If you've ever converted your money to a foreign currency, you must have noticed a difference in the final amount. Have you ever wondered why that happens? This difference is accounted for by the mid-market exchange rate (MMER), which is a vital component in cases of international money transfers.

Sending money overseas has never been simple, especially for businesses that trade internationally. Converting money to a foreign currency leads to a difference in the final amount, and this happens due to the mid-market exchange rate (MMER). Exchange rate fluctuations due to MMER can be a major issue for startups as the money received from abroad will never match the amount you expected to receive or send. Startups and SMEs dealing internationally can send or receive money abroad to a globally-distributed workforce, a global supply chain, or receive funds from foreign clients or investors.

What is the Mid-Market Exchange Rate?

The midpoint in an international transaction involves MMER, sometimes known as the middle or interbank rate, at which banks exchange currencies. Consider the global foreign exchange market - the mid-market rate, at which the bank is prepared to trade in the interbank market, is the average of the purchasing and selling prices of two currencies. Instead of being a trade rate, it is a computed rate.

The mid-market exchange rate is the middle point between the selling and buying price of a pair of currencies. Every currency pair at present has a distinct, constantly changing mid-market exchange rate that is determined by national and international macroeconomic factors. For instance, the exchange rate between the US dollar and the Indian rupee currently is 80.015.

Why, When, and Where do You See the Mid-Market Rate?

The Mid-Market Exchange Rate is important if you transact in multiple currencies or make international money transfers since it impacts the net amount you transfer abroad or receive from abroad. The charge you pay to your bank is the difference between the mid-market rate and the forex net rate at which you exchange two currencies. That's why you will never get charged the mid-market exchange rate. MMER is the rate banks charge each other while exchanging currencies.

Mid-market exchange rates are crucial when any startup or SME is making an international payment, or an individual makes an international money transfer. When you look on Google or through independent sources like Reuters and XE, you will discover the mid-market exchange rate.

How is the Mid Market Exchange Rate calculated?

