International Bank Account Number

The IBAN number (International Bank Account Number) is a standardised identifier associated with a bank account used to handle international money transfers. The IBAN is crucial in cross border payments as it aids in preventing potential operational problems. This article is going to explore everything you need to know about the IBAN number. Stay tuned!

What is IBAN Number?

An IBAN, or as said, International Bank Account Number, is a unique number used to identify bank accounts in international money transfer and helps to facilitate the processing of cross border payments by standardising the format of account numbers.

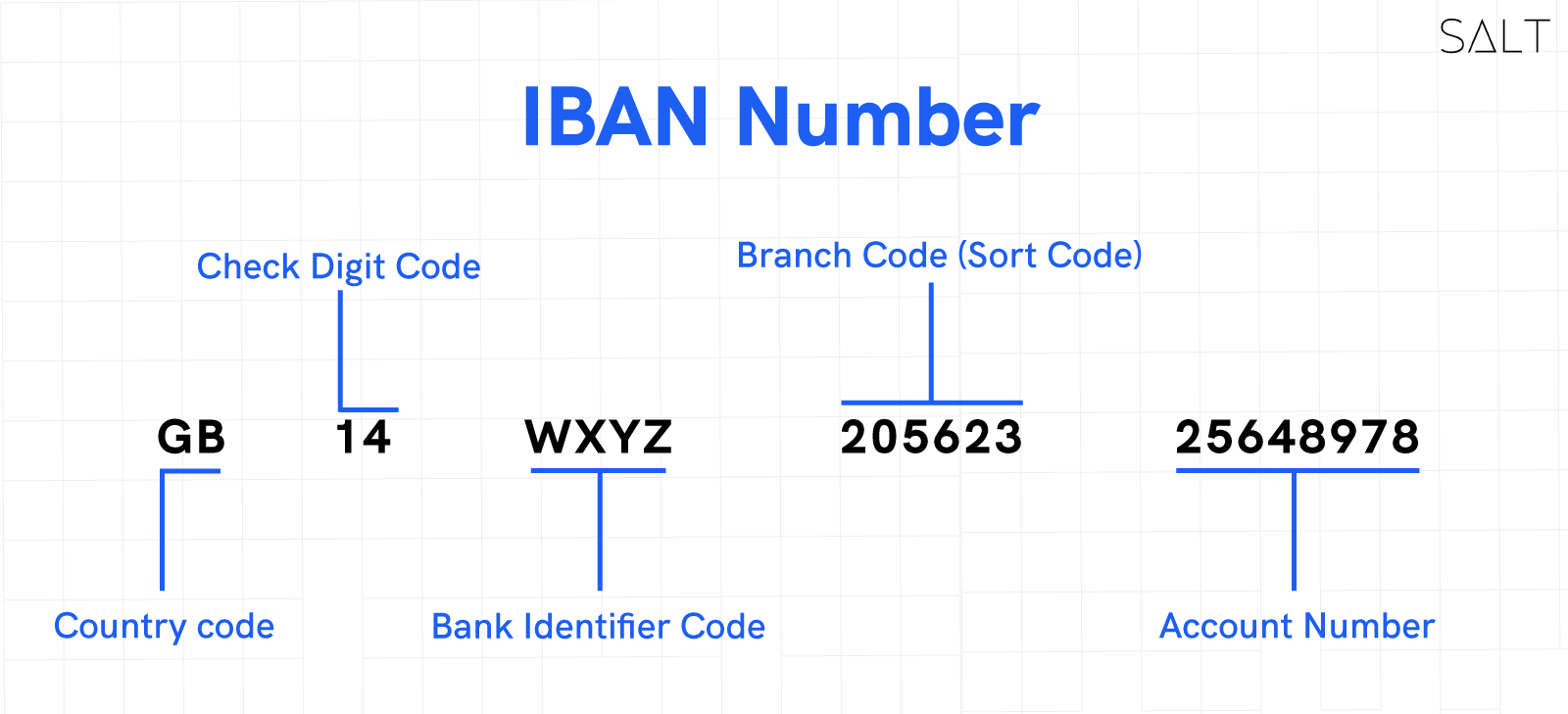

The IBAN consists of letters and numbers, and its structure varies depending on the country. In general, it is made up of several parts:

The country code:

This is a two-letter code that indicates the country where the bank account is held. For example, "DE" for Germany, "FR" for France, and so on.

