Suppose you're into exporting business or a startup offering services globally. In that case, foreign transactions must be a part of your daily life.

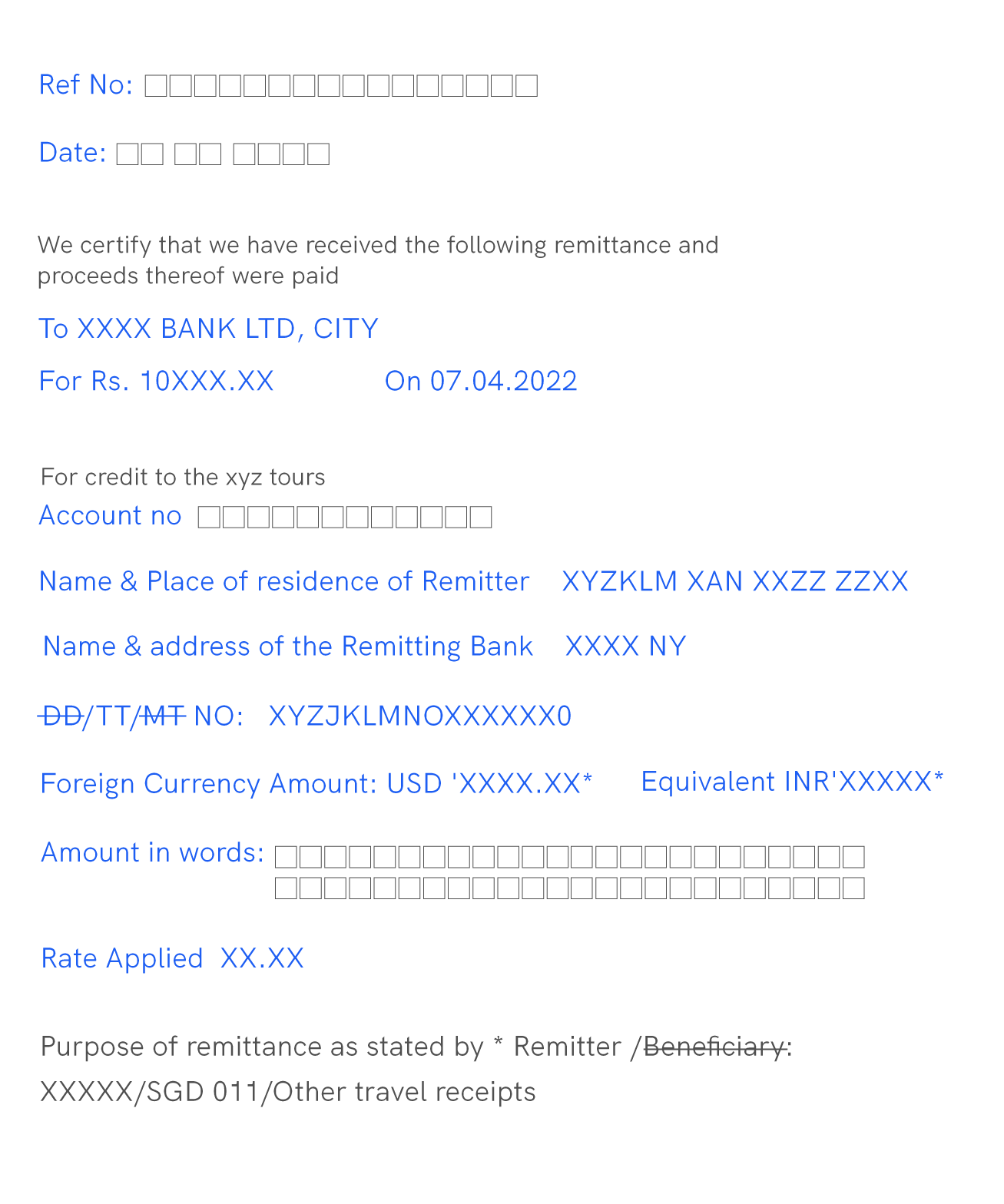

In the case of inward remittance to India, you need a FIRC as per the RBI and FEMA guidelines. FEMA or the Foreign Exchange Management Act, the legislation covering the flow of money in and out of India and RBI (Reserve Bank of India) India's central bank and regulatory body, mandated having a certificate of proof of any transaction received from overseas to India. This certificate is known as Foreign Inward Remittance Certificate or the FIRC. Beneficiaries who receive international payments or cross-border payments, need to procure a FIRC as proof of the authenticity of the transaction. FIRC is also called Foreign Inward Remittance Advice (FIRA).

