If you have considered going global with your small business, startup, or even as a freelancer, international invoice requirements might have crossed your mind. So, how to invoice international clients from India?

International invoicing is the process of issuing invoices for goods or services to clients or customers in different countries, ensuring compliance with specific requirements and regulations. It involves currency conversion, language localisation, tax compliance, and adherence to international business practices.

Businesses must gather accurate client information, such as legal business names, addresses, and tax identification numbers, and determine the appropriate currency for invoicing. They also need to provide shipping and handling information, specify payment methods, and comply with tax and legal requirements specific to the client's country.

If you are wondering how to invoice international clients from India, we have got a checklist of everything you need to remember about international invoice requirements!

How to Invoice International Clients from India?

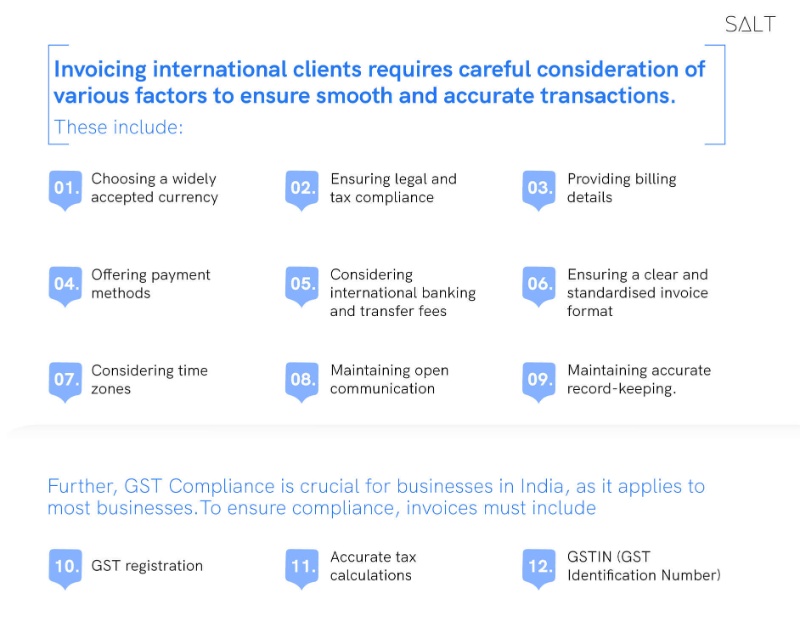

To ensure smooth transactions and adherence to global business norms, invoicing international clients takes careful consideration. Utilise this simple how-to to efficiently invoice your clients abroad:

Use an Invoice Template

As a freelancer, a small business, or a startup, the most efficient way to go about invoicing international clients is to use a template or an invoice generator available online. This would ensure that you are not missing out on any of the essentials and are presenting your invoice in just the correct, professional way.

In case you want to generate international invoices yourself, read on to find out the considerations.

Invoicing International Clients Yourself

Here’s how to invoice international clients from India yourself:

Collect accurate and complete details from your international client, including their legal business name, address, contact information, and any country-specific tax identification numbers.

Do remember to determine the currency to invoice your international client- invoicing in foreign currency in India may involve denominating in their local currency or widely accepted currencies such as the US Dollar or euro. Clearly specify the chosen currency on the invoice.

Invoicing international clients includes providing all necessary information on the invoice for both parties to understand the transaction, so remember to include your business name, address, contact details, and taxpayer identification number.

Further, assign a unique invoice number and include the invoice date and payment due date.

Clearly outline the products or services provided, specifying quantity, unit price, and any applicable taxes or discounts. If customs require specific codes or descriptions, include them as well.

If applicable, clearly state shipping and handling costs separately or include them in the total amount. Specify the shipping method, expected delivery time, and provide any relevant tracking or customs information.

As part of invoicing international clients, clearly explain the payment process, including the payment due date, acceptable methods, and any additional information required for international transactions, such as your bank's SWIFT code or IBAN number.

Accurately calculate the total amount due and present it clearly on the invoice. Ensure that any taxes, fees, or discounts are properly itemised. If needed, provide a breakdown of the total, including subtotals for different products or services.

If your client's primary language differs from yours, consider providing an invoice in their language or including a translated version alongside the original.

