International business and trade have increased significantly in the recent times, leading to increased foreign payments for Indian small businesses, startups, and freelancers. These payments are subject to the Indian government's tax regulations, and one of the most critical regulations is TDS or Tax Deducted at Source. TDS collects income tax in India by deducting a certain percentage of the payment before it is credited to the recipient's account.

What is the TDS on Foreign Payments?

TDS on foreign payments refers to the tax deductions made on payments made to foreign companies or individuals. The Indian government has enacted various laws and regulations to ensure that the income earned by foreign entities from India is subject to Indian tax laws. TDS is the primary mechanism used by the Indian government to collect tax on foreign payments.

TDS on foreign payments applies to various transactions, including payments for services, royalties, technical services, professional services, interest, and rent. TDS deductions can range from 10% to 40%, depending on the type of payment and the nature of the transaction. The TDS deductions must be made at the time of payment, and the payment recipient is entitled to receive the balance amount after deducting the TDS.

Implications of TDS on Foreign Payments

TDS on foreign payments has several implications for Indian companies and individuals making foreign payments. Some of the implications include the following:

Increased Cost of Foreign Payments:

TDS on foreign payments increases the cost, as a portion of the payment is deducted as TDS. This can significantly impact the bottom line of Indian companies, especially those making frequent foreign payments

Increased Administrative Burden:

TDS on foreign payments increases the administrative burden of Indian companies, as they must ensure that TDS deductions are made correctly and on time. This requires them to keep track of the TDS rate, due date, and certificates, and submit TDS returns regularly.

Lower Receipts for Foreign Companies:

TDS on foreign payments can also affect the recipient of the payment, as the amount received may be lower than expected due to TDS deductions. This can impact the financial stability of foreign companies and individuals, mainly if they rely heavily on Indian payments.

Compliance Issues:

Non-compliance with TDS regulations can lead to significant financial penalties, interest charges, and even legal action. Indian companies must ensure that TDS deductions are made correctly and on time to avoid compliance issues.

Delays in Payments:

TDS on foreign payments can also cause delays in payments, as the Indian company must ensure that TDS deductions are made before crediting the payment to the recipient's account. This can cause disruptions in the normal business flow and negatively impact the relationship between the Indian company and the foreign recipient.

