Usually, seed funding is the first equity funding of an early-stage start-up. As a startup's lifeblood, it's vital that the value of the business is evaluated carefully to ensure investors' interests while simultaneously taking care of early-stage startup founders’ goals and objectives for pivoting their dream business. Typically, seed funding is at a premature state of the business, which is at the pre-revenue stage. The analogy can be explained by considering how farmers harvest produce by planting seeds.

Business valuation can be an arduous job for startups that essentially have no assets or history to refer to, given they are at an early stage in their life cycle. There are many variables are at play when valuing a company for seed funding. The process is also neither straightforward nor one-size-fits-all.

While some may believe that the valuation of a startup is hard science and requires the analysts' immense dedication to leaving no space for errors, it's also an art where analysts can add value to the startup by playing with the numbers and presenting them in a desirable way to the VCs or angel investors.

Here are a few points that should be kept in mind by early-stage startups before deep diving into the theories and formulae of valuation:

1. Whether the company is in a Hot Sector or Cold Sector

If a company specialises in an industry or sector that is redundant or cold, the potential investors can draw their hands back. A company thriving in a booming industry or a hot sector holds a higher chance of getting funding and even sometimes premiums from investors.

2. Marketing Strategies

At the initial stage, the companies searching for seed funding have no products or services available for sale. However, the management team has to decide the marketing strategies beforehand to assure the investors of trusted distribution channels that are efficient and serve a large mass of target customers. The investors can get an insight into the growth of the business in this manner.

3. Is the Business Prototype Ready?

A prototype is the basic model of the product or service the startup aims to provide and is tested in real-life scenarios to gauge its validity and usability. Designing an ideal prototype is a major factor in gaining investors’ interest. Hence, before presenting your pitch to the investors, double-check your prototype.

4. Relevance to Market Trend

Another important factor to consider is the market trend, that is, whether the product or service is in demand by the customers. Does the startup promise traction? If the company holds traction, it shows that the growth and development of the business are likely to move upwards on the chart, which is a plus point for the investors.

5. Founders’ Image

Investors might also be interested in the reputation and the public image of the company's founders. A good and positive image of the founders sheds a healthy light on the business and may attract investors. For example, a serial entrepreneur with a successful company launching another startup will gain positive responses from the investors

6. SWOT Analysis

An in-depth SWOT (strength, weaknesses, opportunity, threat) analysis performed by the management team of the company will give a thorough idea of the business. The management team can glean an idea of where the company stands in the market and what it is actually worth and value it accordingly.

7. Comp Analysis

Investors may use comp or comparable home analysis to understand the value of the startup by comparing it with companies that are similar in size, location or of the same sector or industry of their company to calculate its standing in the market.

8. Competition

If the startup is a hot sector model with innovative ideas, maybe ones that have never been heard of, there might be a hoard of investors looking for stakes in the company. In such a case where there is high competition in the deals offered by the investors, the founder holds leverage and can negotiate the amount of investment, thus increasing the value of the company.

Other major consideration points are growth rate, the volume of the target audience, market conditions, the expertise of the management team, and diversity in skills.

How to Calculate the Valuation of a Startup for Seed Funding

The next step, obviously, will be to select a suitable method of valuation. Few valuation techniques for startups that require seed funding from angel investors, VCs, etc., are the Venture Capital method, Berkus Method, Scorecard Valuation Method, Risk Factor Summation Method, Asset-based / Book Value method, Discounted Cash Flow, etc.

Below are a few valuation techniques for startups that require seed funding from angel investors, VCs, etc.

#1 Venture capital method

The venture capital method of seed funding is essential to attract and serve venture capitalists. The procedure begins with estimating future revenues and then moves to identify business exit plans. The method requires multiple pre-money valuation formulae. Let's look at the two steps:

Step 1: Calculate the Terminal Value

Terminal value is a projected value of a startup at a particular time in the future.

1) Forecasted revenue in the harvest year

2) Forecasted profit margin in the harvest year

3) Calculate the industry P/E ratio

Where harvest year is the exit year of the start-up and P/E is the price per earning ratio.