Once you’re done creating the invoice, transmit the invoice to your international client using a secure and reliable method. While email is commonly used, be mindful of any country-specific preferences or restrictions that may require alternative delivery methods.

Monitor the payment status closely and follow up with your client when necessary. Maintain a record of all communication related to the invoice, including payment confirmations.

Key Considerations for Invoicing International Clients in India

To answer the question of ‘how to invoice international clients from India?’, here are some specific considerations to keep in mind:

Payment Methods:

Now the big question: which payment method is the most suitable for international transactions? The payment method you end up choosing can make a sizable difference in terms of efficiency and speed of your invoice payment.

Here are some options you can try out:

Wire Transfer:

Now, this is the most standard method for cross-border transfers that you can use. You simply need to provide your international clients with your banking details with the invoice, and they initiate a wire transfer to pay you.

However, this is not an effective method if speed is your requirement, and small, frequent payments are not exactly viable since the intermediary fees and foreign exchange rates can eat into your compensation.

Credit Cards:

Credit cards may be a quicker way for your customers to pay you, but they will be charged a hefty foreign exchange fee in proportion to the amount mentioned in the invoice (anywhere between 1% to 3% usually). This may result in you losing business in case your customers find a cheaper, local option.

Foreign Bank Accounts

You may consider opening several foreign bank accounts to give a domestic option while invoicing international clients. However, this process won’t be very efficient for you, because

You need to invest a lot of time in managing these different foreign bank accounts, and

You would still need to initiate cross-border transfers to get your income to your Indian bank account.

Transact with a Neobank like SALT Fintech

At SALT, we help you earn in seven different foreign currencies, and your income is processed to your bank account immediately after it’s received into your local SALT account. Further, we provide currency conversion at the lowest FX rate of 1.75% of the transaction, and you further benefit from free FIRC, unblocked funds, zero chargebacks, and dedicated relationship managers.

Unlike payment gateways and other online international payment services you can utilise, we charge no subscription/ annual fee, there are no hidden charges, and no markup fees either, making SALT just the right partner when it comes to invoicing international clients.

International Taxes

You must account for international sales taxes when invoicing international clients. This includes noting variables like whether your business is transacting with individual consumers or other businesses, the market of your customers, and more.

GST Compliance

When you are figuring out how to invoice international clients from India, GST compliance is crucial, as it applies to most businesses. To ensure compliance, invoices must include

GST registration,

accurate tax calculations,

and GSTIN (GST Identification Number).

Further Considerations

Do familiarise yourself with the reverse charge mechanism (RCM) and comply with reporting and payment requirements. Accurately calculate the Indian Rupee (INR) equivalent for foreign currency invoicing, using prevailing exchange rates and mentioning the rate on the invoice.

Export documentation is essential for international clients, and consulting with authorities or customs is necessary to ensure compliance. Withholding tax obligations must be clearly communicated to clients and provided with required documentation. Payment methods should be convenient for international clients, such as international wire transfers or online payment platforms.

Language and cultural sensitivity should be considered when preparing invoices, and translations or internationally recognized financial terms should be used to avoid confusion. Familiarise yourself with international laws and regulations, including anti-money laundering (AML) and Know Your Customer (KYC) requirements.

Finally, maintain accurate records of invoices, payments, and correspondence with international clients for financial reporting, audits, and tracking transactions. Seeking professional advice from a qualified accountant or legal professional can provide specific guidance based on your business and the countries involved.

Conclusion

We do hope this post tells you all you need to know about ‘how to invoice international clients from India?’, and helps you in understanding the international invoice requirements!

Are you a business owner in India searching for a convenient global banking solution? SALT Fintech is here to simplify global banking for Indian businesses, offering easy management of your finances through local accounts. Our goal is to provide a streamlined banking experience that saves you time and energy. Explore the Salt Fintech website now to learn more about our services and discover how we can assist you in reaching your financial goals!

Frequently Asked Questions

How should I communicate and follow up with international clients regarding invoices?

Maintain open communication with your international clients throughout the invoicing process. Promptly follow up on any outstanding invoices or payment delays, addressing any questions or concerns they may have.

How to receive payment from international clients?

Salt Fintech can be an easy solution for your business to receive payments from international clients, that too in over six foreign currencies! We create local accounts for your business and process your cross-border transfers instantly, making for a smooth global banking experience for you!