In 2020, $140+ trillion in payments was processed across international territories. The trajectory of these cross-border transactions, where the payer and the recipient are located in different countries, is only headed in one direction - up. Every market - from Asia Pacific to Europe and America - is expecting to see cross border payments grow in the coming years. What does a closer look at markets like India reveal?

First off - a quick look at the basics.

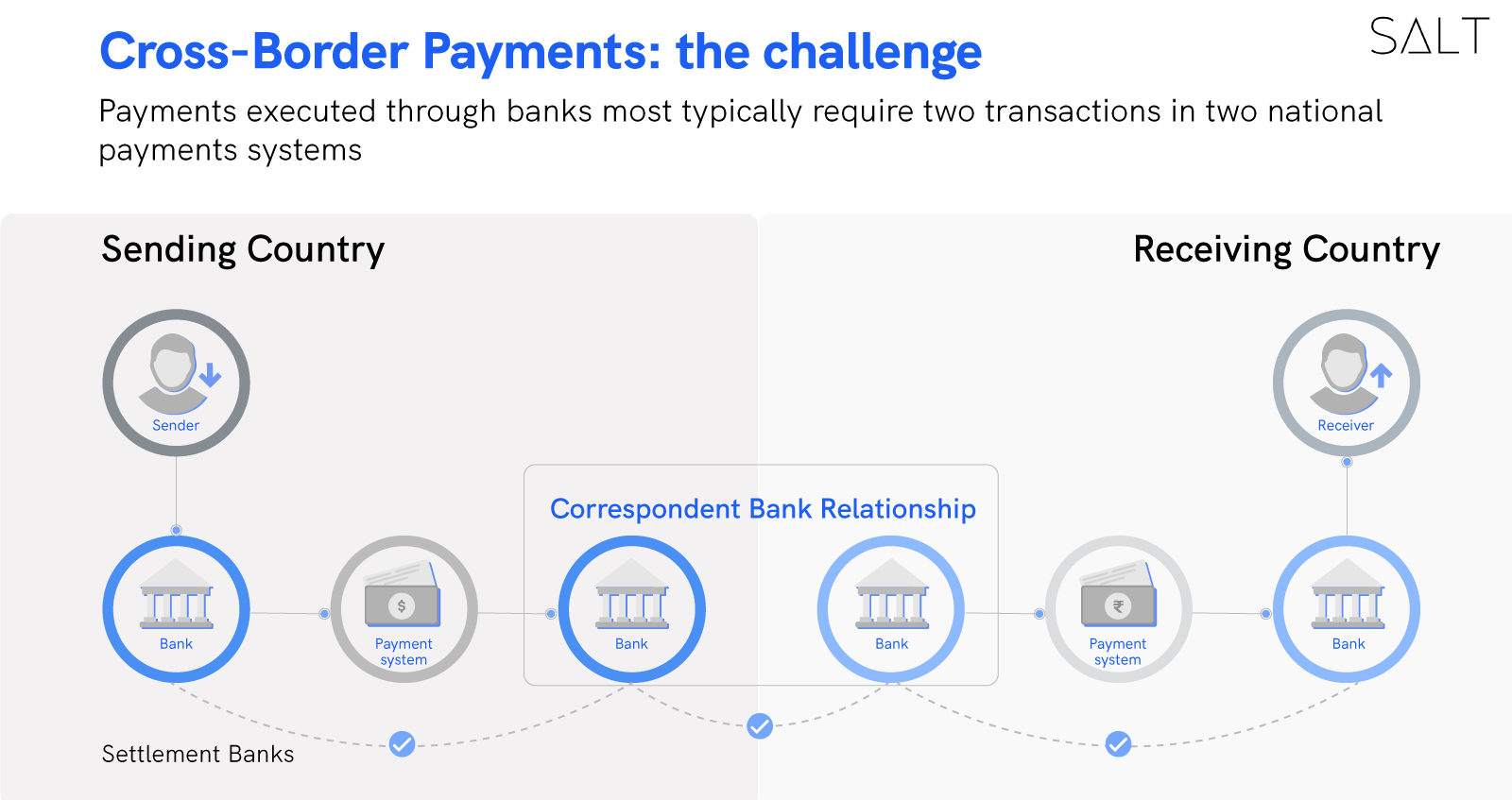

International fund transfers require the transformation of one country’s currency into another. And if it sounds complex, that's because it is. There are a lot of players involved - from domestic banks and payment systems, to international transfer protocols and verification systems.

