A term sheet is a written document executed following a pitch meeting or a preliminary corporate meeting of ideas over the proposed deal. A term sheet is a contract between a start-up founder and an investor. It is a document that the parties (start-up founders and angel investors/venture capital investors) exchange that contains the main terms and conditions of the funding.

Before finalising the legal agreements and beginning the time-consuming due diligence, the term sheet highlights the essential aspects of the deal agreements and sorts out the disparities. A term sheet is also sometimes referred to as a memorandum of understanding (MoU) or a letter of intent (LOI).

The term sheet is "Non-Binding" since it merely reflects the important and broad areas of agreement between the parties under which the investment will be made. It also serves as a template for in-house or external legal teams to follow when drafting final agreements.

To assess the nature of the term sheet, 'whether binding or not binding,' the facts and circumstances of the case must be considered. A term sheet is a document that outlines the key financial and other important terms of a proposed transaction, which are subject to negotiations and certain conditions. It acts as a precedent before the formation of final legal documentation such as a Business Transfer Agreement, Joint Venture Agreement, Subscription Agreement, Shareholders Agreement, and many others. As a result, a term sheet serves as the foundation for all definitive agreements.

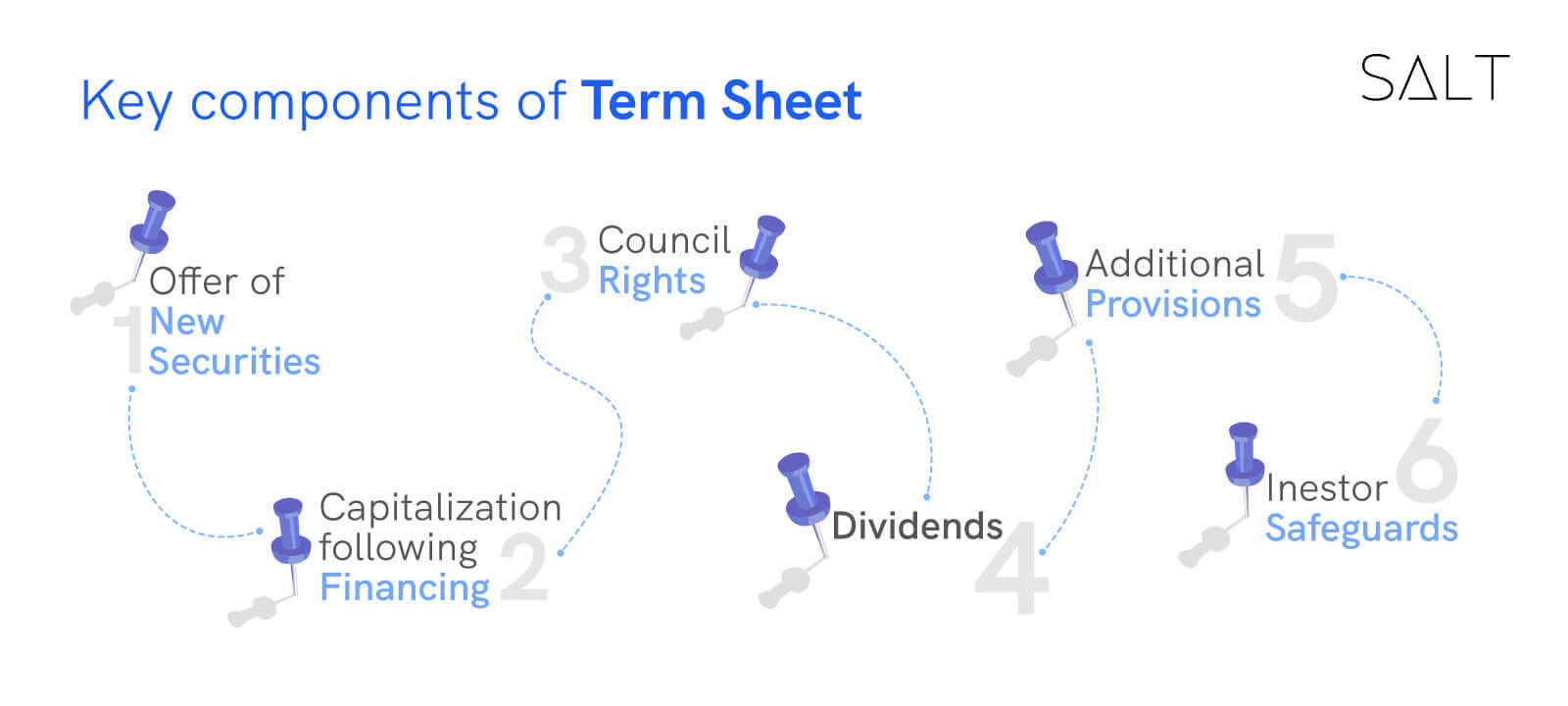

Key components of Term Sheet

Offer of New Securities

This section typically describes the securities being offered. Investors may choose between preferred and common shares. Preferred shares typically come with rights that give them precedence over common shares. For instance, preference shareholders are given mandatory dividends and precedence over the equity or common shareholders. However, preferred shares do not usually come with voting rights. In contrast, common shares often only have one vote that each share may exercise if a shareholder vote is required.

Capitalisation following Financing

The goal of this part is to provide a summary of the company's financial structure following the new funding that is being proposed. The reader can ascertain the company's pre-money and post-money values thanks to the material in this section. Pre-money valuation, as the name suggests, refers to the agreed worth of the company before the new investment, and post-money value is the company's mathematical value after the investment.

Council rights

This refers to the power of an investor to nominate or choose candidates for a board of directors. However, they may insist on appointing independent directors who would also hold a majority and bring one or even more attendees to all board meetings. Investors typically only ask for the right to nominate a small portion of the board.

Dividends

A dividend is an amount of money that is routinely (quarterly or annually) distributed from a company's profits to its shareholders. One of the key tools that enable investors to preserve their investment and exit a transaction with at least a chance of a return in the case of the company's insolvency is the existence of dividend provisions.

