When it comes to financing your business, two primary options often come into play: equity financing and debt financing. These two methods can be crucial in determining the financial future of your business, but they differ significantly in terms of structure, risk, and potential benefits.

Debt financing vs. equity financing is a confusion that occurs quite often in the minds of upcoming investors. In this blog post, we'll dive into the world of equity financing and debt financing, exploring their differences, advantages, and considerations. So, let's get started!

Understanding Equity Financing

Before we get into the differences of equity and debt financing, let’s understand the definitions.

What is Equity Financing?

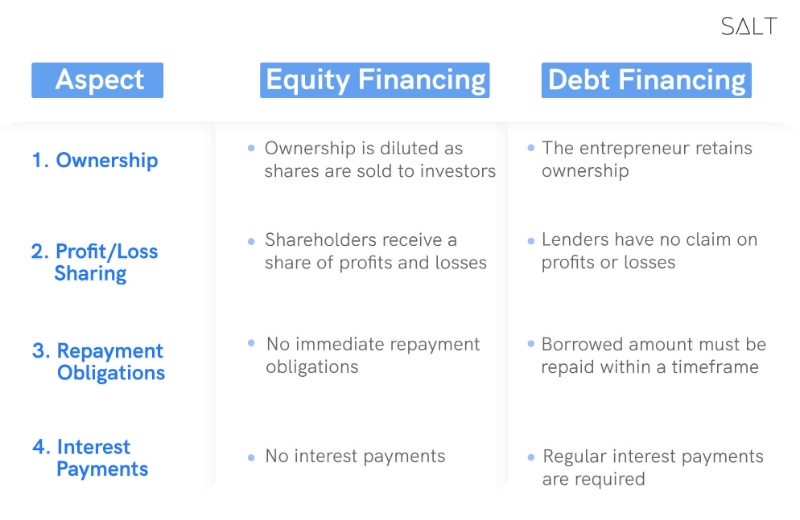

Equity financing is a method of increasing capital by selling ownership shares of your business to investors in exchange for funds. These investors become shareholders, having a stake in the company's ownership and potential future profits. In simple terms, equity financing allows you to obtain funds without incurring debt or having to repay a loan.

The Advantages of Equity Financing

The benefits of equity financing include:

1. Shared Risk

With equity financing, the risk is shared among the investors. If your business faces difficulties or fails, the burden of losses does not solely fall on your shoulders. Investors bear the risk proportionate to their ownership stake.

2. Access to Expertise

Equity investors often bring more than just capital to the table. They can provide valuable guidance, industry knowledge, and strategic input, immensely benefiting your business's growth and success.

3. No Repayment Obligations

Unlike debt financing, equity financing does not require periodic repayments or interest payments. This can ease your cash flow and give you more flexibility to reinvest profits into the business.

4. Potential for Greater Returns

If your business performs well, equity financing offers the potential for substantial returns. As the business grows and becomes more valuable, the value of the investors' shares increases, allowing them to benefit from capital appreciation.

Considerations for Equity Financing

However, when you decide between debt financing vs. equity financing, here are some factors you need to consider:

1. Loss of Control

When you bring equity investors on board, you relinquish some of your ownership and decision-making authority. Depending on the extent of their ownership, investors may have a say in important business decisions, potentially impacting your autonomy.

2. Dilution of Ownership

By issuing shares to investors, your ownership stake gets diluted. This means that you will have a smaller percentage of ownership in the company. If maintaining full control is a priority for you, there may be more suitable options than equity financing.

Understanding Debt Financing

Getting to the second component of our debt financing vs. equity financing debate, what is debt financing all about?

What is Debt Financing?

Debt financing involves borrowing funds from lenders, such as banks, financial institutions, or private lenders, with the commitment to repay the borrowed amount over a specified period, along with interest. In this case, the lender does not gain ownership of your business but instead becomes a creditor.

The Advantages of Debt Financing

The benefits of this one are:

1. Retain Ownership and Control

Unlike equity financing, debt financing allows you to retain full ownership and control of your business. The lenders have no say in your company's management or decision-making processes.

2. Predictable Repayment Structure

Debt financing involves regular repayments over a predetermined period, allowing you to plan your cash flow and budget accordingly. The repayment terms, including interest rates and schedule, are typically agreed upon in advance.

3. Tax Benefits

In many cases, the interest paid on business loans is tax-deductible, reducing your overall tax liability and providing a potential financial advantage.

Considerations for Debt Financing

When you decide between debt financing vs. equity financing, here are some more considerations to take into account:

1. Repayment Obligations

Debt financing requires timely repayment of both the principal amount and interest. Failure to make payments can result in penalties, damaged credit, and even legal consequences.

2. Interest Payments

Unlike equity financing, debt financing involves interest payments, which can increase the overall cost of borrowing. It's important to carefully consider the interest rates lenders offer and evaluate the impact on your profitability.

3. Collateral or Personal Guarantees

Depending on the lender's requirements and your creditworthiness, debt financing may require collateral or personal guarantees. This means that you could risk losing assets or be personally liable for the loan in the event of default.

Choosing the Right Option for Your Business

Out of debt financing vs. equity financing, you would ultimately choose either based upon your requirements and business strategy. Here are some things to keep in mind while making the choice:

Evaluating Your Needs and Goals

The choice between equity financing and debt financing depends on several factors, including your business's stage, industry, growth potential, and personal preferences. There is a considerable difference between equity and debt financing, which can affect your investments. Consider the following questions when making your decision:

1. How much control are you willing to relinquish?

2. Are you seeking long-term partners and expertise?

3. Can you comfortably manage regular loan repayments?

4. What is your risk tolerance?

5. What are your growth objectives?

Finding the Middle Ground

Sometimes, a combination of equity and debt financing can be viable. By inspecting the underlying difference between equity and debt financing, This hybrid approach allows you to access capital from various sources, combining the advantages of both methods while mitigating their downsides. It's essential to assess your business's specific needs and consult with financial advisors to determine the most appropriate financing mix for your unique situation.

Difference between Equity and Debt Financing

Conclusion

As we saw, the difference between equity and debt financing are many, and each has their shares of pros and cons. Ultimately, the decision depends on your business's circumstances and goals. Carefully evaluate the advantages and considerations of each method, and remember to seek professional guidance when making financial decisions.

Salt Fintech, with our range of services tailored to B2B clients, offers competitive rates for inward remittances and compliance handling, making it an attractive choice for businesses seeking cost-effective solutions. By partnering with Salt, you can navigate the complexities of international transactions while minimising fees and optimising your business’s global operations. Visit our website today to find out more!

Frequently Asked Questions (FAQs)

1. Which one should startups and early-stage companies pick: equity or debt financing?

Equity financing might be better for startups since it brings capital without the burden of immediate repayment, which allows startups and early-stage companies to focus on growth and development. Meanwhile, established companies may choose to opt for debt financing since their creditworthiness would be more attractive to lenders.

2. Why should I choose equity financing over debt financing?

Depending on your organisational cash flow, equity financing might be a better option over borrowing money. One key benefit is that equity financing does not require upfront payment. Instead, it involves shareholders investing in the company with the expectation of receiving long-term dividends. This eliminates the need for the company to repay borrowed funds, allowing them to obtain capital without the burden of repayment. Plus, equity financing does not have a fixed cost, and equity financing allows the company to share its profits with investors without the obligation of interest payments.

3. Can I switch between equity and debt financing?

Switching between equity and debt financing at different stages of your business is possible. However, it's important to carefully consider the implications and consult with financial experts to make informed decisions. Further, the decision to switch between the two options often depends on factors such as the company's financial health, risk appetite, cost of capital, and growth plans.