Contents

If you're sending 10,000 INR to the US, for example:

Your domestic bank sends the instructions to a settlement bank.

The settlement bank, via its relationship with a corresponding settlement bank in the US, executes the transaction.

The international settlement bank then transfer the money to the receiver's bank, ultimately landing it in the bank account.

Nearly every step here involves manual intervention. Leakages in the form of Foreign transaction fees and exchange rate fluctuation makes the process less attractive.

Factors like a rise in global migration coupled with global e-commerce have necessitated not one, but a number of different secure and efficient methods of completing a cross border payment. For instance, in India, inward and outward remittances are a major reason international transactions must be made easy. After all, according to a recent PwC report, India is the largest market for inward remittance flow across the globe, at around $83 billion. India’s inward remittances mostly come from the US and the Middle East, while a large part of the outward remittances are sent to Nepal and Bangladesh.

While not really very different from domestic payments, cross-border payments are certainly more expensive and can take longer to execute. This is because there’s an increased number of parties involved in a transaction (i.e. banks and other third party financial institutions). Typically, for a cross country transaction initiated by an Indian person, an Indian bank would take the payment from the sender and send it across the border to a bank in the receiving country it is aligned with, which would then process the payment through its own payment system and hand it over to the designated receiver. However, for some countries, the payment has to pass through one or more countries in between the sending and receiving countries due to reasons like longer distance and no direct connection with any banks in the receiving country. Through traditional methods in India, international payments usually take two to five working days to be processed, depending on the number of institutions the transacted funds have to pass through.

Basics of a Cross Border Transaction: How to Make One?

The more widely used methods of transferring funds across borders include the use of channels like SWIFT, RDA or Rupee Drawing Arrangement, and MTSS or Money Transfer Service Scheme.

SWIFT or the Society for Worldwide Interbank Financial Telecommunication is a global payment network founded back in 1973, that facilitates international transactions through bank transfers. The network connects approximately 10,000 financial institutions from 212 countries across the world; the network facilitates an average of 11,000 clients from all over the world to initiate nearly 33.6 million transactions regularly. The network works as an intermediary in brokerage and stock transactions, along with providing banking services.

SWIFT assigns banks aligned with it a unique Bank Identifier Code or a BIC (similar to the IFSC code required to make a domestic transfer). To make an international bank transfer, a payer would need the IBAN or international bank account number and the BIC or bank identifier code of the payee.