Terminal value = Forecasted revenue x Forecasted profit margin x P/E ratio

Step 2: Calculate Pre-money Valuation

Pre-money Valuation = Terminal value/ ROI - Investment amount

Let's understand better with an example, suppose a company in the IT sector forecasts revenue of $20 million in 5 years with a 10% profit margin, and the industry P/E ratio is 30. ROI is 10 times the planned investment of $2M

Terminal value= $20M x 10% x 30 = $60M

Pre-Money Valuation = $60M / 10 - 2 = $4M

Hence, the calculated pre-revenue startup valuation is $4M. In the next 5 years, the company can value $60M if it receives $2M as seed funding.

#2 Berkus Method

Dave Berkus, a venture capitalist and angel investor, suggested a gospel for startup evaluation in the 1990s, which was also published in 2001 in the book "Winning Angels" by Amis & Stevenson. According to Berkus, only one in a thousand startups are able to meet or go beyond their forecasted revenue in the promised period. There are five key elements of a startup with values attached to them:

Sound Idea (Basic Value)

Prototype (Reducing Technology Risk)

Quality Management Team (Reducing Execution Risk)

Strategic Relationship (Reduce Market Risk)

Product Rollout Sales (Reducing Production Risk)

A value of $500K is assigned to every aspect stated above, as Berkus assumes a startup should be able to generate $20M by the end of the fifth year. If the company can put the required $500k value in every area, it is eligible for a $2M or $2.5M pre-revenue evaluation. However, in 2016 Berkus said that his method is biased by a few restrictions as well as should only be used for suggestions and considerations rather than as the ultimate method of valuation.

#3 Scorecard Valuation Method

Created by Bill Payne, the scorecard method for valuation is for startups that aim to get funding from angel investors. In this method, the startup company to be valued is compared with another similar company at the seed stage to examine its value.

Let's look at the three steps under this method:

Step 1: Determine the two companies:

Target company: The company that requires funding and is up for valuation.

Company to compare: A recently invested company or a company in the same sector, industry, or market as the targeted company.

Step 2: Next step is to determine the pre-money valuation of the company to be compared with.

Step 3: Now, both the companies are compared on the ground of :

Strength of Management: 0-30%

Size of Opportunity: 0-25%

Product/Technology: 0-15%

Competitive Environment : 0-10%

Marketing & Sales: 0-10%

Need for Additional Capital: 0-5%

Miscellaneous Factors: 0-5%

Each aspect is given a fixed weight based on its importance in the calculation of the company's value. For the targeted company, each aspect is given a rating of below average (<100%), above average (>100%), or at par (100%).

At last, the summation of the aspects is multiplied by the pre-money valuation to get the value of the targeted company.

#4 Cost - to - Duplicate

This method works on the principle of duplication of the startup and calculates how much it would cost to construct a similar business from scratch. If the cost to duplicate is low, then the startup holds very little value. However, if the duplication of the startup is expensive, then the value of the company increases.

The method allows no space for human errors while calculating the reproduction costs and total assets. For example, in a manufacturing company, the cost of production, cost of labor, cost of machines, etc., are included in the calculation.

A downside of this method is that it doesn't consider intangible assets like business growth, future potential revenue, customer retention, brand name, and other such aspects while calculating the value of the company.