For start-ups, the dividend is permitted to build over time by increasing the investor's preferred equity size rather than being paid out regularly. The favoured equity would have grown over time after the investment, and the investor would gain from the fixed rate of return.

Additional provisions

These include the investor's right to undertake due diligence before closure, exclusivity clauses (the company's commitment to rejecting competing proposals), and pay of the investors' expenditures.

Investor safeguards

Important company decisions need investor approval. These often include creating and issuing shares that are more valuable than the shares investors hold, taking on secured debt, restructuring the business, repurchasing shares, and paying dividends. Additionally, management-level decisions like selecting and removing top officers and altering the course of the company's operations may be included.

A term sheet's contents and clauses can be different and changed accordingly to fit different transactions. There are several types of transactions in which a term sheet is needed:

PE(Private Equity)/VC(Venture Capital) Transaction: PE and VC deals generate financial rewards. VC transactions are made in the early stages of a firm or start-up, whereas PE transactions are made later in the company's life cycle. Both, however, required identical terms to be included on the term sheet. Generally, a PE/VC term sheet comprises terms like valuation, investment amount, anti-dilutive provisions, affirmative rights, liquidation, conversion rights, etc.

M&A (Mergers and Acquisition) Transaction: M&A transactions are conducted to achieve strategic benefits and business restructuring. In an M&A transaction, the term sheet will include information regarding the offered price, means of payment, assets and liabilities, business facts, and other typical terms.

What is it used for?

The term sheet's objective is to detect concerns with the proposed deal before devoting time and money to due diligence, as well as to assess the rights and liabilities of the transaction before entering into definitive agreements.

A well-negotiated term sheet reduces future disagreements and identifies "deal-breakers." Furthermore, the term sheet establishes the deal's growth aspirations, startup valuation, and risk mitigation. The term sheet acts as a framework for the documents that must be drafted when selling or purchasing a firm, selling or purchasing shares, or participating in capital raising rounds.

Conclusion

The founders would be better able to make educated decisions and take measures that would benefit the company if they were aware of the terminologies included in a term sheet and their ramifications. Before moving further with the investment closing and setting legally valid terms for the investment, term sheets must be thoroughly understood.

As a start-up opting for a secure platform that safeguards After the term sheet is signed, Table Salt helps startups with their compliance and banking processes while raising funds from foreign investors.