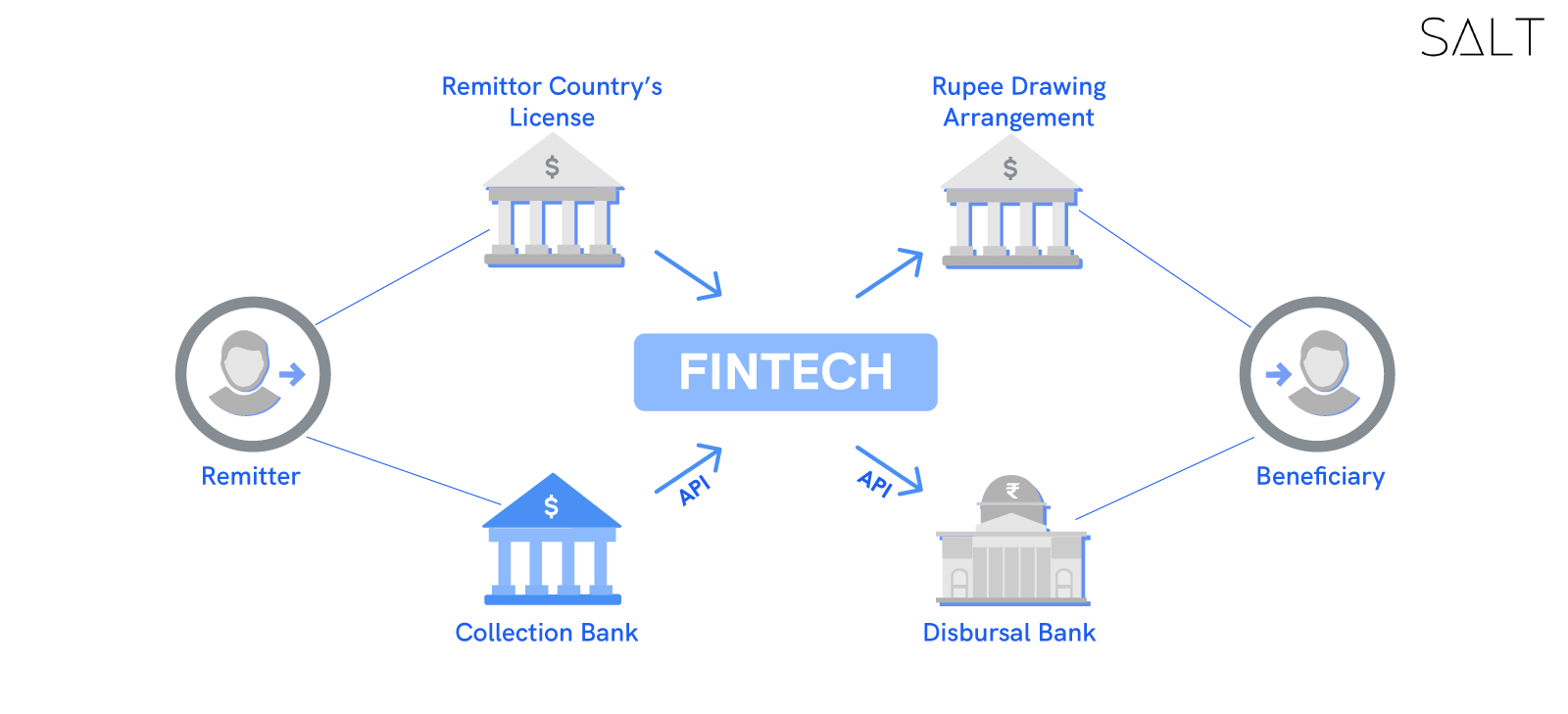

As for RDA or Rupee Drawing Arrangement, it is essentially a channel through which Indians can receive remittances from selected countries across the world. Indian banks have partnered up with many international exchange houses so as to provide a quicker remittance facility to Indians in foreign countries. Senders can use said exchange houses to transact money to Indian receivers, and the payment is credited to the beneficiary’s bank account within only a few hours. Notably, this method only facilitates inward remittances; the RDA process can be seen in the diagram below:

Coming to Money Transfer Service Scheme or MTSS, it is also a way Indian residents can receive personal remittances from abroad; like remittances towards family maintenance and those favoring foreign tourists visiting India are permissible through MTSS. Money transfer companies from abroad called Oversea Principals facilitate these transactions, and Indian agents take over to disburse funds to the payees in India at the current exchange rates. The transactions typically take 24-72 hours to complete, with charges ranging from 0.3–5% of the amount sent. MTSS is a service only meant for inward personal remittances with a maximum transaction limit of $2,500 and a maximum of 30 transactions per year for every beneficiary.

The History of Cross Border Payments

Cross border transactions are not a new concept; in fact, over the course of history, the exchange of international currencies have emerged as a direct result of the many different coins that have been made in different kingdoms and later countries. Even in the biblical times, there were money changers who converted foreign currencies to local currencies so people could avail themselves of goods and services in a certain area.

