rates is different for investors, business owners, and the government of a country. International currency exchange rates are of two types, and every person interested in currency exchange must know these technical terms.

Floating rates

Every currency around the world is dependent on international trade and the performance of the economy as a whole. The concept of a floating international exchange rate arises from this need. The rates of different currencies worldwide fluctuate in relation to other currencies depending on their demand for business and supply around the globe. For instance, the US Dollar remains one of the strongest currencies and the most preferred by all investors and businesses, given its stability and the growth prospect of the United States.

For the uninitiated, this means an increase in the use of one currency in trade will increase its value against the others. Floating currency exchange has a lot of benefits and contradicting demerits as well. It helps provide equilibrium to the demand and supply chain of businesses. If a currency falls, the value of commodities from the country at stake also falls. This then increases the demand for the said commodities resulting in balancing the currency rate again.

Fixed rates

The concept of fixed currency exchange rates has been discarded by most countries worldwide as it does not help provide ease of business. Fixed currency rates are the currency exchange rates set by a federal bank or the government of a country in relation to other currencies from the world. The government pegs such rates by trading its currency for different currencies worldwide. During the breakdown of the economies between 1968 and 1973, most governments around the world discarded this currency exchange system as it added instability to the national reserves and thus impacted the economy of a country.

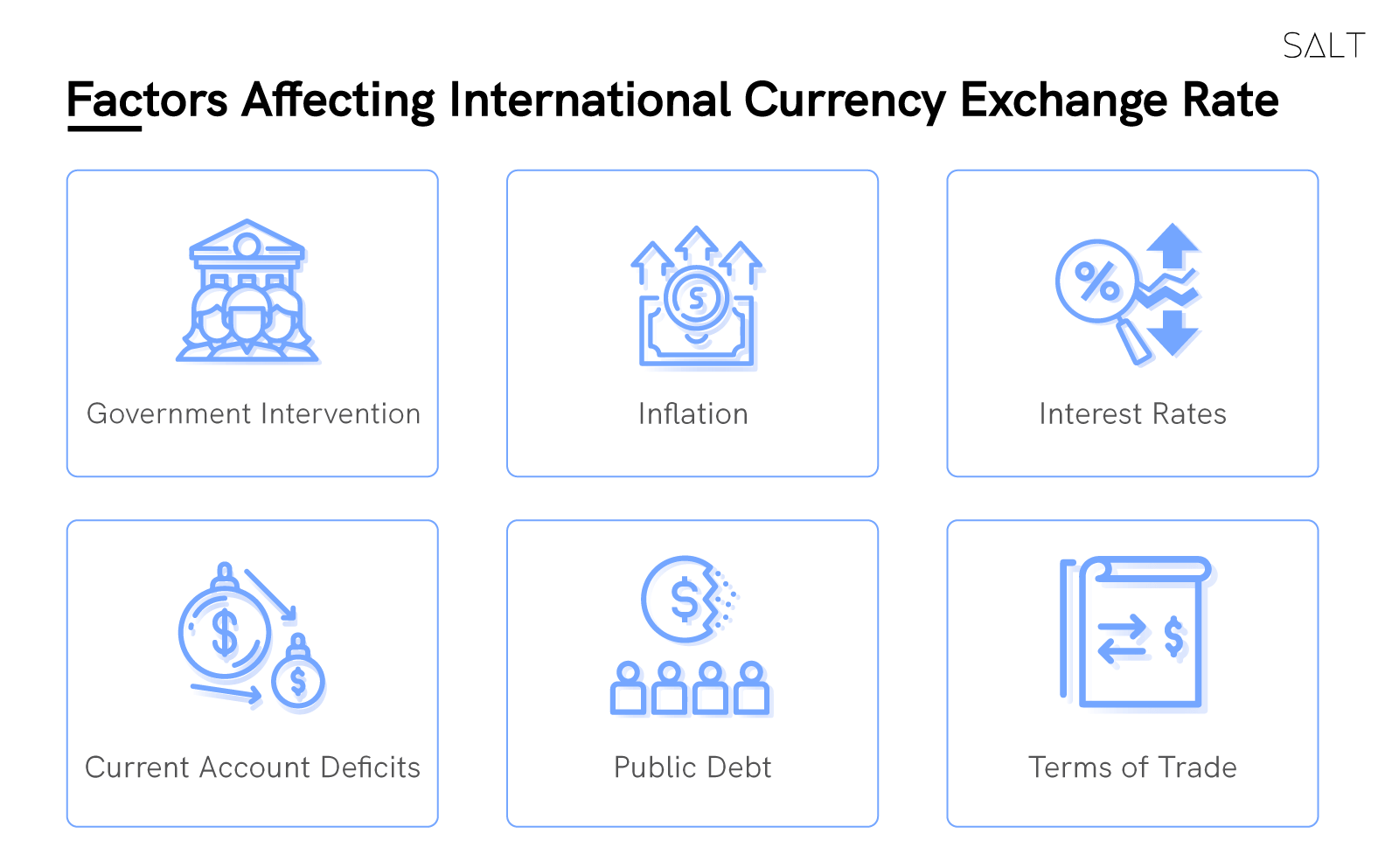

Factors Affecting International Currency Exchange Rate

Multiple factors are involved in determining the worth of one currency against another. Today, most currencies follow floating exchange rates; thus, the international market usually decides how much a currency is worth. Apart from the market scenario, some other factors also need to be learned to get in-depth knowledge about what brings forth changes in the exchange rates:

Inflationary Conditions

The term inflation generally means a decline in the relative purchasing power of a currency in comparison to other currencies. Countries with strong economies and managed demand-supply chains have stronger currencies. This means one can buy more commodities by paying less in that currency. Thus, if a country is suffering from high inflation, the purchasing power of its currency declines, and thus its position against other currencies in the world also declines.

Banking interest rates

Cash liquidity is a major deciding factor regarding a currency's worth. Banks tend to control the amount of cash flow in an economy by changing the interest rates from time to time. If a currency is experiencing low liquidity, banks tend to reduce the interest rates, allowing more cash to flow into the economy and, ultimately, the pockets of the consumers. To control inflation and support strong currency exchange rates, banks in a country also increase the interest rate when there is too much currency in the market, thus reducing the demand.

Political influence

Countries with a strong political stand tend to attract more business towards it and thus invite more foreign currency flow. This also means that international businesses and angel investors must use local currency and do business locally. This thus increases the demand for the currency, thus maintaining the exchange rate. The opposite scenario is also true in the case of a poor political arrangement in a country.

There are other important factors, such as the confidence of traders and investors in a currency, governments trying to maintain the currency rates, ease of trade, etc.

Conclusion

The international exchange rate is an important concept that drives economies worldwide. Different countries try to maintain a stronghold in the market by providing support to their currencies. The economic effects of currency exchange are visible in terms of the performance of small businesses and startups.

Using a multi-currency account through neo-banking platforms like Salt is a great way to get your international business streamlined, with the cash flows managed in a hassle-free way.

Such accounts can help in managing foreign investments and also manage the usage of different currencies according to specific needs. You can use the Salt platform to know the currency rates as well. Apart from that, government sites such as CBIC for India can be followed to get information about international exchange rates.