The number of immigrants in Canada is about to reach the 2 million mark in 2023, and Indians make a fair share of that. With 1.86 million population of Indians in Canada, it's safe to say that Canada is attractive to Indians. So whether you're someone living in Canada who is wondering how to send money from Canada to India to your parents, or if you’re an Indian business looking to be paid by a Canadian client, here are the best ways to send money from Canada to India.

Contents

Canadian Dollars to Indian Rupees

The exchange rate from Canadian Dollars to Indian Rupees, as of January 3, 2024, stands at about INR 62.

Best Ways to Send Money from Canada to India

Now, back to our actual topic of discussion. How can someone send money from Canada to India? The several methods include:

Wire Transfer or Electronic Transfer

In a wire transfer, banks worldwide send money to one another's accounts using an international communications network called SWIFT (Society for Worldwide Interbank Financial Telecommunication). Such an international money transfer can be made from a Canadian bank account to the recipient's Indian bank account.

The transfer request to send money from Canada to India can be sent online or by visiting a bank branch. You must fill out an online form when doing a wire transfer online. Otherwise, you must visit the bank, get the form and submit it in person. The following details will be required-

Name of beneficiary

Name and address of beneficiary bank

Beneficiary's account number, and

Bank's SWIFT code.

Although wire transfer is considered one of the best ways to send money by high-street banks for international money transfer, it tends to be very slow and pricey. This is because when you do international money transfer with a bank, you'll be paying currency exchange fees to convert your currency into another currency over and above the standard set of fixed fees, commission fees, and other bank fees that your bank may charge.

A wire transfer takes between 1 and 5 working days to complete. It can be safe usually, provided you check your details carefully before initiating a transaction.

Cheque or Demand Draft

The option to send money from Canada to India using a cheque or demand draft is there if a wire transfer is unavailable.

First, the sender needs to draw a cheque and a demand draft in the name of the beneficiary in India. They will have to attach a letter of instruction to the cheque, and in the case of a demand draft, they will have to fill up a demand draft form. Then the cheque or demand draft can be sent to the beneficiary’s bank in India through mail or courier for processing.

Cash Pickup

Cash Pickup is one of the best ways to send money from Canada to India.

According to a recent World Bank report, India is home to 130 million adults without access to formal banking, making services like cash pickup one of the best ways to send money from Canada to India.

Cash pickup is a method of international money transfer where the sender initiates the transaction, and the recipient collects the funds in cash at a designated location, often at a local bank or financial institution.

After the sender has paid service fees and currency exchange rates, the recipient can go to a designated location and present a valid photo ID and the transfer reference number to receive the cash.

Cash pickup transfers charge slightly higher fees as compared to the previous options, but they do arrive faster. In comparison, bank deposits have lower fees but often take longer. Cash pickup transfers can be safe using reputable services, but risks like theft or fraud exist.

Using International Payment Processors and Neobanks

There are many fintech services available now, such as the online payment system PayPal or neobanks like SALT Fintech that can help you out with international money transfers, be it for business or personal purposes. For businesses operating in India, you can use such services to send invoices to your Canadian clients to allow them to send money from Canada to India smoothly.

With online payment systems like PayPal, costs can be relatively high due to varying transaction costs and exchange rates, as well as a lack of help in compliance. Therefore, they are convenient for small transfers but may not be the most cost-effective option for larger sums.

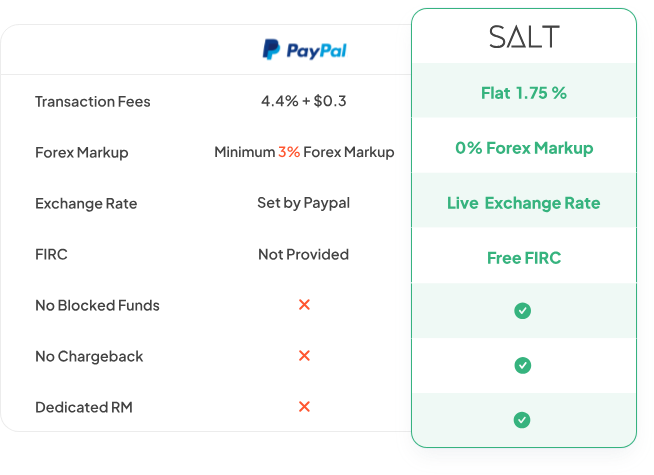

An alternative to expensive payment services is SALT. We charge a flat 1.75% fee for all your cross-border transfers, with 0% forex markup, no threats of blocked funds and chargeback, free FIRC, dedicated relationship managers, and a lot more convenient features to make international payments the easiest for you!

Compare PayPal and SALT - send money from Canada to India

Using a Foreign Exchange Broker

These services specialise in large transfers and can negotiate good currency exchange fees. Costs vary, but generally, they charge fees or offer competitive exchange rates. Transfer times may range from a few hours to several business days, depending on the foreign exchange broker and the chosen transfer method. However, the security factor is dubious at best, since safety of the fund depends on the provider's reputation and regulatory compliance.

Keep in Mind while Bringing Money from Canada to India:

Now we know about the many options one has to send money from Canada to India. However, how do you make your choice? Based on these factors, of course:

Exchange Rate

Make sure you are using a service provider that would charge currency exchange rates based on the live rate you can find with a Google search, so no hidden charges are added. SALT Fintech can be a good option for your business transactions in this case, since we go by the live exchange rate on Google.

Security

Prioritise regulated providers with solid security measures like encryption and multi-factor authentication. Investigate their track record for data protection and ensure they comply with relevant financial regulations.

Fees

Examine the provider's fee structure meticulously. Look for transparency, including hidden or extra charges beyond the stated fees. Hidden fees can significantly impact the cost of your money transfer. They can take various forms, including exchange rate markups, undisclosed transfer fees, recipient fees, and service charges. A fixed fee like SALT’s can help you plan your finances better.

Convenience

Evaluate the user-friendliness of the transfer process. Consider factors like the ease of initiating transfers, tracking transactions, and accessing customer support. For example, with neobanks like SALT Fintech, you have convenience at your fingertips with a simple UI and 24/7 customer support.

In conclusion, to send money from Canada to India, make sure you are providing your client with an option that takes into account all four of the aforementioned factors. SALT Fintech can be your dependable global business ally, offering competitive pricing, a commitment to not charging extra on exchange rates, dedicated customer support, relationship managers, and a solid dedication to ensuring your business's compliance. We're here to support you in all situations!