The check digit:

This is a single digit used to confirm the validity of the IBAN. It is calculated using a specific algorithm and helps detect errors in the IBAN.

The bank code:

This is a code that identifies the bank that holds the account. The format and length of the bank code vary depending on the country.

The account number:

This is the actual account number of the bank account. It is usually made up of letters and numbers, and its format and length also vary depending on the country.

IBAN is used in international money transfers between countries in the European Union and many other countries worldwide. It helps to ensure that the money reaches the correct bank account by providing the necessary information about the bank and account holder. The IBAN facilitates the automatic processing of payments by eliminating the need for manual verification of the account number and bank code, which can efficiently reduce the risk of errors.

When making international money transfers using IBAN, you must provide the recipient's IBAN, the account holder's name, the bank's name, and the SWIFT/BIC (if needed). This ensures that the transfer is directed to the correct bank account and the proper account holder.

How to find an IBAN?

An IBAN is a unique number assigned to bank accounts in various countries. There are several ways to find your IBAN number, depending on your bank and the country where your account is held.

Check your bank statement:

Your IBAN should be listed on your bank statement, usually at the top or bottom of the page. It may be referred to as "IBAN," "IBAN number," or simply "account number."

Log in to your online banking account:

Many banks provide access to IBAN numbers through their online banking platforms. You should be able to find your IBAN number in your account details or by clicking on a link labelled "IBAN" or "account number."

Contact your bank:

If you cannot find your IBAN number through your bank statement or online banking account, you can contact your bank directly. They could provide you with your IBAN number via phone or email.

Visit your bank branch: If you cannot find your IBAN number through other means, you can visit your bank branch in person. They would be able to provide you with your IBAN number on the spot.

Check IBAN calculator: Many websites provide an IBAN calculator where you can find your IBAN by providing your bank account number, sort code, and bank name.

It is important to note that your IBAN may differ depending on where you hold your account. If you have multiple accounts, make sure you're using the correct IBAN number for the account you're trying to access.

When you're providing an IBAN number to someone for cross border payments, it is always a good idea to double-check the number with your bank to make sure it is correct, as it can prevent any error that might happen due to typos or wrong information provided.

Which countries use the IBAN?

IBAN is a system in many countries worldwide to identify bank accounts in international money transfers. The European Committee for Banking Standards (ECBS) developed the IBAN system to facilitate the processing of cross border payments in the European Union (EU) and other countries.

IBAN number is mandatory for cross border payments in many EU countries and countries in the European Economic Area (EEA). It is also used by many other countries worldwide, including the Middle East, Africa, and Asia. Some of the countries which are using IBAN are: European Union (EU) countries, European Economic Area (EEA) countries, Switzerland, Norway, Iceland, Liechtenstein, Croatia, Serbia, Montenegro, Bosnia and Herzegovina, North Macedonia, Tunisia, Algeria, Lebanon, Iran, United Arab Emirates, Saudi Arabia, Bahrain, Kuwait, Oman, Qatar, and Yemen.

It's always an excellent idea to check with your bank to confirm whether IBAN is used in your country and, if so, what the format and structure of the IBAN should be. When making an international money transfer, IBAN is important as it eliminates errors and reduces the possibility of delay in processing payment.

Conclusion

In conclusion, an IBAN (International Bank Account Number) is a unique number assigned to bank accounts in countries participating in the IBAN system. It identifies the bank accounts in international money transfer and the processing of cross border payments.