There are many natural questions that come to mind when we first encounter the term FIRC, such as:

What's an FIRC?

When do I need the FIRC?

How can I get FIRC?

Or how important is FIRC?

This blog is focused on how FIRC procurement works in India for inward remittances and what significance it holds in various aspects like tax-saving and other legal benefits in case of transactional disputes. Having a FIRC makes things easier from several perspectives, so let’s see what FIRC is all about.

What is an FIRC?

First things first, let's know what FIRC stands for. It is for Foreign Inward Remittance Certificate. According to the Foreign Exchange Dealers Association in India (FEDAI) and the Reserve Bank of India (RBI), a FIRC is a document that serves as evidence of foreign transfers to India. Financial institutions or similar authorities issue and accept this document as lawfully accepted proof that an individual or organisation has received payment in a foreign currency from overseas.

Who needs a Foreign Inward Remittance Certificate?

Goods and service exporters from India, individuals, and organisations working remotely within the country for overseas companies, global sellers, etc., all require a FIRC to prove they have received the payment from the opposite party outside India. Individuals or organisations that receive international payments or money transfers from abroad need to request the issue of a FIRC from the authorized dealer bank.

How long does it take to receive money from abroad to India?

Why is FIRC Required?

FIRC is considered a monitor for all foreign transactions and transfers to India. As mentioned, India's central bank, The Reserve Bank of India, closely monitors all remittances from abroad flowing into India. Banks authorised for such remittances, known as Authorized Dealers or AD, are required to report such transactions to RBI's Export Data Processing and Monitoring System or EDPMS.

FIRC does more than just serve as proof of payment. It also contains the essential remittance details like account number, beneficiary's name, the purpose of the payment, and the amount paid, which becomes useful for tax filing purposes because a FIRC entitles you to certain tax relaxation on service tax, as it's not levied on certain services provided overseas.

Can banks issue FIRC?

Physical FIRC was discontinued by the end of 2016. Currently, Issuers can only apply for an e-FIRC. The answer is; Banks can issue an e-FIRC, but not all banks. According to the RBI guidelines, an e-FIRC can be issued only by AD Category-I banks authorised and monitored by RBI for such remittances under the law.

Are there any charges for the issuance of FIRC?

The AD-1 banks do charge a fee for issuing a FIRC. Although, the service fee is not the same and depends on the amount and the time of issue concerning the transaction timeline. The banks also take a turnaround time to issue a FIRC as it's not an immediate process like getting an IMPS reference. The time taken by the bank depends on the authorisation process and if the documents submitted by the issuer were proper and complete.

If you are receiving foreign payments from merchants and individuals using Salt, you can download the FIRC on your dashboard free of cost!

What is the RBI limit for receiving inward remittances?

The inward remittance is capped at $2,500 per transaction, with up to 30 transactions permissible each calendar year.

Conclusion

International payments and money transfers from abroad are quite a hassle, especially for SMEs. They require proper documentation and certificates for both taxes and income declaration proof. However, it’s given to abide by the laws and regulations for such transactions, no matter how complicated they are. Although you can surely expect convenience while dealing with such overseas transfers if you choose the right bank.

That's why you need a banking service that offers low, transparent exchange rates, does not charge absurdly high fees, and is fast and easy to use. Besides all of these, the transactions should be fully compliant too!

You can try SALT for an amazing global banking experience with multi-currency accounts and easy international transfers. Salt helps SMEs and freelancers process international payments within 24 hours at the best possible rates. FIRC Available for free.