India is becoming the startup hub for the world. Even though India's economic climate is excellent for startups to grow and flourish, a lack of adequate capital is one of the main reasons why most startups fail to make it beyond stage one. Without capital, there's a good chance that a startup won't be successful in launching a good or service.

This is where pre-funding and post-funding come in. However, any startup in India must adhere to certain regulations before collecting funding. Businesses that fail to comply with regulations risk incurring numerous fines and penalties. Furthermore, it is the founders' fiduciary responsibility to make sure that the investor's money is in trustworthy hands.

The funding rounds are usually more oriented towards the startup founders and marketing team presenting a problem and its solutions to the investors. These rounds can be for national investors or in front of international investors. In any case, following the rules set for pre-funding and post-funding is necessary. The startup also requires an international bank account to receive the funds easily.

At this point, taking help from the neo-banking system may be advantageous. Keeping the funds safe and not getting penalties is often the biggest priority for startups. Salt provides a one-stop solution for managing the legal and banking for startups' international fundraising.

Startup plans and funding requirements

Every startup is a business opportunity based on problems faced by the community and a venture giving solutions to those problems. As a founder, you would require to do proper research about the problem you are going to address and the scalability of your business before going in front of investors. Investors, be they domestic or foreign, generally ask for a plan to promote the business in the market and scale it.

Startups need to be ready with their target audience and a way to approach them. Apart from that, the current financials, projected growth, profit and loss, balance sheet, cash flow, etc., are a must if any startup requires the investors to put their money in them. The last thing is to discuss what the investors will get in return for investment. The plan for sharing equity or taking debt is a pre-funding requirement for all startups.