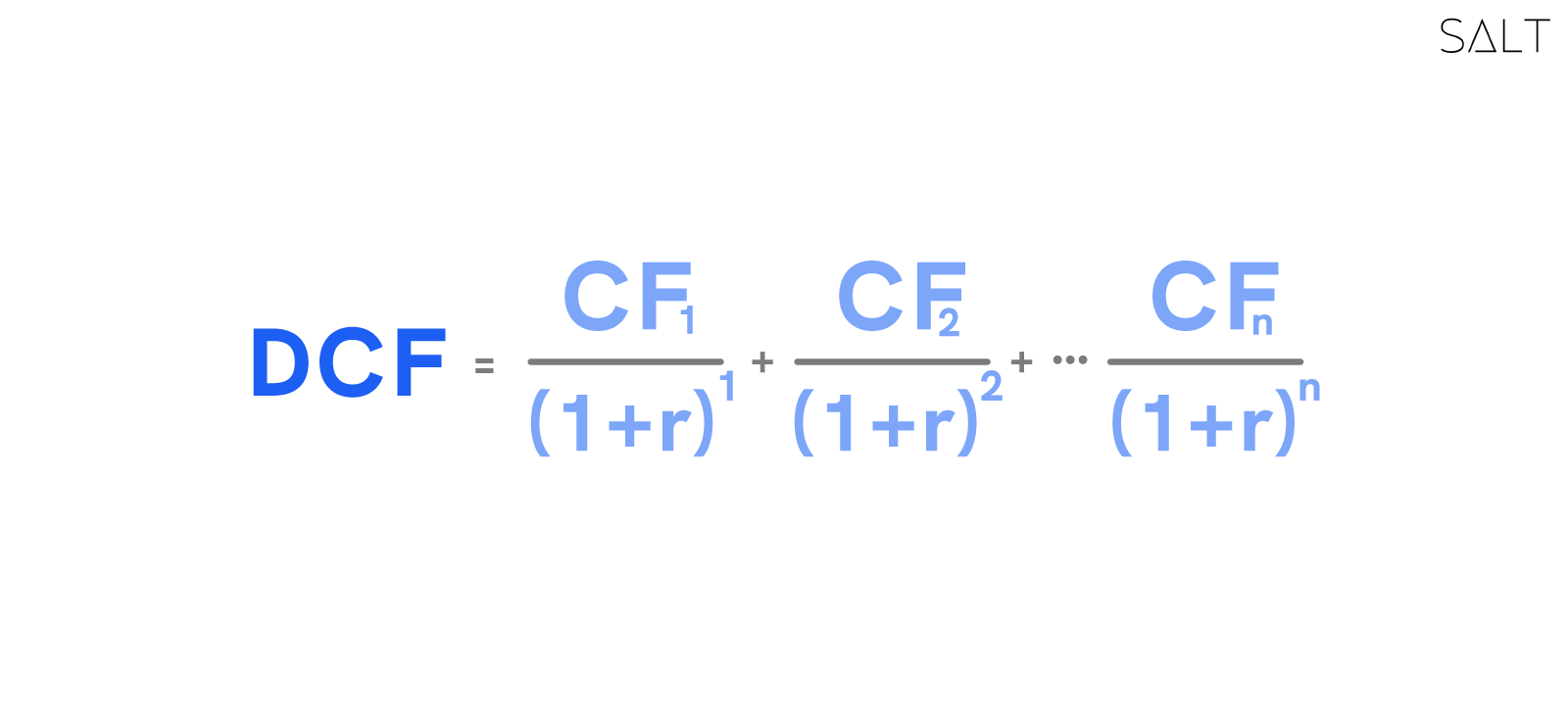

#4 Discounted Cash Flow

Startups with no historical performance are ideal for being valued by this method that looks at the future performance of the company. It forecasts how much cash flows the company will bring in the future. Then the cash flows are discounted at a discount rate or at a certain rate of investment prevalent in the market.

CF = Cash Flow

DCF = Discounted Cash Flow

r = Discount rate

Future cash flows are discounted as the value of the cash flow in the present is more than the value in the future years. The higher the discount rate, the riskier the investment in the company.

To value startups might be a tricky endeavour but not an impossible one. The business valuation report doesn't provide absolutes but estimates that the investors have to club with their experience, intuition, and expertise to put money into startups. The third and final step for startups and SMEs is to understand the difference between Pre-Money and Post-Money valuation of an early-stage startup.

Valuation is crucial for every startup or SME, for it helps them decide the amount of equity the early-stage founders need to give to venture capitalists and angel investors. Table by Salt provides solutions to entrepreneurs and founders to get their valuation report prepared diligently while making sure fundraising and compliance sorted in a hassle-free way.