Have you ever been worried about what would happen to your hard-earned savings if the financial institution of your choice were to go bankrupt? With the SVB collapse, followed by Signature Bank, the whole world is in a frenzy. Many Indian depositors are stuck wondering what kind of insurance they can have in the Indian banking system, just in case a situation similar to the SVB collapse rises up here.

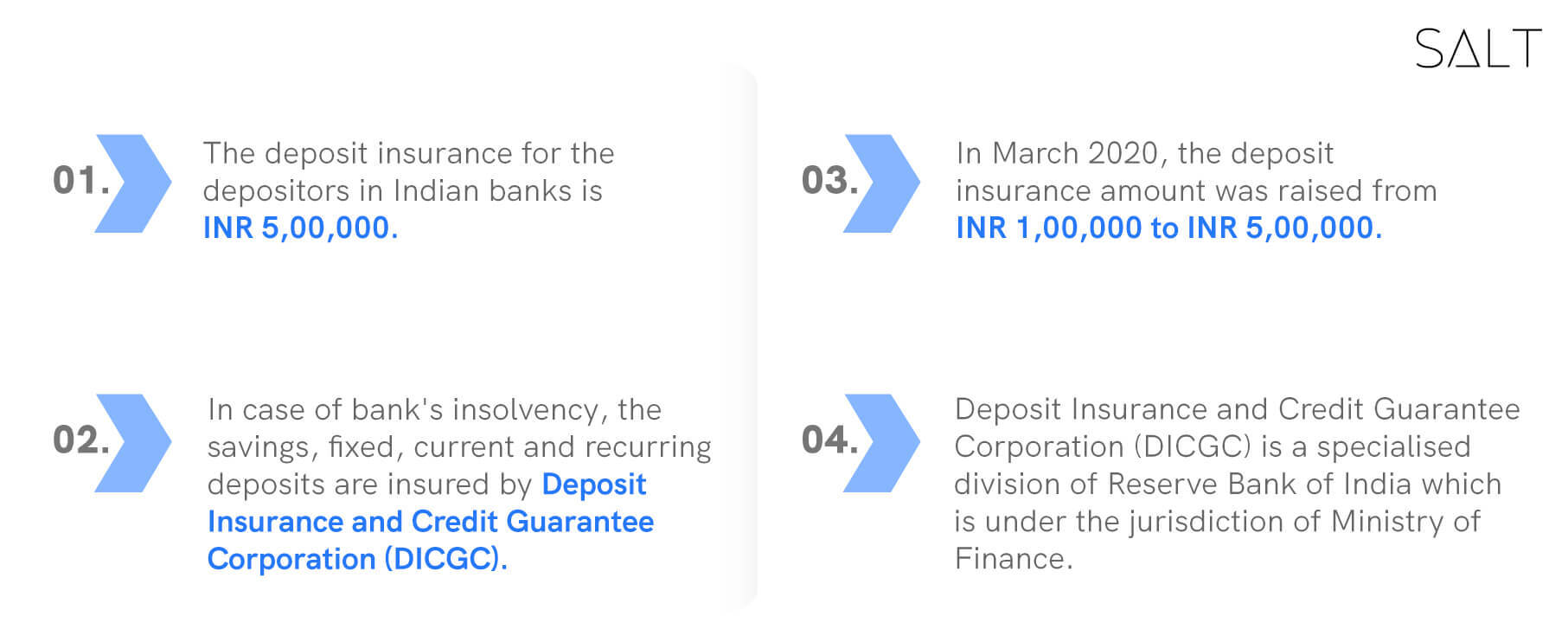

Fortunately, Indians have a safety net in the form of the Deposit Insurance and Credit Guarantee Corporation (DICGC). In this post, we delve into the nitty-gritty of the DICGC's deposit insurance scheme.

Importance of Insurance for Indian Depositors

Insurance for depositors is crucial to safeguarding their savings and investments. In the event of bank failure or bankruptcy, depositor insurance provides protection against loss of funds up to a certain limit, meaning that even if the bank goes under, depositors can still retrieve their money without suffering significant financial losses.

The importance of insurance for depositors was highlighted during the global financial crisis of 2008 when several countries witnessed large-scale bank failures leading to significant economic damage. However, with effective regulatory measures and prudent risk management practices, Indian banks have maintained stability even during challenging times.

In India, The Deposit Insurance and Credit Guarantee Corporation (DICGC) was established in 1961 to provide deposit insurance to bank customers. In the event of a bank failure, DICGC provides compensation of up to ₹5 lakh per depositor and bank, ensuring small depositors’ protection against financial losses due to the failure of their bank.

DICGC: What Do You Need to Know?

The DICGC covers all deposits, including savings, fixed, current, and recurring deposits, with the exception of the following:

Funds deposited by foreign countries

Federal and state government deposits

Inter-bank deposits

State Land Deveent Bank deposits with the State Co-operative Bank

Any sum owed for a deposit received outside of India

Amounts specifically exempted by the corporation with prior consent from the Reserve Bank of India

In the instance of a bank liquidation, DICGC is responsible for paying the liquidator the claim amount of each depositor up to ₹5 lakhs within two months of receiving the liquidator's claim list. The liquidator must pay each insured depositor the claim amount matching to their claim amount.

Major Challenges Faced By The Indian Banking System

One of the major challenges faced by the Indian banking system regarding deposit insurance is the lack of awareness among depositors about their rights and entitlements. This lack can lead to several problems for both banks and customers. For instance, it can result in customers placing too much trust in their banks without understanding the risks involved. It could also lead to panic withdrawals when there is uncertainty about a particular bank's financial health, potentially exacerbating liquidity issues for banks.

To address this challenge, banks must proactively educate their customers about DICGC coverage and other related matters, such as how they can access information on claim procedures. The RBI has also recommended measures such as displaying notices at branches informing customers about DICGC coverage and organising seminars or workshops on customer education.

Increasing awareness amongst depositors about their rights and entitlements is crucial for ensuring stability within the Indian banking system. Banks must take responsibility for educating their customers on these important matters, while regulators should continue to monitor compliance with existing regulations governing disclosure requirements around DICGC coverage, so that all stakeholders can benefit from greater transparency around this critical aspect of banking operations.

Bottom Line: Insurance for Indian Bank Depositors is Crucial

The importance of being aware of deposit insurance coverage limits in the Indian banking system cannot be overstated, especially in light of recent events such as the SVB collapse. The Deposit Insurance and Credit Guarantee Corporation (DICGC) provides insurance for Indian depositors, but it's crucial for customers to understand the limits of this coverage and spread their deposits across multiple banks to reduce the risk of losses. By taking these precautions, customers can protect their savings and minimise the impact of potential banking failures such as the SVB collapse.

Want to access the ease of global banking with local accounts as a small business in India? Salt has got you covered! Give our website a visit today to find out more!