Once you start to understand the world of finance and banking, there are many floating pieces of jargon you would need to find the meaning for to navigate this sector. Sort codes might be one of those.

What are bank sort codes, and how to find bank sort codes?

All those questions of yours are answered in our comprehensive article!

Contents

What is a Sort Code in Banking?

For banking in the United Kingdom and Ireland, sort codes are domestic bank codes: a six-digit number assigned to each bank to route domestic fund transfers. Sort codes provide a standardised identifier for banks and branches, ensuring transactions are directed to their intended destinations.

What are Bank Sort Codes: The History of Sort Codes

In the latter parts of the twentieth century, the bank sort codes emerged when the usage of bank cheques was touching an all-time high. Sort codes were brought in as a way to pinpoint the authentic origins of the cheques, so every party in the wiring process knew where the funds were coming from, and where they were headed.

What is a Sort Code in Banking:

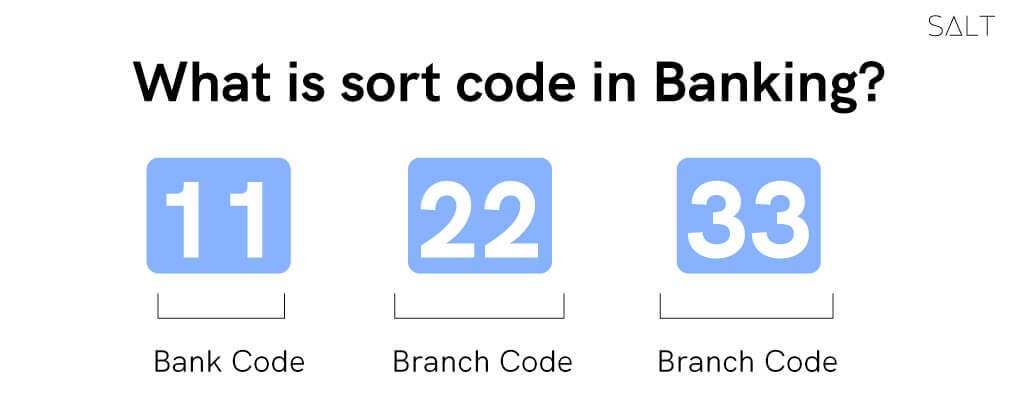

As pictured above, a sort code example would be 112233, where the first pair of digits is the bank code, and the other two pairs represent the city and the branch code for the bank.

What is a Sort Code in Banking: How Does it Work?

Here’s a detailed overview of the functions of the bank sort codes:

Bank and Branch Identification: Of course, bank sort codes verify the authenticity of the sender and receiver in transactions.

Account Routing: The sort codes, along with the recipient's account number, guides the transaction to the correct bank and branch. Accuracy is crucial for successful transactions, as incorrect or mismatched sort codes can cause delays or send the transactions to the wrong account.

What are Bank Sort Codes: Where Can You Find Your Sort Codes?

Here are a few ways you can check for your bank sort codes:

Check Your Bank Statement:

If you have paper statements, look for a section that lists your account details. Your sort codes should be clearly printed there. For electronic statements, log in to your bank’s website and access your statement to find the banking sort codes.

Banking Card:

Check your debit or credit card. Some cards display the banks’ general sort codes on the front or back of the card. However, keep in mind that the sort code on your card might be the generic code for the bank and not specific to your branch.

Contact Your Bank:

If you cannot find your bank sort code through the methods above, consider contacting your bank's customer service.

Bank's Website:

Some banks provide sort codes on their official websites. You can try searching for "Sort Codes lookup" or a similar query on your bank's website to find the required information.

Search Engines:

In some cases, you might find your bank’s sort codes through a simple online search. Be cautious and make sure you are on a legitimate and secure website when searching for sensitive banking information, however.

Sort Code vs. SWIFT Code: What is the Difference?

Is sort code same as SWIFT code? No, it isn’t, but it may get confusing for you as a user to differentiate when it comes to sort code vs. SWIFT code. How are the two different, then?

Sort code vs. SWIFT Code:

Conclusion

We hope this post has been helpful if you were looking for an answer to ‘what are banking SORT codes?’, or ‘how to find bank sort code?’. Always remember to input the correct sort codes for smooth and fast domestic transactions in the UK and Ireland! For further informative articles on the world of finance, do not hesitate to check out the SALT Fintech blog!

If you are looking for a global banking solution as a business operating in India, Salt Fintech can be an easy solution for your business to receive payments from international clients, that too in seven foreign currencies! We create local accounts for your business and process your cross-border transfers instantly, making for a smooth global banking experience for you!

Visit our website today to find out more!

Frequently Asked Questions

1. How to check if I have entered the correct sort codes?

You can verify your sort codes from your bank’s website, or you can make use of a sort code checker available online: you may find many banks officially making those available. Further, if you are inputting the sort code online before a transfer, the page would verify the sort codes entered for you and notify you in case it is wrong.

2. Differences between sort code and account numbers?

While your account number identifies your particular bank account for domestic and international transactions, your sort codes identify the bank branches you have accounts in in the UK and Ireland. We hope this tells about the distinctions of sort code and account numbers!