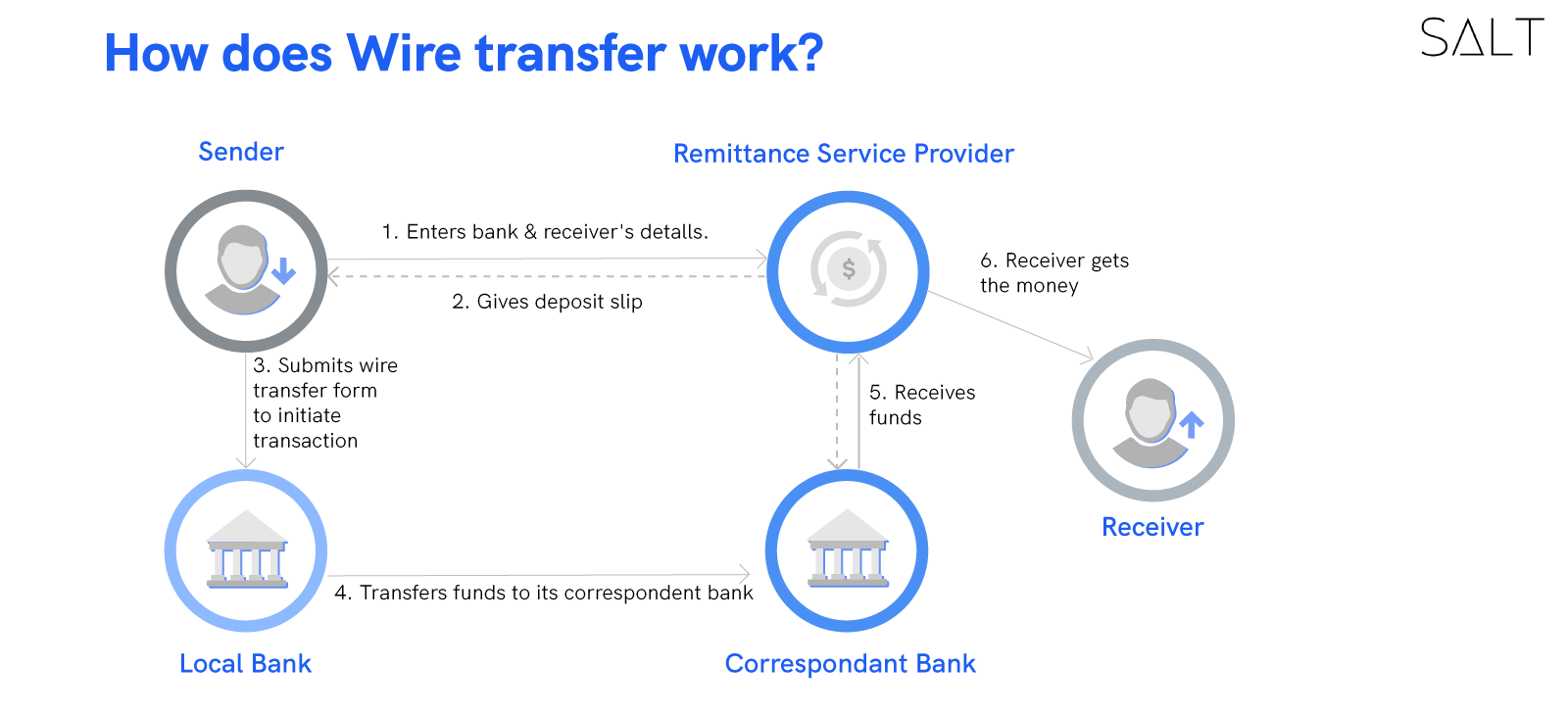

As time has gone by, the physical movement of a particular currency to foreign countries has ceased, and newer ways have been invented to transfer value. With the rise of industrialization, the need for cross border transactions became dire. So, in the late nineteenth century, an organization named Western Union - previously a telegraph company - started facilitating the transfer of funds to a place some distance away through ‘wiring’. A sender would pay the money to be sent in an office for the operator to ‘wire’ it, and the money will be collected by the recipient in another office location. Even today, some remittance companies have office locations across the globe for the recipients to pick up the money sent to them as cash.

