In the recent times, events like the SVB collapse and the downfall of Signature Bank has put many aspects of the financial world, including offshore banking, under a microscope. This has led to increased scrutiny of banking practices. However, it’s undeniable that offshore bank accounts are beneficial and crucial for those engaged in international operations.

In this blog, we'll explore the basics of ‘what is offshore banking?’ and how offshore bank accounts can benefit businesses, as well as important considerations to keep in mind in light of the SVB collapse and subsequent regulatory developments.

Whether you're considering offshore bank accounts or simply want to learn more about this topic, read on to discover what offshore banking is, how it works, and how it can benefit your business.

What is Offshore Banking?

Offshore banking refers to opening a bank account outside of the country where the account holder resides or does business. This can be in a tax haven or low-tax jurisdiction, such as the Cayman Islands, Bermuda, or Switzerland. The main benefit of offshore banking is that it allows businesses to access favourable tax policies, reduced regulations, and increased financial privacy.

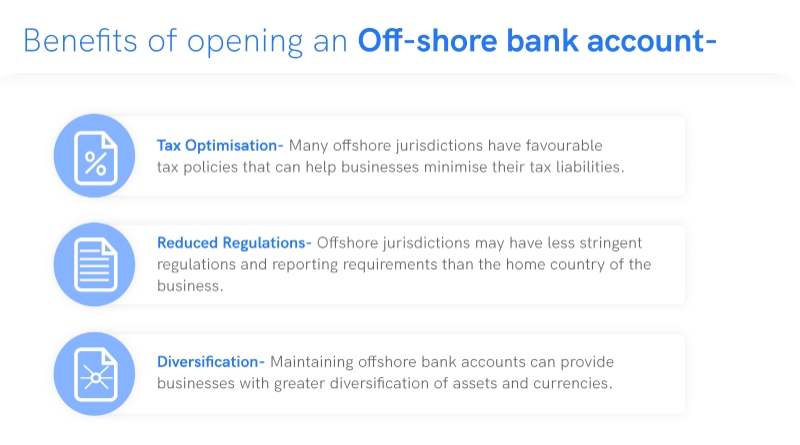

Offshore bank accounts can provide a range of benefits to international businesses, including:

Tax Optimisation:

Many offshore jurisdictions have favourable tax policies that can help businesses minimise their tax liabilities. For example, some countries have lower corporate tax rates or may not tax certain types of income, such as dividends or capital gains.

Reduced Regulations:

Offshore jurisdictions may have less stringent regulations and reporting requirements than the home country of the business. This can reduce administrative burdens and costs associated with compliance.

Diversification:

Maintaining offshore bank accounts can provide businesses with greater diversification of assets and currencies. This can help mitigate risks associated with currency fluctuations or political instability in the home country.

It's important to note that while offshore bank accounts can offer these benefits, businesses must ensure that they are abiding by all applicable laws and regulations in both their home country and the offshore jurisdiction. This includes reporting any income earned or assets held in offshore bank accounts to tax authorities.

How to open an offshore bank account

Now, let’s find out how you can create an offshore bank account:

The basic requirements

Opening an offshore bank account is similar to opening a usual bank account in your home country in many ways. You'll need to provide personal information such as your name, date of birth, address, citizenship, and occupation, and verify your identity with a passport or other ID. Banks also verify your residence or physical address, which can be done with a utility bill.

Some offshore centres require an apostille stamp, which can be obtained from a nearby government office.

Offshore bank accounts offer the option to hold funds in different currencies, which can be beneficial for international businesses. However, there are consequences to consider, such as foreign tax liabilities and currency exchange fees. While holding funds in certain currencies can earn interest, exchanging currencies can be costly depending on the fees and rates offered.

Offshore bank accounts are funded via international wire transfers, usually. However, it’s important to remember that this process often incurs steep fees. While wire transfers are simple, pricing varies between banks, so it's important to find good deals. Of course, domestic cheques aren't accepted, and in-person deposits are impractical.

Making Withdrawals

Offshore banks offer various withdrawal options, including debit cards, but fees can add up, so withdrawing large amounts at once can minimise costs. Cheques are not recommended due to confidentiality concerns, and they may not be accepted locally. However, using two accounts, one offshore and one domestic, can provide greater privacy and security while also allowing for convenient access to funds through wire transfers.

Get Started with an Offshore Bank Account for your Business

As recent events such as the SVB collapse have shown, it's essential for businesses to make informed decisions, especially if you are operating a small business or a startup planning to go global. By taking a responsible and transparent approach, businesses can leverage the benefits of offshore bank accounts while minimising potential risks. Moreover, it's always the best option to seek advice from qualified professionals to ensure that your offshore bank accounts creation is sound and legally compliant.

Multi-currency accounts brought about by SALT can help businesses with international transactions that are less complex, and completely remove foreign exchange markup charges. Give the Salt website a visit to learn about all the benefits of global banking we can provide your business with!