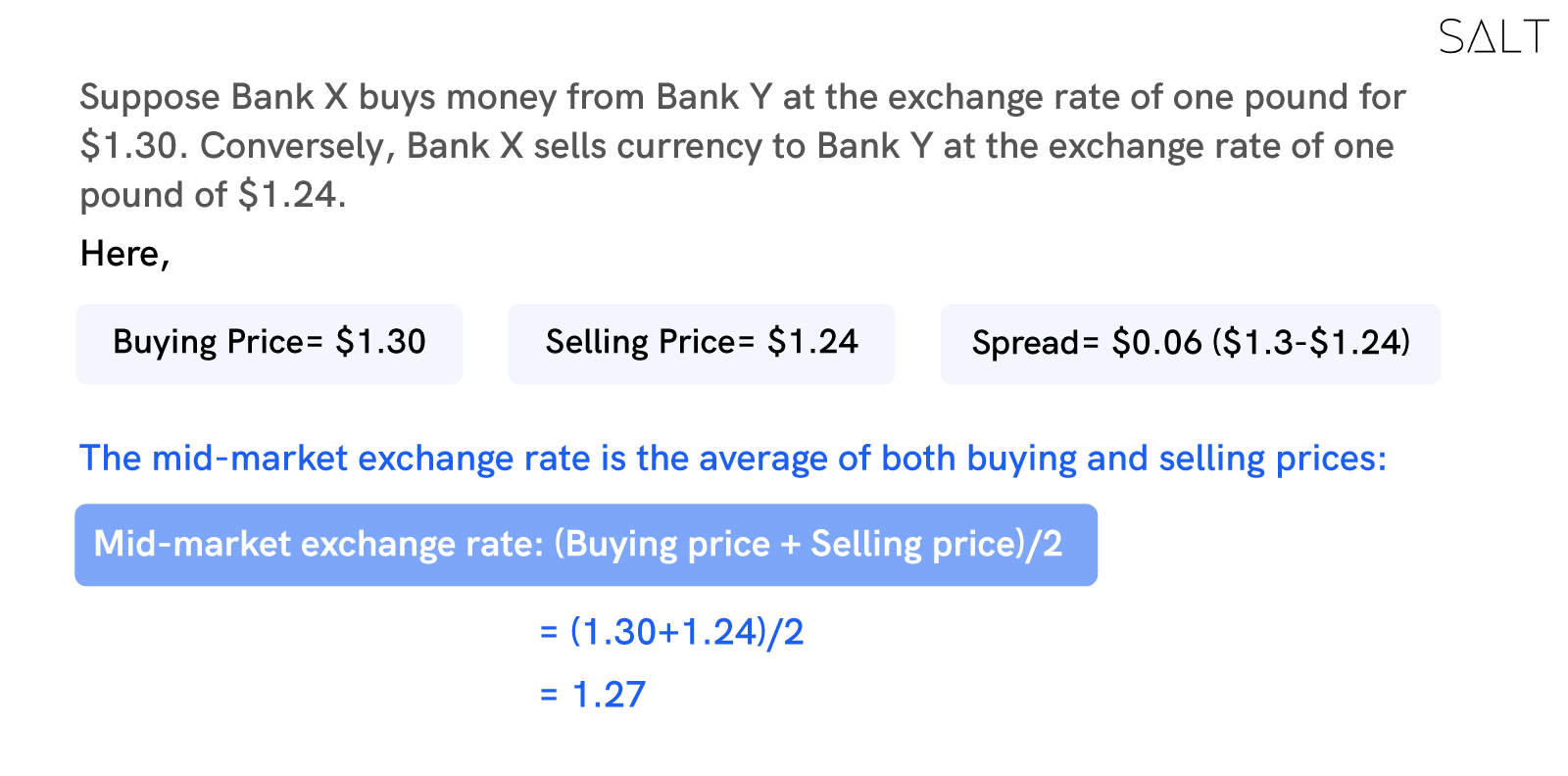

It's critical first to grasp what the term "spread" refers to comprehend mid-market rates. The price difference between the buy and sale is known as the spread.

The average (or midpoint) of the spread (buying price and the selling price) is used to establish the mid-market rate.

The mid-market rate, in this case, is $1.27. The rate you receive from a reputable money transfer provider should be as near the mid-market rate as possible, with a little spread.

Can individuals send at Mid-Market Exchange Rate?

Individuals who send money abroad can send it at the mid-market rate if their exchange provider doesn’t mark up the exchange rate. Besides, they are also required to pay a transaction fee which the service provider charges additionally.

How to Find the Best Exchange Rate?

Usually, making international money transfers at the mid-market exchange rate is not possible. This is because currency exchange providers set their exchange rate margins to benefit from cross-border money transfers, banks, and other providers of currency exchange services.

But with Salt's neobanking solutions, you can transfer money abroad or receive money from abroad at the mid-market exchange rate with no markups or hidden fees involved. With Salt, the only exchange rate that you need to take care of is the mid-market exchange rate and you can make the best of your international transfers!

XE, Yahoo, and Bloomberg are some of the most reliable platforms to note the current exchange rates for various currency pairs. Cross-border payments should be made at the closest rate to mid-market exchange rates.

Why are there different Mid-Market Exchange rates?

The Foreign Exchange (FX) market is not a centralised market as opposed to equity trading, which takes place in an organised market. Major players are tier-1 banks, with ten holding more than 70% of the daily FX transactions.

As a reminder, the daily FX volume is USD 966.7 billion. So the quote can vary from bank to bank, but the difference is very small, thanks to arbitrageurs who keep the market with no price discrepancies.

That's why the mid-market rate can vary slightly from one liquidity provider to another.

Is the Mid-Market Exchange Rate constant?

The Mid-Market Exchange rate fluctuates very often. The determinants which affect the exchange rate include:

Inflation Rates

Nation's current account or balance of payments

Government debt

Terms of Trade

Political stability & performance

Recession

When making an international money transfer, knowing the mid-market exchange rate will help you receive more for your money, but there are other factors to take into consideration as well. This comprises:

A common rule of thumb is to transfer money as near to the mid-market exchange rate as you can if you're looking to save money on international money transfers. The closer you are to this conversion rate, the more money your beneficiary will ultimately receive because the majority of currency providers and institutions make money from the exchange rate margin.

A smart currency partner can even help you set up a limit order to ensure that your funds are automatically transferred when the market reaches a preset exchange rate, which will help you maintain your attention on the wider picture.

The Bottom Line

A sound understanding of the mid-market exchange rate is crucial for businesses and SMEs operating globally to have transparent transactions. Many exchange service providers markup the mid-market rate by adding their profit margins. This increases the individual’s or company’s overall transfer expenditure.

It is not difficult to get wound up in the currency exchange task. Managing foreign payments can be time-consuming and occasionally expensive for an early-stage business going global. Salt is a reliable banking solution that deals with cross-border transactions at the lowest rate of - 1.75% of transactions and compliances for Indian SMEs. With Salt, your venture can procure hassle-free forex banking services across the globe.