Sending and receiving international payments can be worrisome, especially if you aren't equipped with the right information. But a transfer to India can easily be made through a wire transfer. Let's find out what information is required to execute a transfer to India.

What is a Wire Transfer?

The computerised method of transmitting money from one account to another, anywhere on the globe, is known as a "wire transfer." If you work abroad, a wire transfer is a safe and secure way to send money to friends or family in India.

International wire transfers are quick, safe, and practical. You can use a wire transfer option to send money abroad and receive international payments in India. If the necessary information is provided, a wire transfer can also be used to send money for investments or a mortgage. Banks may impose a fee for wire transfers to India or other countries. Let's find out how to carry one out and what information is required.

What Information is Required to Receive Money From Abroad via a Wire Transfer?

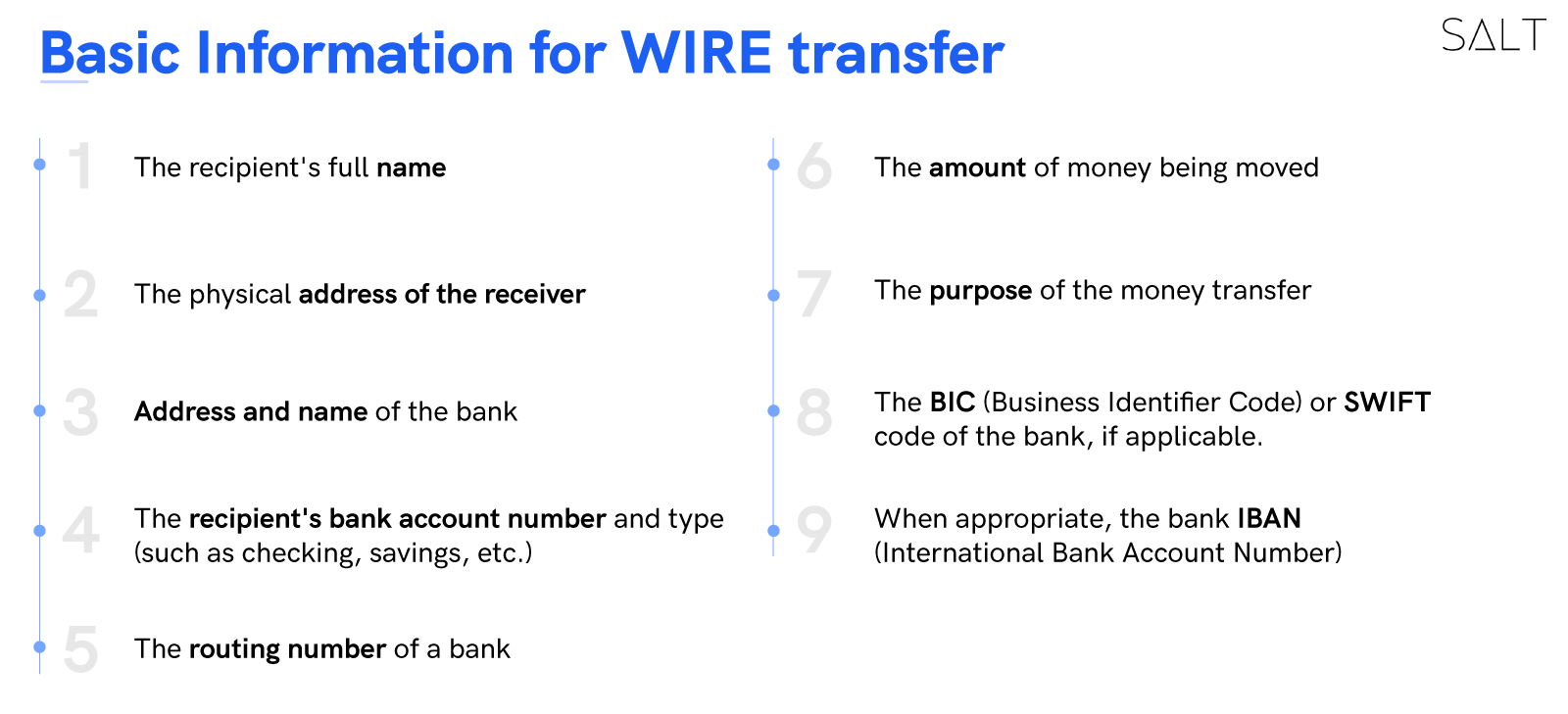

In order to receive international payments from abroad or vice versa, the sender must supply details regarding the recipient's bank account, just like domestic transfers. Some institutions can also require a social insurance number (SIN) or an individual taxpayer identification number (ITIN) when sending money overseas. Depending on the recipient's bank, specific information may vary; however, the following is often needed:

How to Carry out a Wire Transfer:

To initiate an international wire transfer to India, you must give instructions to your local bank by supplying a request form.

In the form for the wire transfer, enter the beneficiary's bank name, address, and account number, along with the IFSC code, beneficiary email address, and contact information.

For a smooth wire transfer operation, mention the SWIFT codes of the beneficiary as well as your local bank.

Send the form to your local bank.

Within one or two business days, money will be sent from your account to the beneficiary's account.

Features and Benefits of a Wire Transfer

Wire transfer is a time-tested and reliable method of sending money to India. The money is credited to the recipient's account one or two days later.

To initiate a wire transfer, you simply send an instruction to your local bank.

You can wire transfer money to open fixed deposits, make investments, and pay off home loan EMIs.

Now that we've established and understood how wire transfer to India works, the question is, does it happen instantly? Let's find out.

Does a Wire Transfer Take Place Right Away?

Although not instantaneous, a wire transfer is speedy, and the service provider determines the delivery time. Domestic wire transfers through a bank typically take one to three business days. Wire transfers may take less than a day if you and the recipient have bank accounts with the same banking institution. The completion of international money transfers could take up to five business days.

The best way to find the time taken for a wire transfer to complete is to check with the specified organisation since some banks or service providers may provide options to reduce the time required for a wire transfer. Additionally, certain nations, such as Afghanistan and Cuba, take a long time to pay. Your wire transfer will take longer if you send money from such nations. Additionally, one needs to avoid mistakes while transferring money through wire transfers. Below is a list of what to keep in mind.

What to Keep in Mind While Making a Wire Transfer?

When sending money, be careful because wire transfers are irreversible. The most typical errors recorded are as follows:

The sender mistypes the name of the city or nation.

The sender forgets to provide the bank's address along with the name.

The SWIFT or IBAN code provided by the sender is incorrect.

The sender transfers money in a foreign currency that is not accepted by the bank or nonbank service provider receiving the payment.

Because of these errors, there are chances that you may send your money to the wrong person, which could worsen processing delays. Because of this, all wire transfer specifics must be understood by both the sender and the recipient. Consider going the extra mile and contacting your service provider to get the specifics on wire transfer requirements and instructions.

While you are aware of the information required to deposit money into a bank account, domestically or abroad, always be sure that the data you give the bank or wire transfer service provider is accurate and valid, and you'll be good to go!

A bank that takes care of all your needs and requirements can make a huge difference in international money transfers. Salt’s global banking solutions cater to SMEs and freelancers alike. Salt’s bank accounts are digitally managed and support multiple foreign currencies and come with a host of added utilities to transfer money from abroad or send an international wire transfer instantly!