The valuation of an early-stage startup is crucial to its success (or failure) in any venture capital financing round. When it comes to establishing firms, most start-up and early-stage founders have the similar objective of ensuring long-term, profitable growth and development. But acquiring funding is an essential requirement, whether you're just starting or hoping to scale exponentially.

These numbers valuing the financial worth of a startup-up or an SME are significant because a startup's pre-money valuation and post-money valuation can significantly affect the success of the startup funding stages.

So, what distinguishes pre-money valuation from post-money valuation, and what do these terms mean? Let's find out.

What is Pre-Money Valuation?

A pre-money valuation is the value of a firm before any outside capital or the funds received post the most recent round of funding have been added. Pre-money is best defined as the potential value of a startup before it starts to receive outside funding. This valuation provides investors with a sense of the company's current worth and the value of each share that has been issued.

Many other factors are considered during the pre-money appraisal for business owners and investors to reach agreeable conditions. These comprise the current state of the market and the estimates of other companies operating in the same sector. Pre-money revenue is another item on this list that applies to more established businesses.

An investor may decide the ownership percentage and cost based on the above-mentioned factors. This, in turn, provides you with a pre-money valuation before investing.

What is Post-Money Valuation?

Conversely, post-money valuation refers to the company's value after receiving funding and subsequent investments from VCs, angel investors, or other sources. The post-money valuation takes into account recent capital infusions or external finance. Knowing what is being discussed is crucial because these are key ideas for valuing any firm.

What is the difference between the two?