Ways to Minimise TDS on Foreign Payments

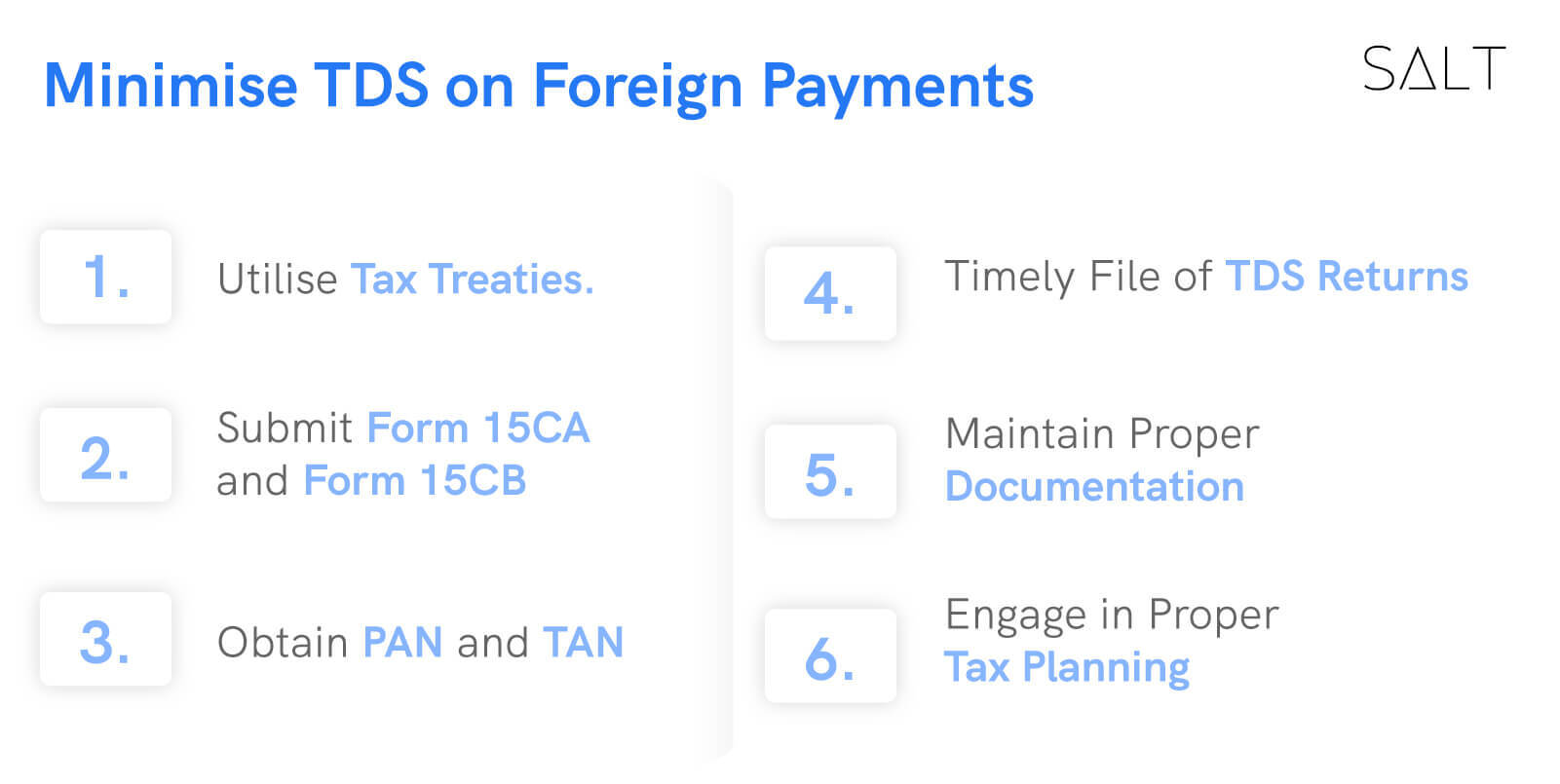

TDS on foreign payments can significantly burden Indian companies and individuals making foreign payments, as seen above. However, there are several ways to minimise TDS on foreign payments, including:

Utilising Tax Treaties:

India has entered into tax treaties with several countries to reduce or eliminate TDS on foreign payments. By taking advantage of these tax treaties, Indian companies and individuals can significantly reduce TDS deductions on foreign payments.

Submit Form 15CA and Form 15CB:

Form 15CA is an online form that needs to be submitted to the Indian tax authorities by the person making the payment, while Form 15CB is a certificate that needs to be issued by a chartered accountant. These forms are used to certify that the payment being made is in compliance with Indian tax laws.

Obtaining PAN and TAN:

To minimise TDS on foreign payments, it is essential to get a PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) from the Indian Income Tax Department. These numbers are required to make TDS deductions on foreign payments.

Timely Filing of TDS Returns:

Indian companies must file TDS returns on time to avoid penalties and interest charges. Filing TDS returns on time also helps to minimise TDS deductions, as TDS certificates can be obtained more quickly and accurately.

Maintaining Proper Documentation:

Proper documentation is essential to minimise TDS on foreign payments. Indian companies must retain all relevant documents, including invoices, contracts, and TDS certificates, to ensure that TDS deductions are made correctly and to claim TDS credits.

Engaging in Proper Tax Planning:

Proper tax planning can help Indian companies and individuals minimise TDS on foreign payments. This involves understanding the TDS regulations, the tax treaties, and the various ways to reduce TDS deductions.

Conclusion

In conclusion, TDS on foreign payments can significantly impact Indian companies and individuals making foreign payments. However, there are several ways to minimise TDS on foreign payments, including utilising tax treaties, opting for lower TDS rates, claiming TDS credit, obtaining PAN and TAN, timely filing of TDS returns, maintaining proper documentation, and engaging in appropriate tax planning. To minimise the impact of TDS on foreign payments, it's essential to understand the regulations and consider the various ways to reduce TDS deductions.

Read more on how to manage risks of your international transactions.

Salt is a neobank dedicated to making global banking easy for small businesses and startups in India. Give our website a visit today to find out more about us!