Later on, banks reinvented the ‘wiring’ process for international fund transfers, and so rose methods for EFT or Electronic Funds Transfer. Eventually, organizations like SWIFT came along too, so cross border payments can be passed on safely.

Why Are Cross Border Payments Much More Difficult Than Domestic Payments?

Even as the methods of cross border payments have grown more refined over the years, they are still inefficient when it comes to being cost-effective or agile. Indeed, in the modern digital age, the conventional modes of cross border payments have grown unattractive, due to reasons like-

The excessive transaction charges and the prolonged waiting period. Cross border payments require several banking locations to deal with one another, which in turn means navigating through multiple changes of currencies, varying taxable amounts, and transaction fees. With the many entities working on the single transaction, the process can naturally be quite slow.

A majority of both inward and outward remittances in India take place through public sector banks that involve a lot of complex paperwork (such as a higher level of KYC), plus the lack of transparency with international bank transfers is concerning too.

As for international debit cards, they charge quite high transaction fees.

Other issues include incompatible formats from banks from different countries, and a quite low level of automation in the internal systems of the domestic banks.

SWIFT is perhaps the most-used method for making cross border payments, but even that falters because of multiple reasons. For example, a big issue in cross border payments is that they are subjected to regulatory requirements from a lot of different places simultaneously - the country of origin, the destination country, and any other jurisdiction a transaction might need to pass through. For instance, when an Indian user sends funds to someone in one of the European countries, there are the RBI’s regulations and guidelines for the payment to abide by (in terms of AML, KYC, limits, etc.). Then in Europe, the SEPA system and other legislations like PSD2 to be satisfied too.

Is SWIFT Still a Preferred and Reliable Way of Making Cross Border Payments?

The SWIFT network makes transactions to almost every country in the world possible, and conversion to any currency easy. Throughout the years, SWIFT has remained one of the most trusted ways of making a cross border payment. However, just like any other traditional way of transferring value across countries, SWIFT has its shortcomings as well.

The execution of a SWIFT transaction takes a lot longer than a usual online transfer of funds; SWIFT transactions are processed in about three working days on an average. Therefore, standard SWIFT transfers are quite a lot slower than other similar services. It’s to be noted though that with SWIFT, payers do get the option of paying an extra fee for the accelerated processing of a transaction.

There are three choices senders get with SWIFT regarding the amount of time a particular transaction takes to be processed:

The standard transaction: the fund transferred reaches the receiver in two working days after it was sent.

The urgent transaction: the money sent is received after one day.

The express transaction: with this one, the transaction is executed on the same day it is initiated.

However, while this may be solving one problem, another issue is raised in the process: that of high transaction charges.

Just like any other standard method of making cross border payments, SWIFT does not manage to avoid the problem of high transaction costs either. Moreover, these charges are different for every country. It is also not always possible to determine the cost of a certain transaction because it depends on how many banks (domestic and international) will be required to act as an intermediary in its execution.

Needless to mention, both of these issues render SWIFT (as well as any other traditional way of doing a cross border transaction) not suitable for transfers of small amounts.

Fintech Uprising in Cross Border Payments

It’s only natural that a digital age client, used to the convenience of virtual payment services, would want for the same amenities a domestic transfer offers while making a cross border payment too. It’s why fintech companies are leveraging up and coming technologies to bring cost-effective solutions for international payments. There are fintechs introducing flexible payment options, better customer service, and expansive global reach in cross border payment systems, along with lower transaction fees and decreased processing periods.

While there are technological solutions that let users connect to traditional bank networks for cross border transactions more easily, there are also some providing cross border payment rails completely independent from conventional banking networks. PayPal’s arrival in 1998 (then named Confinity) made cross country payments lower-cost and more effortless than ever before. Later after 2010, many Fintech startups came up, providing several digital cross border payment solutions for users across the world.