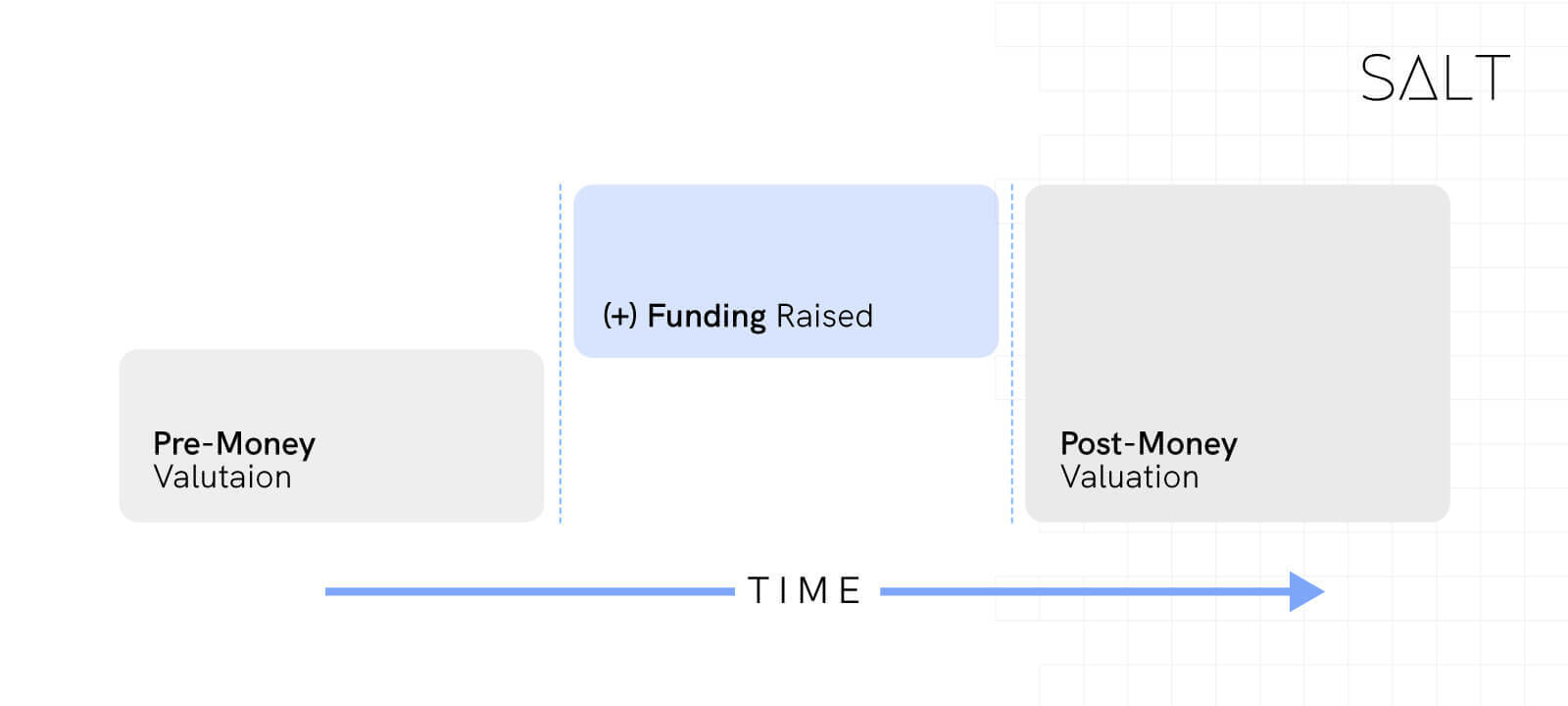

Timing determines the difference between a company's pre-money and post-money valuation. A company's pre-money valuation is its agreed-upon value before it obtains the following financing round, whereas a company's post-money valuation is its implied value right after obtaining the funding.

How to calculate Post-Money and Pre-Money Valuation

Calculating post-money valuation is pretty straightforward. The post-money valuation of a corporation can be determined by simply adding the investment's value to the company's pre-money valuation. Alternately, you can determine post-money valuation by dividing the new investment amount by the number of shares the VC/Angel investor received in exchange for the investment they made in the early-stage startup/SME and multiplying the resulting per-share price by the total number of shares issued after your investment.

Or

Post-Money Valuation = Financing Raised/ % of Equity Ownership given to VC/Angel Investor

However, figuring out a company's pre-money value is significantly trickier. The pre-money valuation of a firm is a negotiated value based on various variables and formulas determined by investors and early-stage founders rather than just straightforward math. When evaluating the pre-money valuation of a company, the parties consider several criteria. Recent similar offers, exit value estimates, and historical cash flow are a few examples of possible factors and startup metrics. Determining the pre-money valuation of a business can be extremely challenging because the valuation of pre-revenue enterprises is frequently passionately contested.

Relevance of Convertible Notes in Pre-Money Valuation

Due to the significance of a firm's venture capital valuation, start-up founders and investors frequently engage in contentious discussions on the pre-money valuation of a company. These disputes are frequently challenging to settle. The pre-money valuation of a firm can be particularly difficult to ascertain when securing the first round of funding because it is difficult to assess the genuine value of the product, and the parties may even be requested to agree on the valuation of early-stage businesses. Convertible notes usually referred to as convertible debt, can be useful in several circumstances.

With the help of convertible notes, companies can raise money while postponing valuation until after the business has grown more established. Although these notes are loans, they become equity in a subsequent investment round. Investors typically receive specific guarantees or warranties for accepting the risk of an undefined valuation.

Why is the Distinction Between Pre-and Post-money Valuations Important?

The difference between a company's pre-money valuation and post-money value is significant since it ultimately determines the equity stake that investors will be entitled to following the completion of the financing round.

Which Has Greater Relevance for a Business?

For various reasons, pre-and post-money valuations are both crucial for successful fundraising.

A later-stage startup planning to go public and sell shares to investors other than venture capitalists may be more interested in the startup’s post-money value. Additionally, the later in the stage you are, the more crucial it is to guarantee that your investors will experience at least a 5x return on investment (ROI), or a 25% rate of return, in a few years.

The opportunity a firm has generated can be communicated to an investor through a pre-money valuation. On the other hand, a post-money valuation reflects a company's capacity for growth and its requirement to attract investors' money.

To sum it up

Your company is pushed into scalability once the post-money valuation is invested in. The pre-money valuation represents the physical assets, intangible assets, and sweat equity (startup capital, concept development, personal risk, etc.) you've invested in the company. Make sure you are knowledgeable about both pre-and post-money valuations and that you are prepared to analyse the terms of investment before engaging in funding conversations with possible investors.

A reliable and trustworthy service provider can go a long way in solving all of the business’s financial and operational issues.

For startups raising funds, Table by Salt helps you get the pre-money valuation report, complete RBI & MCA filings related to the pre-funding and post-funding by just paying a fraction of the costs and slashing the time taken by half. It can’t get any better than this!