Businesses rely heavily on international money transfer methods to expand their reach and tap into overseas markets. Traditional methods like international wire transfers and bank drafts have been the go-to for cross-border payments for so long, but they come with hefty fees and lengthy processing times, making them less than ideal for many companies seeking efficiency and cost-effectiveness. PayPal may come to mind for a modern-day business, but what if you had a cheaper alternative to PayPal?

Enter- SALT, a fintech company that specialises in cost-effective solutions for international transactions. We focus on serving B2B clients, including LLPs, private limited companies, partnerships, SMEs, and startups. SALT provides competitive rates and efficient compliance solutions tailored to the specific needs of Indian businesses.

In this blog, we will understand the need for a cheaper alternative to PayPal and look at SALT's offerings. Without further ado, let’s begin!

First, let’s understand why we need PayPal alternatives anyways?

Why sееk PayPal alternatives?

Source | Cheaper alternative to Paypal

While PayPal has long been a popular choice for online transactions, its suitability for international business transactions is questioned due to several limitations and drawbacks. Here are some:

PayPal's fees: They often include a percentage of the transaction amount and a fixed currency conversion fee. This can make it costly for businesses dealing internationally. The fee per transaction comes to around 4.4% of the amount + $0.3 + additional currency conversion charges.

PayPal's processing times: These can range between 3-5 days, leading to delays in receiving funds and potentially disrupting business operations and cash flow.

Exchange rates: These are set by PayPal, and can potentially be quite demanding, especially for businesses engaging in cross-border payments frequently.

Compliance: PayPal isn’t much help here, required certifications have to be taken care of by a business itself.

Low on flexibility: PayPal does not bring customized support for businesses.

Given these limitations and drawbacks, business operations are increasingly seeking cheaper alternatives to PayPal, which offer lower goods and services fees, faster processing times, and greater flexibility and support for their specific needs. SALT Fintech is one such alternative to PayPal for B2B clients looking to streamline their international transactions and reduce costs.

Now, let's understand how SALT Fintech can help businesses in international money transfers:

SALT's offеrings for Indian businеssеs participating in Cross-Border money transfers

Source | SALT Fintech as a PayPal alternative

SALT Fintech has two main services that cater to the needs of Indian businesses going beyond borders: inward remittances and compliance handling. These are intended to assist companies in streamlining their international transactions and ensuring compliance with regulatory requirements, all while minimising costs and maximising efficiency.

Let’s discuss SALT’s services as a cheaper alternative to PayPal:

Inward remittances

SALT Fintech offers a streamlined and cost-effective solution for receiving payments from international clients or partners.

SALT charges a fixed fee of 1.75% of the transfer amount for inward remittances. This fee covers the cost of obtaining the Foreign Inward Remittance Certificate (FIRC), which is provided to you within 24 hours of the international transaction.

No sign-up fees or subscription charges are required to use our service. This enables businesses to access their funds quickly and efficiently, helping to improve cash flow and reduce administrative overhead.

Compliance handling

SALT Fintech offers a comprehensive compliance management solution for businesses dealing with foreign investments, including pre-funding and post-funding compliance.

For instance, SALT aids in FIRC acquisition if inward remittance is a regular part of the business transactions.

Now, let's compare SALT's services with PayPal.

SALT Fintech: an altеrnativе to PayPal

When comparing Paypal's services to cheaper alternatives like SALT, several factors come into play like cost, speed, and compliance. Let's explore how SALT's offerings stack up against PayPal and other payment solutions in these areas:

Cost

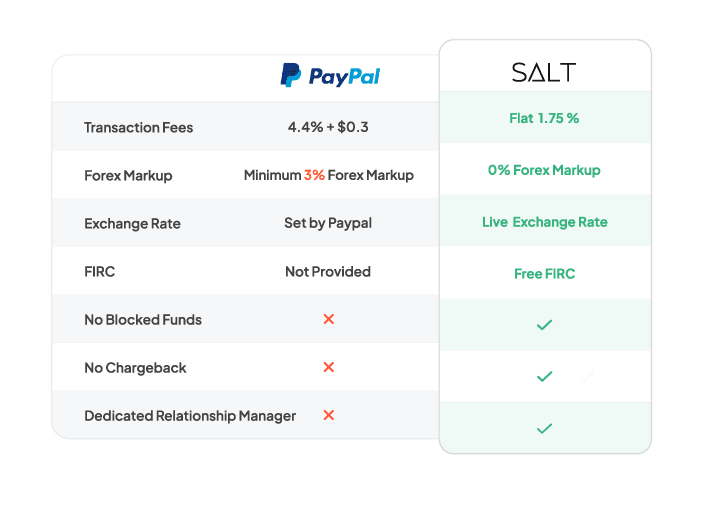

SALT and PayPal diverge notably in their fee structures.

PayPal imposes transaction fees based on variables like country, currency, and amount, along with a minimum 3% forex markup. SALT has a fixed fee.

SALT refrains from levying any markup on currency conversion, usually adhering to the Google rate for converting to INR. The Google rate refers to the exchange rate provided by Google, typically based on real-time market data.

Notably, PayPal's transaction fees can reach 4.4% of the transferred amount plus $0.3, whereas SALT adopts a flat rate of 1.75%.

Source: SALT and PayPal comparison

Other criteria

At SALT, you can know that your transactions won't encounter blocked funds or chargebacks. This assurance provides a sense of security and reliability for businesses utilising SALT's services.

In contrast, PayPal doesn't typically offer the same guarantee, leaving the potential for disruptions or complications in transaction processing.

Unlike PayPal, SALT provides designated relationship managers for global banking needs.

Overall, SALT's services have these benefits for Indian businesses engaging in cross-border payments:

A cheaper alternative to PayPal for international money transfers

Offer lower fees

Faster processing times

Enable streamlined compliance handling

By choosing SALT Fintech, businesses can streamline their international transactions, reduce costs, and focus on growing their operations in the global marketplace.

SALT at your rescue

SALT Fintech offers a compelling PayPal alternative for international businesses seeking cost-effective solutions for cross-border transactions. By providing competitive rates, faster processing times, and streamlined compliance handling, SALT Fintech enables businesses to minimise costs, improve cash flow, and focus on growing their operations in the global marketplace.

If you have any further questions or want to learn more about SALT Fintech as a cheaper alternative to PayPal, please don't hesitate to contact us. We're here to help you navigate the complexities of international business transactions and find the right payment solutions for your needs!

Frequently asked questions

1. Why did PayPal quit India?

On February 4, 2021, PayPal announced it would end domestic payments in India by April 1, 2021 and would mainly focus on international e-commerce due to regulatory challenges.

2. Did Elon Musk create PayPal?

Yes, Elon Musk co-founded PayPal in 1999 when he was approximately 28 years old. Musk's online banking business, X.com, merged with Confinity, a company specialising in online payments, to form PayPal in March 2000. Musk played a pivotal role as the CEO in guiding the newly formed organisation.

3. Is GPAY the same as PayPal?

PayPal and Google Pay are digital wallets that let you hold, send, and receive payments and shop in person and online. Nevertheless, Google Pay and PayPal accounts aren't inherently connected; they are separate products.

4. Is PayPal banned in India in 2023?

PayPal India has discontinued domestic payment transactions and is now only available to businesses for cross-border transactions. Individual PayPal accounts and domestic sales have been discontinued.