The rise of neobanks is also closely linked with the increasing demand for convenient cross border transaction solutions. A neobank- or a digital-only bank- offers global banking solutions that make cross border payments faster and more secure. Neobanks make room for convenient, flexible banking; with neobanks, both domestic and global transactions can now be processed with equal speed and ease. In the post-pandemic times, the popularity of the neobank is spreading fast around the world. In India, neobank startups reportedly raised over $230 million in 2020 alone. Further, the size of the global neobanking market is anticipated to hit $333.4 billion by 2026 at a CAGR of 47.1%.

Meanwhile, the NPCI (National Payments Corporation of India) is also attempting to increase its global reach by extending the usage of UPI (Unified Payments Interface) internationally. They aim to leverage UPI for quicker inward remittances, and cross border transactions in general. As per a PwC report from June 2021, a US-based financial services provider has already introduced an inward payment method that lets users send money to India using the payee’s UPI ID only.

- Is India Ready for Innovative Solutions in the Cross Border Payments Ecosystem? The RBI’s Stance on Innovations in Cross Border Payment

As the RBI’s push to extend both Rupay and UPI’s global reaches signifies, the Indian government is aware that the country is more than ready for further fintech solutions to simplify cross border payments. Back in 2019, RBI had launched a regulatory sandbox for promoting fintech innovations. With the third cohort still in process, the first and second cohorts had shortlisted respectively six and eight startups on themes of cross-border payments and retail payments. The RBI’s second cohort theme of the regulatory sandbox framework in particular was how fintechs can solve the many issues faced by the cross border payments sector. Many fintechs in India have leveraged technological solutions since then to address the pain points of the older legacy models.

For instance, Open Financial Technologies was selected by the RBI as part of the second cohort. The startup has created a blockchain-based cross border payment system using Hyperledger Fabric- an open source blockchain based on Linux. The system brings down the time occupied by the collection of money against the export of goods and services to four days, and even decreases the transactional charges by 30%.

Similarly, moneyHop is also an RBI-regulated fintech that aims to become an instant and cost-effective international remittance platform where clients can complete their cross border payments in just four simple steps.

Now, in the January of 2022, India’s central bank has introduced an exclusive fintech department that will be responsible for facilitating and regulating the growing innovation in fintech, as well as handling any fintech related challenges. The department will be aiming to strike a balance between creating more opportunities for and encouraging fintech innovations, and prioritizing consumer protection.

The central bank has appointed its executive director Ajay Kumar Choudhary to be the head of the new fintech department, as well as that of the monitoring and inspection branches. A key reason behind the creation of the separate fintech department is being said to be the incredible fintech growth the India Stack APIs have stoked. Indeed, with the number of smartphone users in India having grown to around 844 million in 2021.

An RBI official has stated that cross border payments is one of the many areas the fintech department will be responsible for looking into. The UPI payments have already not only lowered the expenses of domestic payment, but also sped them up; however, in terms of cross border payments, the UPI is still only slowly connecting other countries’ e-payment systems with that of India. According to the RBI official, the government of India recognizes that the deficiencies in the international payments sector are mostly caused by regulatory issues, and also that different jurisdictions will need to be coordinated with payment instructions being published in common language(s) for said issues to be solved.

As per the RBI internal circular, the new fintech department will be dealing with everything in relation to inter-regulatory coordination and internal coordination in fintech.

Conclusion: What Does the Future Behold for Cross Border Payments in India?

With the establishment of a fintech department, we can expect the procedure of building a brand new regulatory framework for fintech innovations in India to speed up. As for cross border payments, these new developments may soon result in a set of regulations on par with global regulatory mandates that will make cross border payments more accelerated and cost-efficient for people.

With global e-commerce steadily rising in volume, instantaneous cross border payments are an absolute necessity. With innovations in fintech and a strong backing from the government, it does seem cross border payments in India have a promising future ahead.