Pre Funding Compliances

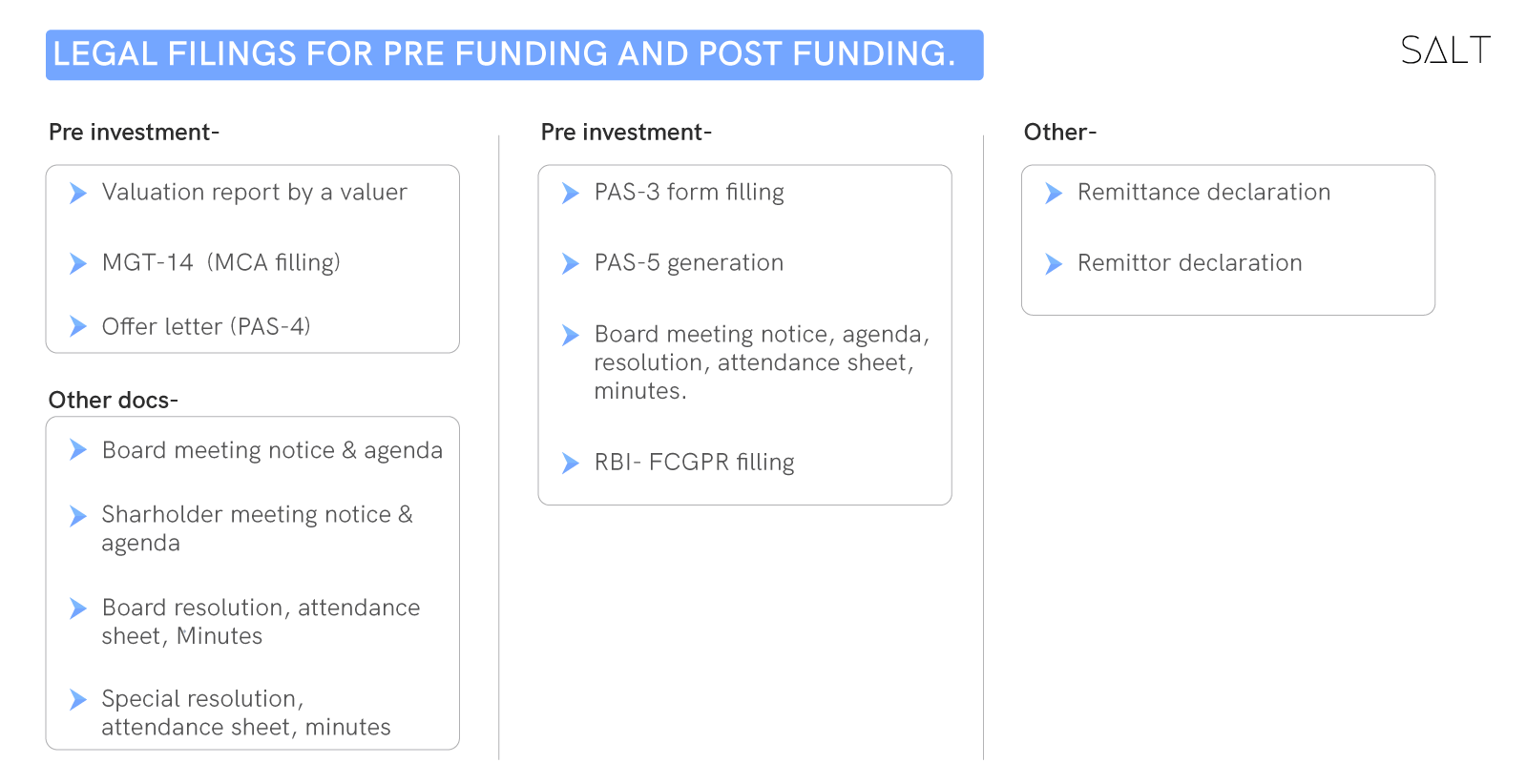

Startups in their initial stages require funding for enacting their plans and going into the market. Before reaching the pre-funding stage, the startup performance is pretty much based on the prototypes and the proof of concept. The preparatory stage for raising funds is important, and startups need to be ready with their valuation report, which is a monetary valuation of the business generated by a registered valuer (registered by the IBBI) to assess the business and shareholding in the startup. Apart from that, the government makes pre-funding compliances mandatory to keep the business from insolvency and protect the investors’ money. A term sheet summarising all the terms under which investors proceed with investments and seekers accept them must also be prepared.

In order to make the process of pre-funding simpler and hassle-free, the Indian government introduced ‘Companies Act 2013’. Under this act, every startup has the right to raise funds from within the country or through foreign investments. The act mandated that pre-funding compliances, including the need for valuation reports and holding board meetings, be adhered to. This act also allowed for the preferential allotment of shares. Preferential allotment can be called an early distribution of shares to raise quick funds for the startup. The shares can be exchanged for funds based on the preference of the management, VCs, and startup founder.

There are also other compliances that need to be followed and documented as a safety measure mandated by the Companies Act. Pre-funding compliances are necessary to keep the startup's share allotment and funding details crystal clear with management and the investors. Salt bank is a safe option for the management to be free from the documentation as they check if the funding compliances are met by the company or not. They provide hassle-free banking solutions, which mean less stress to the founders and VCs.

Compliance With The Registrar

According to the Companies Act 2013, any startup or a private entity can issue equity in a company to raise funds within or outside the confines of India. This provision is helpful for the startup as they can issue shares pre-funding based on preferences and even receive international payments.

Conduct A Proper Board Meeting

Notice of the meeting must be sent to each member of the Board at least seven days prior to the date of the meeting. Before going to the funding rounds, the private entity must also present the valuation report, bank account statements, cash flow records, and other financial records to the board. The company will also require opening an International bank account. The board must agree with all the records presented and thus finalize the offer for funding.

Extraordinary General Meeting (EGM)

Since the necessary arrangements are made for preferential allotment and a final offer for funding is drafted, conducting an EGM is a requirement. This meeting needs to assess the special resolution about the allotment and pass it before moving to the fund. Other requirements are to file MGT-14, and a PAS-4 letter must be sent to all the allottees from the preferential allotment.

Offer letter

Finally, the company needs to send a placement offer letter to all the allottees within 30 days, and the records related to preferential allotment need to be filed with the Registrar of the company. And with this, the company gets clearance to receive funds from investors.

Post funding compliance

A company still has other post-funding compliance requirements to undertake after securing funding. Allocating shares to investors is often the next step after publishing an offer letter and submitting a complete preferred allocation record to the Registrar.

Allotment of shares

As soon as the funds are received, designated shares are to be provided to the allottees, and this has to be done within sixty days of receiving payments. After the shares are allotted, a return of allotment must also be filed with the Registrar within thirty days.

Drafting and issuing shares certificate

The final compliance to abide by is to create and issue share certificates to all investors, thus making the shareholding pattern of the company official. In the case of receiving money from abroad, the company also needs to follow some additional RBI policies.

Optional compliances for startups

Optional compliances usually come into effect under special circumstances.

In case the founders of the startup had already prepared share holders’ agreement that restricts the share transfer, exit rights to investors, vesting schedule, etc., the company's articles of association need to be amended.

In the case of investors asking for a board seat, the optional compliance of adding a director needs to be followed.

Conclusion

Clearly, starting a new business and entering the market to raise capital is not easy at all. The compliances mandated by the government do increase the work for a founder or the VCs in the company, but they also help in protecting the investments and thus keep the financial stability of the company further ahead. The pre-funding and post-funding compliances mentioned in this content are to be followed strictly if a startup wants to avoid penalties and lookout by the authorities in India.